Social Security is an important part of your retirement income. That’s why we wade through all the options (up to 81 if you are married) to help you maximize your benefit. What you get to spend of that benefit depends on what you get to keep, and what you get to keep depends on what you pay in taxes.

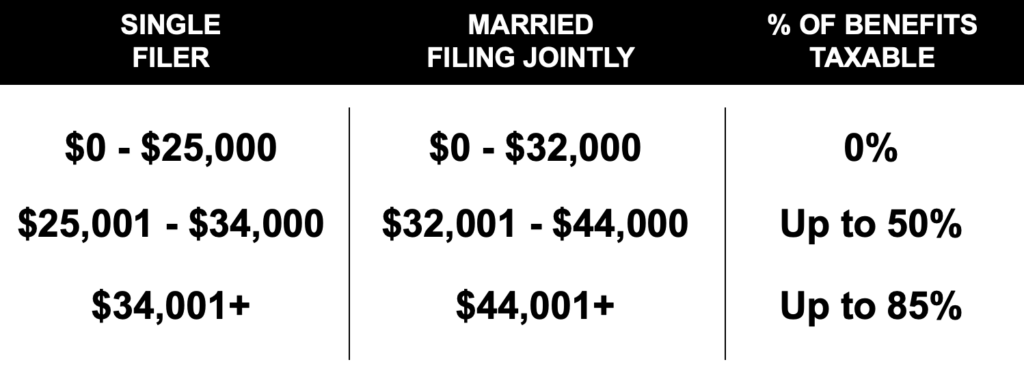

Initially, Social Security benefits were not taxable income. In 1983, Congress changed the law and authorized the taxation of Social Security benefits. Starting in 1984, up to 50% of Social Security benefits could be taxed if the taxpayer’s total income exceeded certain thresholds.

In 1993, legislation raised the portion of benefits subject to federal taxation from 50% to 85%. The increase applied to what the federal government deems “higher income” beneficiaries, while beneficiaries of modest to lower incomes would be subject to a 50% rate or no taxation at all.

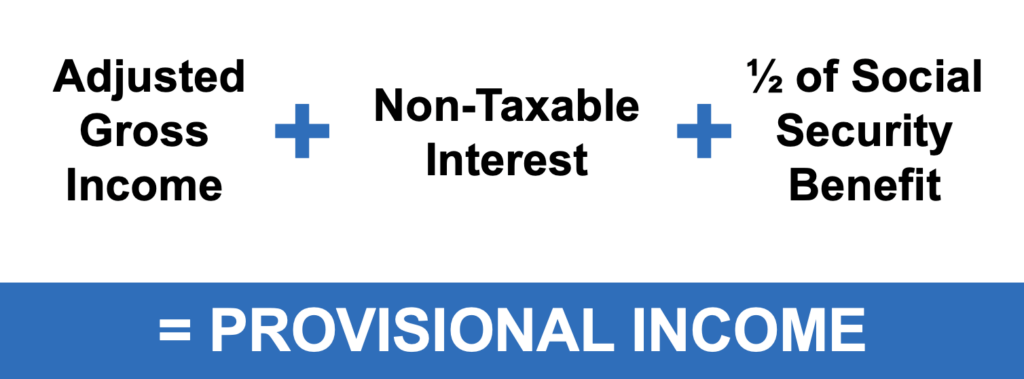

Provisional Income

Who pays taxes on their Social Security benefit and how much they pay is determined by provisional income. To calculate provisions income, you have to start with your adjusted gross income from your tax return, excluding Social Security benefits. This figure could include wages, self-employment income, pension benefits, dividends, interest, or any other form of taxable income.

Next, add interest income that is nontaxable at the federal level, such as municipal bond interest or interest earned on assets inside a Roth retirement account. Finally, add one-half of Social Security benefits from your Form SSA-10900. Keep in mind that married couples should include income from both spouses.

This is your provisional income – the measure the IRS uses to determine whether or not you’ll pay taxes on your benefit.

State Taxes

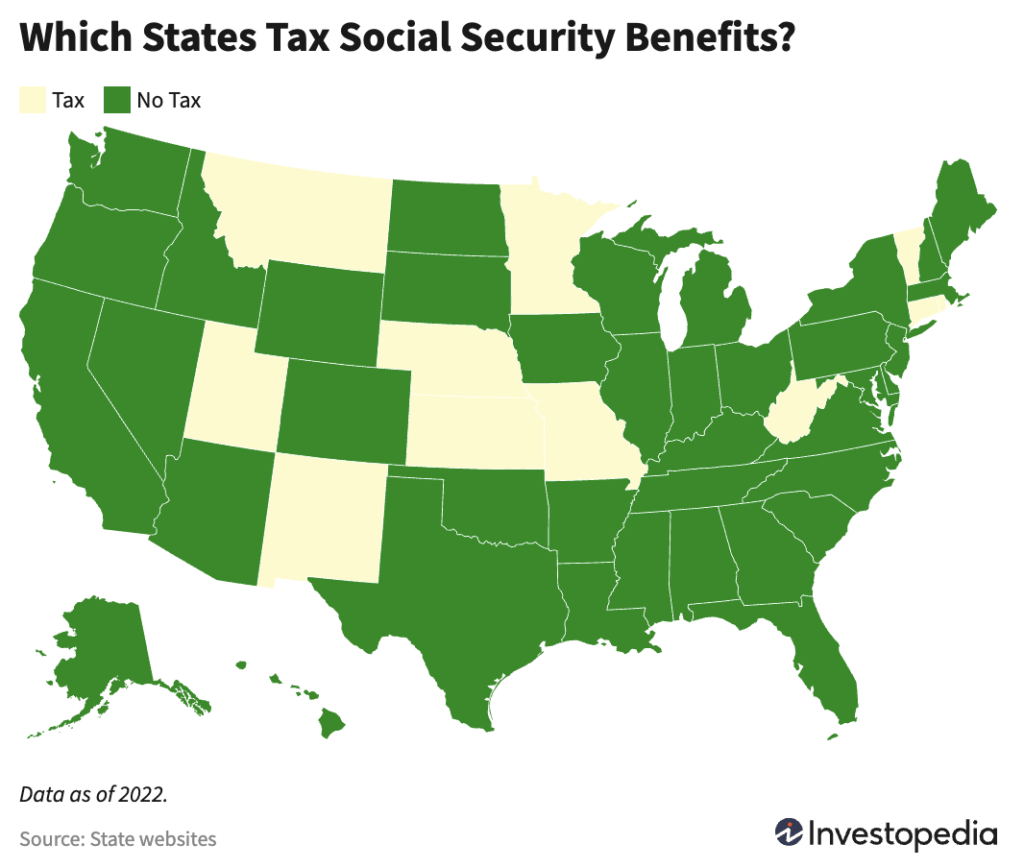

While the federal government taxes Social Security benefits using provisional income, state taxes work differently. Thirty-eight states and the District of Columbia do not tax Social Security benefits. Eleven states tax some or all of their residents’ Social Security benefits. Colorado taxes only Social Security benefits received by residents under age 65. The rates, exclusions, and income limits vary by state.

Data as of 2022. Source: Investopedia

Taxes can reduce the amount of money you get to spend in retirement. That’s why it’s essential to have a long-term tax plan. Understanding provisional income and the amount of taxes you could owe on your Social Security benefit is an important part of your customized retirement plan.

Sources: SSA.gov, Investopedia