We look at why you can’t simply “set it and forget it” when it comes to retirement planning. We highlight the importance of ongoing maintenance and adjustments to adapt your written plan to life changes and legislative updates.

Covered topics:

– The need for ongoing attention to retirement plans

– Implications of legislative changes on retirement plans

– Importance of proactive planning and ran ongoing relationship with your retirement planner

– Three distinct phases of retirement and how they impact retirement planning

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

TRANSCRIPT

Molly Nelson [00:00:00]:

A retirement plan is a great start, but what happens next? Why you can’t set it and forget it right now, on Retiring Today. Welcome to Retiring Today. I am Molly Nelson here with Loren Merkle. Loren is a CERTIFIED FINANCIAL PLANNER™, a Certified Financial Fiduciary®, and a Retirement Income Certified Professional® and that means, Loren, you sit down with people every day. You help them develop retirement plans.

Molly Nelson [00:00:45]:

So we know that some of the people watching, they’ve developed retirement plans with you and your team. And some of the people watching have a retirement plan, and they’re feeling good about that. First, we want to say congratulations. If you do have some kind of plan, that’s a great start, because most people who are looking to make that transition to the retirement phase of their life actually don’t have a retirement plan, let alone a written retirement plan. So, if you’re one of the lucky few who have a written retirement plan, congratulations. That is a great start. That may not be the end, though.

Molly Nelson [00:01:13]:

Yeah. And this concept for today’s show stems from questions we sometimes get in our Retire Ready phone calls. And they’ll say, well, Loren, Chawn, or Clint or Haley, once you write me a plan, it’s bye-bye, we’re done, right?

Loren Merkle [00:01:28]:

Yeah. I distinctly remember a visit that I had. This was the second visit with this gentleman, and he said, Loren, I love everything you’re talking about. We’re talking about my tax plan. We’re talking about how I’m going to get income when I retire, talking about how I’m going to have income 20 years in retirement. I love it all. But I feel like once we get this plan all set up, it’s set up, and I don’t need you guys anymore. And since we started working with that gentleman, there have been many changes in his life that have taken place.

Loren Merkle [00:01:56]:

Like his mom. His mom passed away, and so he inherited some money from his mom. Different types of money, different rules around those different types of inheritances. Legislation has changed significantly since we set up his plan the first time. So he has come to the realization that there, in fact, are many things that can take place over the course of one’s retirement that would require adding on to the plan, subtracting from the plan, just changing the plan as life changes.

Molly Nelson [00:02:22]:

Yeah. And that’s what we want to get at today, is you use the term set it and forget, I think of the slow cook of the chili you have going all day. That’s great. When you’re trying to eat, eat dinner later in the day and start it early. But when it comes to retirement, that just doesn’t work. And we want to explain to people why, because really, at the end of the day, you want to make the most out of your retirement. You don’t want to just hope that it’s going to be done. When you go to take the lid off, you want to know that it’s going to get you all the way through.

Loren Merkle [00:02:44]:

I think if there’s one phrase that we can all walk away with from today’s show is that your retirement plan is not a set it and forget it. And the reason why it’s not a set it, forget it, because life changes. Your life has always changed. It will continue to change, even in retirement. And then there’s other things outside of your control that can also change, like legislation. Just a prime example of how some changes outside of your control, like legislation, can actually have a big impact on your overall retirement plan. Some of you may remember the Secure Act was passed and took place January 1st of 2020, and there were many provisions within this legislative change. In fact, over 60 retirement planning provisions were involved in this.

