The standard monthly cost of Medicare Part B will increase by 6% in 2024. Medicare Part B covers certain doctors’ services, outpatient care, medical supplies, and preventive services. The cost will increase by $9.80 to $174.70 from $164.90 in 2023.

The annual deductible for Medicare Part B beneficiaries will rise $14 to $240 in 2024, from $226 in 2023.

The increase comes after Medicare Part B premiums were lowered by $5.20 from 2022 to 2023. The Centers for Medicare & Medicaid Services (CMS) had cut the fee after lower-than-projected spending on an Alzheimer’s drug and other Part B items and services.

Why are Medicare premiums going up?

The Medicare Part B premium and the deductible are rising because of projected increases in health care spending and, to a lesser degree, having to repay providers for underpayment from 2018 to 2022, according to CMS.

Medicare Part B Income-Related Monthly Adjustment Amounts (IRMAA)

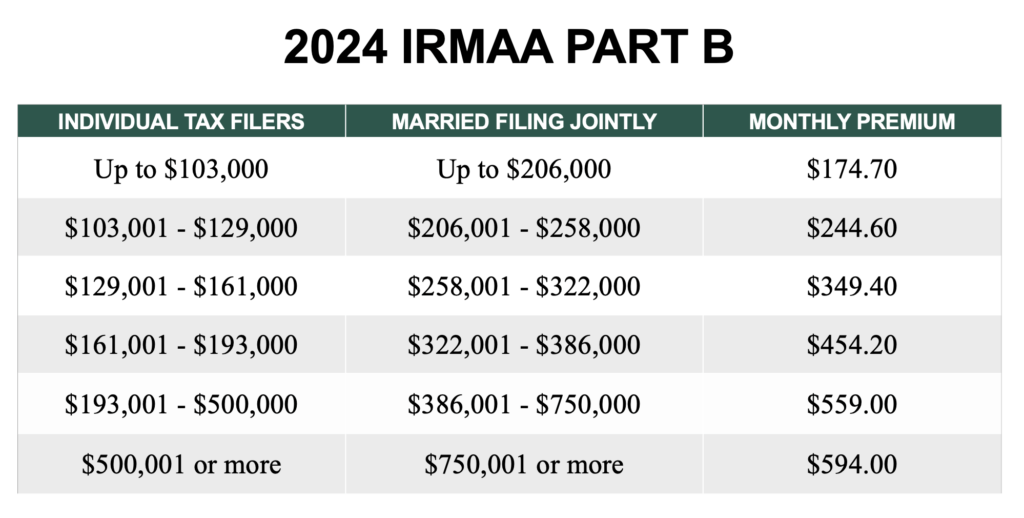

What you pay for Medicare Part B is based on income. Higher-income earners will pay a Part B Income-Related Monthly Adjust Amount (IRMAA). IRMAA is determined by income from your income tax returns two years prior. This means that for your 2024 Medicare premiums, your 2022 income tax return will be used.

For example, beneficiaries who file individual tax returns with a gross adjusted income between $103,000 and $129,000 in 2022 will pay $244.60 a month for Part B in 2024 instead of the standard $174.70. On the highest end, someone with income of $500,000 or greater will pay $594.00 a month for Medicare Part B.

Medicare and Social Security

Increased Medicare premiums will take a bite out of next year’s 3.2% Social Security cost-of-living adjustment or COLA. If you receive Social Security, your Medicare Part B premium is automatically deducted from your check each month.

In August 2023, the average monthly Social Security benefit was $1,705.79, according to the Social Security Administration. A 3.2% COLA would mean an extra $54.58 each month, with $14 deducted from that to pay for the higher Medicare Part B premium.

You’ve probably been getting a ton of information about Medicare enrollment and supplements in the mail and online. It can be challenging to wade through and even more difficult to apply to your situation. Get answers. Schedule a 15 Minute Retirement Check-Up Call today! You can ask questions about Medicare, Social Security, or any aspect of retirement.