Social Security benefits, Medicare premiums, and contribution limits are increasing in 2024. Here is a look at 2024 by the numbers.

3.2% Social Security

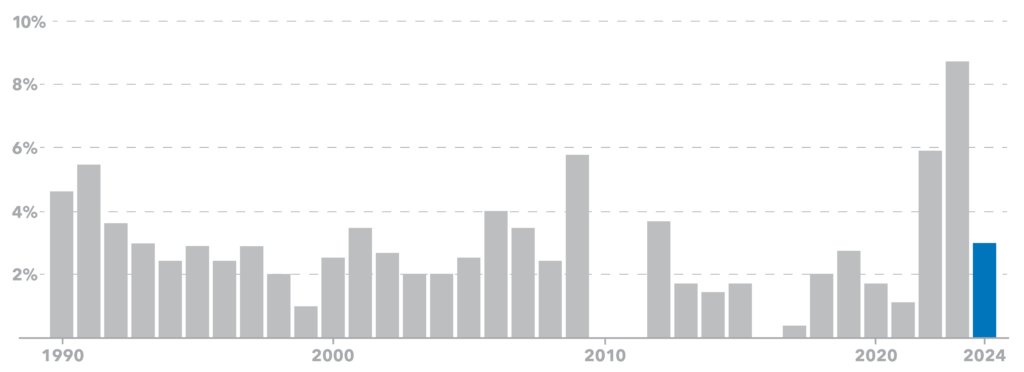

Social Security benefits will increase 3.2% in 2024. On average, Social Security retirement benefits will increase by more than $50 per month starting in January, according to the Social Security Administration. That’s far less than the historic inflation-induced 8.7% cost-of-living or COLA boost of 2023. The COLA is calculated using the Bureau of Labor Statistics’ Consumer Price Index, or CPI.

Payroll taxes finance Social Security. The maximum amount of earnings subject to Social Security payroll taxes will be $168,600, up from $160,200 in 2023.

Social Security cost-of-living adjustments since 1990

Source: Social Security Administration

If you claim Social Security between 62 and your full retirement age (FRA), your benefits could be reduced if you are still working. The earnings limit will increase to $22,320, up from $21,240 in 2023. For every $2 in earnings above that limit, $1 in benefits will be withheld.

6% Medicare

The standard monthly cost of Medicare Part B will increase by 6% in 2024. Medicare Part B covers certain doctors’ services, outpatient care, medical supplies, and preventive services. The cost will increase by $9.80 to $174.70 from $164.90 in 2023.

The annual deductible for Medicare Part B beneficiaries will rise $14 to $240 in 2024, from $226 in 2023.

The increase comes after Medicare Part B premiums were lowered by $5.20 from 2022 to 2023. The Centers for Medicare & Medicaid Services (CMS) had cut the fee after lower-than-projected spending on an Alzheimer’s drug and other Part B items and services.

Why are Medicare premiums going up?

According to the Centers for Medicare & Medicaid Services (CMS), the Medicare Part B premium and the deductible are rising because of projected increases in health care spending and, to a lesser degree, having to repay providers for underpayment from 2018 to 2022.

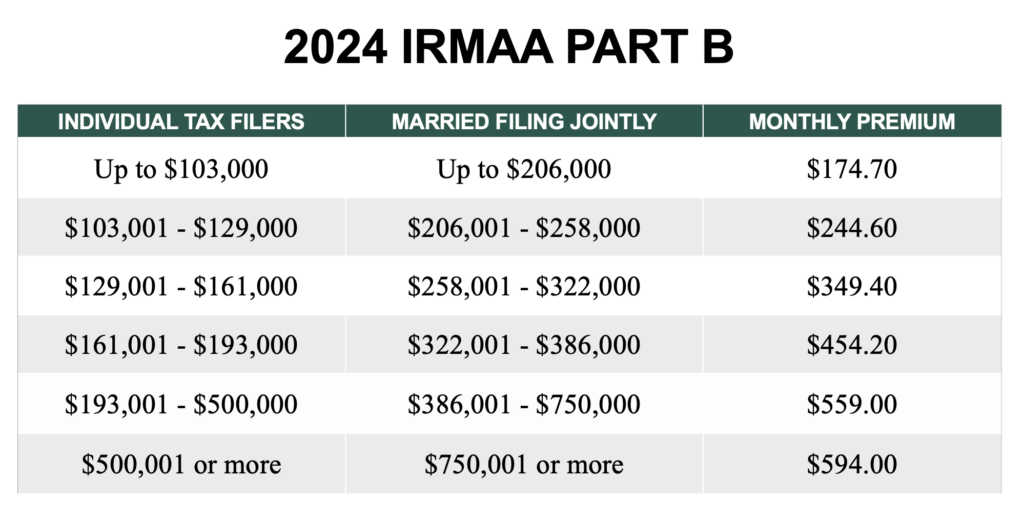

Medicare Part B Income-Related Monthly Adjustment Amounts (IRMAA)

What you pay for Medicare Part B is based on income. Higher-income earners will pay a Part B Income-Related Monthly Adjustment Amount (IRMAA). IRMAA is determined by income from your income tax returns two years prior. This means that for your 2024 Medicare premiums, your 2022 income tax return will be used.