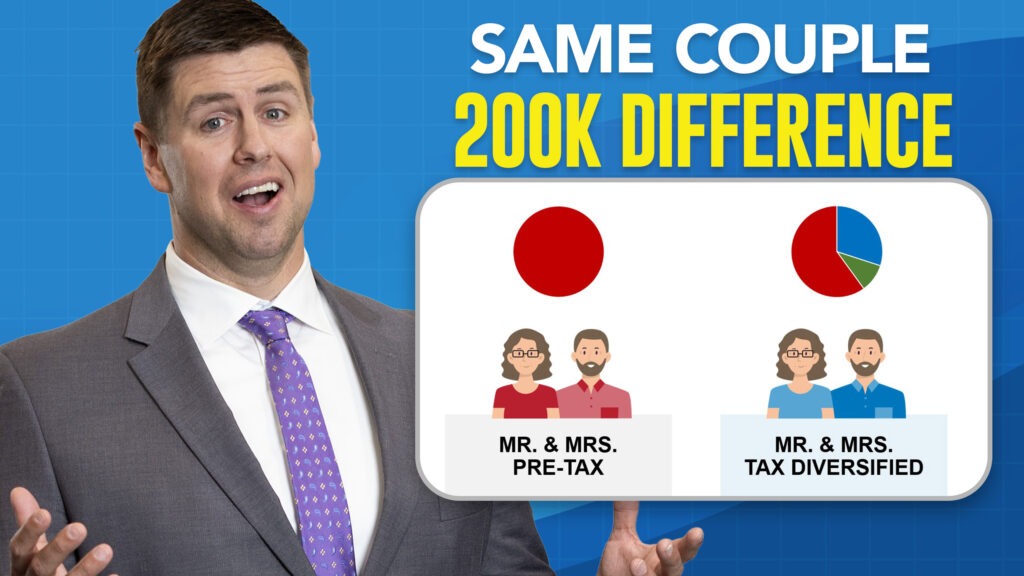

Loren Merkle [00:03:30]:

But one of those provisions affected the required minimum distribution, which is the law that says once you reach a certain age, you have to start taking distributions from your pretax accounts, like your IRA or your employer type of accounts, like the 401(k). So, once you reach a certain age, now, prior to this legislative change, that age was 70 1/2. But when the first Secure Act passed, it moved that age for some people from 70 1/2 to 72. And then, as if that wasn’t complex and confusing enough, there was a revision to the Secure Act that moved it for some other people, the required distribution age from 72 to 73, or for another group of people, 75. So if you’re sitting here and you have some of these accounts, IRAs, 401(k)s, you’ve never paid taxes on that money before. You know there’s going to come a time where you have to take a distribution. But now the question is, when is that time for you? Because you’re sitting around the kitchen table with some of your family and they’re over 70 1/2, they fall within one piece of legislation, and they’re saying you have to start taking distributions out of 70 1/2. But you’ve heard from a coworker that actually you don’t have to take them out until 72.

Loren Merkle [00:04:50]:

And now maybe some people are saying 73 or even 75, it becomes very confusing. So, if you are unaware of the type of legislative changes that take place or even misinterpret these legislative changes, it can cost you dearly. Just a quick example. Let’s say your required distribution amount is $10,000. You’re in the 22% marginal tax bracket, meaning that the Secure Act law took place. You thought you had to take your required distribution at seven and a half, but in fact, you didn’t have to take it until 72. But you went underneath the old legislation. You took the $10,000 out, 22% federal tax bracket, $2,200 in tax.

Loren Merkle [00:05:34]:

You took the distribution out, you didn’t have to. You paid the 22% or $2,200 in tax. You didn’t have to. At that time, if you were aware and interpreted the legislation changes appropriately for you, then you have now a whole bunch of different options that don’t involve paying taxes on money you don’t have to. And just taking it out as distribution. Like as an example, you could just do a qualified charitable distribution, which means you’re not donating to your churches and nonprofit organizations that are meaningful to you in cash, but you’re taking it from your pre-tax IRA, sending it directly to those organizations. You don’t pay taxes on that, they don’t pay taxes on that, and they can benefit from your contribution. That’s an example.

Loren Merkle [00:06:23]:

Or maybe even just a simple Roth conversion where you’re taking money from that pretax account, you’re shifting it over to the Roth. You will pay taxes, but you’re doing that intentionally, because once that money is underneath the Roth, it grows tax free forever. An incredibly powerful strategy. Pre-RMD and for some people, even post RMD age. But if you’re not aware of how the legislation changes impact you, these ideas, these strategies may not be top of mind for you to take advantage of along the way. So, there’s a lot of things that do change. Some of these things are outside of your control, some are in, but you need to be aware and then understand how they apply to your specific situation.

Molly Nelson [00:07:08]:

Okay, I heard you say something there I got tripped up on. It was interpreting the legislation. Now, I know you read that bill. I know you read both Secure Acts pretty thoroughly. I’ve read a little legislation in my day as my time as a news reporter. Interpreting legislation is not easy for most people.

Loren Merkle [00:07:25]:

Well, it’s not easy. And also, it was very vague. So there were aspects of that bill that were very specific, left little room for misinterpretation. But then there was a lot of provisions that left a lot of room for misinterpretation. And so, even now, all these years later, people are still wondering how those provisions apply to them. And when I say people, I’m not talking about novices. I’m talking about scholars in the industry who are still discussing what does that legislation actually means. And so there has been a lot of conversation back and forth with the IRS on some of those, and knowing what those conversations are and what the current takeaways from those conversations, that’s the guidance that you use to help you make those decisions.

Loren Merkle [00:08:09]:

And if you’re not on top of that, then it’s a troublesome world.

Molly Nelson [00:08:14]:

And you set up kind of the point I was getting at brilliantly is that I don’t know that everybody viewing needs to understand the legislation, but it’s like whether you want to cut your own hair or not, or whether you want to work on your own car, if you have somebody that you trust to read the legislation, trust to help you interpret the legislation, I think that’s the kind of maintenance in your retirement plan and the value of a retirement planning on your team.

Loren Merkle [00:08:36]:

Yeah, that’s the part that we really focus a lot of our efforts and timeline and conversations. So, the strategy reviews that we incorporate with the families and individuals we serve, we get together with them at least once a year and go through some of the legislative changes, and we don’t go through the law and the legal aspects of it.

Molly Nelson [00:08:53]:

Good. You don’t make anybody read legislation.

Loren Merkle [00:08:55]:

No, but we certainly go through the implications. What does this change mean to you? When do you have to take your distributions? How can you do it the most tax favored way possible? Are there some other strategies and ideas like charitable donations you’re already gifting in cash to your church? Should you be doing it that way? Are there more efficient ways to do so where your church still benefits? You benefit even more. All these different things we talk about specific to the families and individuals we serve, and then all the noise out there, right? All the misinterpretations, all the other legislation that’s not applicable. You don’t have to worry about that. Let’s just enact strategies that are meaningful to you.

Molly Nelson [00:09:34]:

Today we’re talking about what happens after you have a retirement plan. But you might be wondering, I don’t have a retirement plan. Or what is a retirement plan? Our online Journey to Retirement workshop is a great way to understand what a comprehensive retirement looks like. So, what you’re going to do is go on a journey with John and Sue through their eyes. You’re going to see all of the decisions that John and Sue have to make and what’s coming in retirement. It’ll give you a great understanding of exactly what a retirement plan is a comprehensive retirement plan is. You can sign up for online Journey to Retirement workshop at RetireWithMerkle.com but don’t go anywhere because we still got some more ideas about the things that should be happening after you put together a retirement plan. Next.

Voice Over [00:10:24]:

Anytime I have even the smallest question about my accounts or what effect the latest tax law might have on my situation, the Merkle Retirement Planning team is always there and quick to help. I’m so glad they treat you like well, like family. I’m so happy to have such an excellent team working for my future and ensuring I do the best to achieve my financial goals.

Voice Over [00:10:48]:

Merkle Retirement Planning. Your retirement starts here.