For example, beneficiaries who file individual tax returns with a gross adjusted income between $103,001 and $129,000 in 2022 will pay $244.60 a month for Part B in 2024 instead of the standard $174.70. On the highest end, someone with an income of $500,001 or greater will pay $594.00 a month for Medicare Part B.

$14 Medicare and Social Security

Increased Medicare premiums will take a bite out of next year’s 3.2% Social Security cost-of-living adjustment or COLA. If you receive Social Security, your Medicare Part B premium is automatically deducted from your check each month.

In August 2023, the average monthly Social Security benefit was $1,705.79, according to the Social Security Administration. A 3.2% COLA would mean an extra $54.58 each month, with $14 deducted from that to pay for the higher Medicare Part B premium.

10 Medicare Price Negotiations

For the first time, the government can negotiate prescription drug prices with pharmaceutical companies. Negotiations will begin with ten drugs in 2024. The negotiated prices will go into effect in 2026. The government has announced which drugs will undergo negotiations. They include blood thinners, diabetes drugs, and heart failure medications.

The selected drug list for the first round of negotiation is:

| Eliquis |

| Jardiance |

| Xarelto |

| Januvia |

| Farxiga |

| Entresto |

| Enbrel |

| Imbruvica |

| Stelara |

| Fiasp; Fiasp FlexTouch; Fiasp PenFill; NovoLog; Novolog FlexPen; NovoLog PenFill |

CMS said Medicare recipients spent $3.4 billion out of pocket for these drugs in 2022, with the average out-of-pocket spending for the most expensive drugs as high as $6,497 per enrollee.

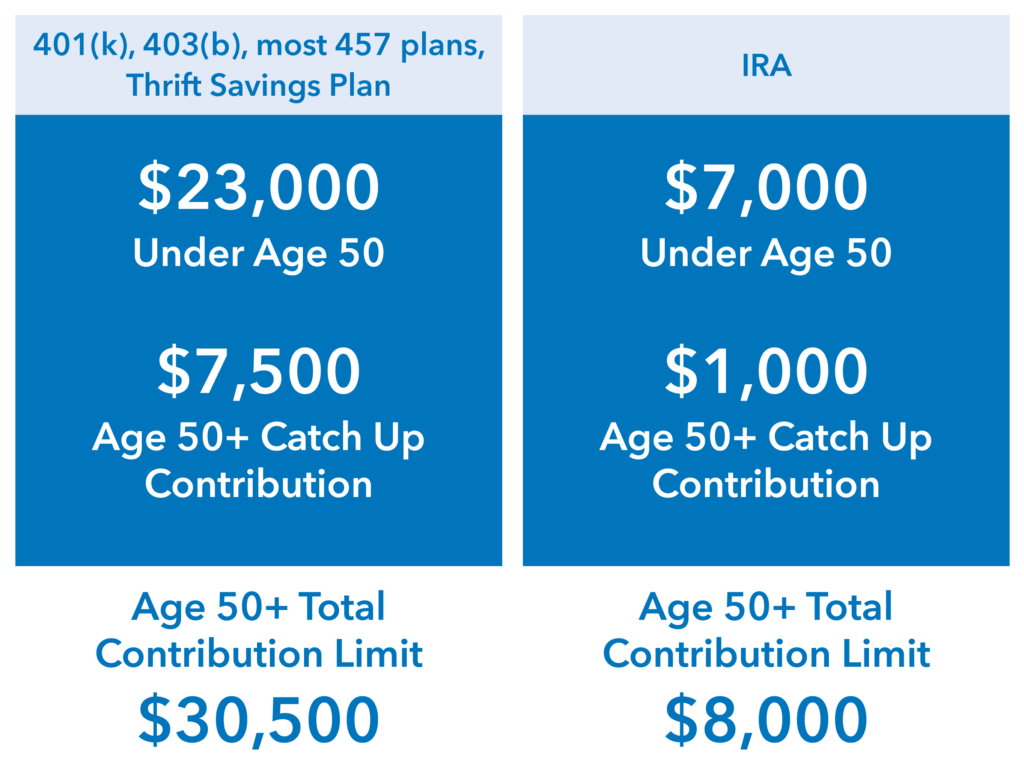

$30,500 Contribution Limits

The IRS will allow you to put more money into your employer-sponsored retirement account next year.

The contribution limit for employees who participate in 401(k), 403(b), and most 457 plans, as well as the federal government’s Thrift Savings Plan, will increase to $23,000 in 2024, up from $22,500 in 2023. The catch-up contribution limit for employees 50 and over remains $7,500 for 2024. This brings the total contribution limit to $30,500 for those 50 and older.

The annual contribution limit to an IRA will increase to $7,000, up from $6,500. The IRA catch-up contribution limit for those age 50 and over remains $1,000 for 2024 for an $8,000 total.

2024 Contribution Limits

As part of Your Merkle Plan, we’ve developed a customized plan for retirement. If you have questions about Social Security, Medicare, contribution limits, or any of the components of Your Merkle Plan, please don’t hesitate to contact us.

You understand the power of a customized retirement plan – but do your friends? Help your friends and family start their retirement journey by forwarding them this important retirement information today.

Sources: SSA.gov, IRS.gov, HHS.gov