Voice Over [00:10:54]:

Do you wonder if you have enough saved for retirement? Will your money last as long as you do? Will taxes, health care costs and inflation derail your retirement? Get answers. Schedule a 15 Minute Retirement Check-Up Call today. We can cover a lot in 15 minutes, including strategies you can implement now to start your retirement journey. Schedule a call at MerkleRetire.com the first step to a confident retirement starts with a simple phone call.

Voice Over [00:11:24]:

Do I have enough saved for retirement? When should I take Social Security? Which Medicare option is best? How do I plan for inflation? Sometimes the road to retirement starts with more questions than answers. We’re here to help. Join us for our upcoming Journey to Retirement workshop. Get answers and start your retirement journey with confidence. Our online workshop includes information on Secure Act 2.0 and changing retirement rules. Visit RetireWithMerkle.com to register for an upcoming workshop. Your retirement journey starts now.

Voice Over [00:11:55]:

The Merkle Retirement Planning team provides personable and professional expertise unrivaled in this area. They include us in every step of the planning process. The peace of mind provided to us by the Merkle team allows us to fully enjoy this special time of our lives. Instead of feeling snake bit, we feel confident that with the Merkle Retirement Planning team at our sides, we can navigate any challenge that comes our way.

Voice Over [00:12:20]:

Merkle Retirement Planning. Your retirement starts here.

Molly Nelson [00:12:32]:

It’s time for Your Journey Your Questions, this is the time in the show when we answer questions from you. These are questions we received during our online Journey to Retirement workshop. So, here’s one of the latest questions we got is, what are the three phases of retirement? And Loren, I’m going to add a little side note here. The three phases of retirement obviously something you talk about in the online Journey to Retirement workshop.

Loren Merkle [00:12:54]:

Yes, the person who asked this question must have been paying attention because we do kind of hint at the three phases. But we don’t go into extreme detail, but they picked up on the fact that there are actually three distinct phases in retirement. The first phase is the phase that you’re really thinking about, probably ten years, maybe even 20 years prior to retirement. This is the go-go phase. This is when you’re really excited, you still have motivation and energy, and you’ve been waiting for this time that now you have all this free time, and you don’t have to go to work. You can go chase the grandkids around, you can motorhome around the country, winter down south. All these things that you’ve been thinking about doing, right, this is the glamorous part of retiring the go go years. But eventually it’s going to transition into the slow-go years where you have a little bit less energy, maybe a little bit less motivation to travel around the country or the world, or maybe even less energy to get outside the house on a more frequent basis.

Loren Merkle [00:13:51]:

So, things just tend to slow down a little bit, and then eventually that’ll transition into the no-go years where you really don’t want to do much of anything outside the house. It’s going to cost you something a little bit different, probably. And one way to think about the spend is in the go-go years, you’re spending money on all the things that you want to do, all the travel and activities. In the no-go years, you’re probably spending more money on the things that you have to spend money on. Not the things that you want to spend money on, but the three distinct phases. If we’re lucky, all of us will see those three distinct phases of retirement.

Molly Nelson [00:14:26]:

And this goes well with what we’re talking about today because I’m going to guess, Loren, in each one of those phases, you may have to retool your retirement plan a little bit, and that includes meeting with your retirement planner to talk about that next phase.

Loren Merkle [00:14:39]:

A prime example of how people’s thought process change as they go through the three distinct phases is the legacy plan. One of the pillars, one of the six pillars of a retirement plan is the legacy planning. During those go-go years, when you’re doing all these activities and you’re excited and on the move, most people, most of you are not really thinking about the time that you’re going to pass away. And then how does everything transition? It should be a part of your plan, but that’s not where most of your thoughts are. But when you get to the slow-go phase, of your retirement and you really confident about what it’s going to take you on a month-to-month basis to do the things that you want to do. And you have enough reserves left over, right. Your confidence in your retirement really is probably at a high now you’re starting to think of things like do you give while you’re alive? And certainly, what happens to all of these different things when you do pass away. And the planning required for that phase of your life is substantially different than even the go-go years when you’re primarily focused on how do you get enough income from Social Security, maybe a pension, and your investable resources to do all the things you want to do.

Molly Nelson [00:15:44]:

And I have to think, Loren, that you can enjoy the go-go years a lot more if you know you have a plan to pay for the slow-go and no-go years.

Loren Merkle [00:15:52]:

Yeah, and that’s why we address all those really initially when you build your plan. So, you have a written plan for all of those different phases of your retirement in the six pillars. But what your focus is on is how do you enjoy yourself in this free time that you now have?

Molly Nelson [00:16:07]:

And one way to enjoy yourself is to have a retirement plan to understand how you’re going to fund this retirement lifestyle. Our online Journey to Retirement workshop goes over just that. And as you can see, you can ask questions during that workshop as well. And we may answer them here on the show. It’s RetireWithMerkle.com. More on why you can’t just set and forget our retirement plan next.

Voice Over [00:16:34]:

Do you wonder if you have enough saved for retirement? Will your money last as long as you do? Will taxes, health care costs and inflation derail your retirement? Get answers. Schedule a 15 Minute Retirement Check-Up Call today. We can cover a lot in 15 minutes, including strategies you can implement now to start your retirement journey. Schedule a call at MerkleRetire.com the first step to a confident retirement starts with a simple phone call.

Voice Over [00:17:05]:

The Merkle Retirement Planning team provides personable and professional expertise unrivaled in this area. They include us in every step of the planning process. The peace of mind provided to us by the Merkle team allows us to fully enjoy this special time of our lives. Instead of feeling snake bit, we feel confident that with the Merkle Retirement Planning team at our sides, we can navigate any challenge that comes our way.

Voice Over [00:17:30]:

Merkle Retirement Planning. Your retirement starts here.

Voice Over [00:17:35]:

Do I have enough saved for retirement? When should I take Social Security? Which Medicare option is best? How do I plan for inflation? Sometimes the road to retirement starts with more questions than answers. We’re here to help. Join us for our upcoming Journey to Retirement workshop. Get answers and start your retirement journey with confidence. Our online workshop includes information on Secure Act 2.0 and changing retirement rules. Visit RetireWithMerkle.com to register for an upcoming workshop. Your retirement journey starts now.

Voice Over [00:18:05]:

You dream of a happy retirement, but there are some big questions to answer. First, do I have enough saved? When should I take Social Security? How will I pay for health care and keep up with inflation? Go to MerkleRetire.com to schedule a 15 Minute Retirement Check-Up Call to talk directly with a Retirement Planner and get answers to your important retirement questions. The first step to your retirement starts with a 15 Minute Retirement Check-Up Call.

Voice Over [00:18:32]:

Anytime I have even the smallest question about my accounts or what effect the latest tax law might have on my situation. The Merkle Retirement Planning team is always there and quick to help. I’m so glad they treat you like, well, like family. I’m so happy to have such an excellent team working for my future and ensuring I do the best to achieve my financial goals.

Voice Over [00:18:59]:

Merkle Retirement Planning. Your retirement starts here.

Molly Nelson [00:19:22]:

This is Retiring Today. I’m Molly Nelson here with Loren Merkle, and we’re talking about why you can’t just set it and forget it when it comes to your retirement plan. And Loren, I was thinking about this, you know, kind of saying it to the viewer, you can’t set it and forget it. But you know what? I’m going to switch this around. Your financial advisor can’t set it and forget it. They should probably be reaching out to you, not you reaching out to them. Or it could be a combination of both, right? Yeah.

Loren Merkle [00:19:44]:

This really should be a true partnership where there’s times that you need to reach out to your planner, but there’s also times your planner needs to reach out to you. But no matter who’s initiating that contact, there’s a couple of true things that should take place in most of these relationships is there should be a scheduled contact. So, a scheduled time on your calendar, scheduled time on your planner’s calendar where you guys have agreed that this time works to get together and the frequency should be at least about once a year. Now, that’s just the scheduled contact, but there’s going to be other times within the course of that year that you might want to conversate or even get together with that planner based on different things that change in your life or outside of your life, like legislation and that kind of stuff as well.

Molly Nelson [00:20:28]:

So, an annual get together, that makes sense. Kind of look at things, see where everybody’s at. What are some other examples of times when maybe you’ve decided with your team, hey, we need to reach out to people and maybe make some changes to?

Loren Merkle [00:20:41]:

Their plan – as a part of a proactive plan – there are certain times that we, as a team, need to reach out to the families and individuals that we serve. We put contingencies within most people’s plan. And what that contingency means is, if this happens, like, let’s say we go through a recession, the market’s down by 30%, our families and the individuals that we serve, their plans are not going to blow up. But there’s contingencies for that, which, I mean, there’s action steps then that we can take triggering events, like a big down on the market. There are action steps that we then take to help take advantage of that overall market. And we put a name around that, we call that go time. So, everybody in our team, a lot of the families that we work with, know when it’s go-time.

Loren Merkle [00:21:25]:

That means that there’s an action step within the plan, some environmental event took place, like the market being down. Now, there’s things that we can enact to help take advantage of that. 2020 was a great example of a perfect time frame of which we could do something like that. 2022 also a good time frame. And then each and every year, at least every 18 months, there’s probably some kind of an event that we can enact, a go time like provision in which we do a Roth conversion when the market’s down, or even a dollar cost averaging strategy where we have some safe money that didn’t get impacted by the big downturn in the market, then we can take a piece of that and then put it into the market and buy low. What everybody always says as far as how to make money in the market is buy low, sell high. It’s just really hard to do that, especially when you’re retired and you’re not contributing to something like an IRA or a 401(k) type of investment. But we have those things built in within the plan, and that’s just one example of when we would reach out to the individuals and families that we serve to say, hey, it’s go time.

Loren Merkle [00:22:32]:

This is one of the contingencies in your plan. Let’s start working on it.

Molly Nelson [00:22:36]:

While you were talking, I was imagining, like, a special red go time phone and maybe like, some capes some people put on. And they asked, what do you think?

Loren Merkle [00:22:42]:

I was thinking, you’re imagining the time that you’re at the beach maybe building the sandcastle.

Molly Nelson [00:22:46]:

Yeah. In retirement. Yeah, I’m already thinking about retirement. Yeah, I get that. Sometimes my mind wanders that way, too, when you’re talking like, yeah, retirement, it’ll get here.

Loren Merkle [00:22:55]:

The sandcastles at the beach are a lot like your retirement plan. It’s not set it, forget it. You build a sandcastle at the beach, even if the tide doesn’t come up and wipe it away, they have the wind, you have other elements. So, unless you stay on top of that construction, it is going to go away. Your retirement plan, very much the same way. It needs attention. It needs attention from you, it needs attention from your advisor. It is a partnership. That way it doesn’t get blown away by the environmental elements.

Molly Nelson [00:23:21]:

And you’ve done a good job of giving us some ideas of things that we need to be talking about with our retirement planner, even after we set that initial plan. But now I’m going to back up just a little bit because for some people, they’re still going, do I have a plan? They may have a 401(k), but do they have a plan to spend out of the 401(k)? They might have an IRA, but they haven’t decided which Social Security decision is best for them. So, let’s rewind and talk about some of the work that goes into building a retirement plan. Yeah.

Loren Merkle [00:23:47]:

When we meet with somebody for the first time, almost everybody we meet with does not have a plan. They do have investments. Right. They have their 401(k). They have an IRA, maybe a brokerage account, but that is not a plan by itself. So, we work together and we have a three-step process that we have coined to help us develop the plan and stay on track. But within that three-step process, there might be four, maybe even five individual visits to help construct and then implement this overall plan. We make it a really easy process.

Loren Merkle [00:24:16]:

It should be fun. There’s a lot of financial stuff that goes into it. Maybe that’s not your cup of tea, but I can tell you, getting to see what your retirement looks like on paper from a financial standpoint, and how you can realize your retirement dreams, these things you’ve been thinking about for a while, that is the fun part. And when you can realize that, when you can see that and the anxiety kind of dissipates and goes away and you get to that noise of all the financials and things that you don’t really want to think about, that it kind of evaporates and you can see clearly how you’re going to be able to live your retirement. That is fun.

Molly Nelson [00:24:51]:

That’s a lot of fun. And maybe you can have a conversation about building sandcastles with you.

Loren Merkle [00:24:54]:

Hey, if that’s a part of your plan, you got the grandkids. I like to build sandcastles. Let’s go to the beach. Whatever your retirement is, your plan should reflect this. It’s your life, your retirement. It should be your plan.

Molly Nelson [00:25:06]:

So, it does come with decisions. You might be wondering, what are all those decisions? What do they look like? Here is a great opportunity. It’s our online Journey to Retirement workshop. Here’s what’s going to happen. You can go to that website right now or use the QR code to bring up the camera on your phone. Sign up for a time and a date that works for you. And then you’ll meet John and Sue. You will go along with John and Sue as they make all of these retirement decisions, electing Social Security, looking at Medicare and supplements, tax planning, all the things that are coming.

Molly Nelson [00:25:33]:

Then what you can do is feel like you’re more ready to understand exactly what a retirement plan is and how a retirement plan can benefit you. This is Retiring Today and we thank you for watching.

Voice Over [00:25:57]:

The Merkle Retirement Planning team provides personable and professional expertise unrivaled in this area. They include us in every step of the planning process. The peace of mind provided to us by the Merkle team allows us to fully enjoy this special time of our lives. Instead of feeling snake bit, we feel confident that with the Merkle Retirement Planning team at our sides, we can navigate any challenge that comes our way.

Voice Over [00:26:22]:

Merkle Retirement Planning. Your retirement starts here.

Voice Over [00:26:27]:

Do I have enough saved for retirement? When should I take Social Security? Which Medicare option is best? How do I plan for inflation? Sometimes the road to retirement starts with more questions than answers. We’re here to help. Join us for our upcoming Journey to Retirement workshop. Get answers and start your retirement journey with confidence. Our online workshop includes information on Secure Act 2.0 and changing retirement rules. Visit RetireWithMerkle.com to register for an upcoming workshop. Your retirement journey starts now.

Voice Over [00:26:58]:

You dream of a happy retirement, but there are some big questions to answer. First, do I have enough saved? When should I take Social Security? How will I pay for health care and keep up with inflation? Go to MerkleRetire.com to schedule a 15 Minute Retirement Check-Up Call to talk directly with a Retirement Planner and get answers to your important retirement questions. The first step to your retirement starts with a 15 Minute Retirement Check-Up Call.

Voice Over [00:27:25]:

Anytime I have even the smallest question about my accounts or what effect the latest tax law might have on my situation. The Merkle Retirement Planning team is always there and quick to help. I’m so glad they treat you like. Well, like family. I’m so happy to have such an excellent team working for my future and ensuring I do the best to achieve my financial goals.

Voice Over [00:27:51]:

Merkle Retirement Planning. Your retirement starts here.

–––

We are an independent financial services firm helping individuals create retirement strategies using a variety of investment and insurance products to custom suit their needs and objectives. The content and examples shared are for informational purposes only and should not be construed as investment advice or serve as the sole basis for making financial decisions. Individuals are encouraged to consult with a qualified professional before making any decisions about their personal financial situation. Our firm is not permitted to offer legal advice. Investment Advisory Services offered through Elite Retirement Planning, LLC. Insurance Services offered through MRP Insurance, LLC.