We cover the intricacies of Required Minimum Distributions or RMDs, highlighting their impact on retirement planning and offering insights into strategies that can help minimize tax burdens and optimize retirement income.

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

What Are Required Minimum Distributions (RMDs)?

RMDs refer to the minimum amount that must be withdrawn annually from your tax-deferred retirement accounts, such as 401(k) plans and traditional IRAs, once you reach a certain age. Retirement Planner Loren Merkle explains that when you initially contribute to these accounts, the IRS allows your investments to grow tax-deferred. However, when you reach the RMD age, the IRS mandates that you begin withdrawing funds, thereby converting your tax-deferred retirement savings into taxable income.

Understanding the Moving Target of RMD Age

One of the dynamic aspects of RMDs is the age at which distributions begin. Historically, the starting age was 70 ½, but legislative changes have shifted this timeline. With the passing of the SECURE Act in 2020, the age moved to 72. Then, the SECURE Act 2.0 raised the age to 73, starting in 2023. The age to start taking RMDs is set to increase to 75 in 2033. This shifting timeline necessitates regular monitoring of legislative decisions, as these can directly impact your retirement strategy.

How to Calculate RMDs

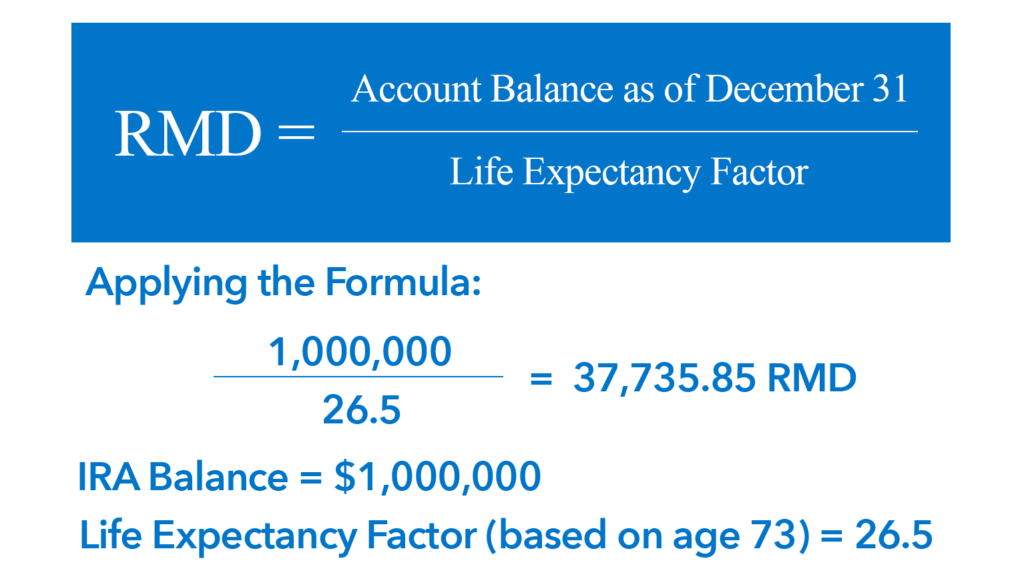

RMDs are calculated by dividing your previous year-end retirement account balance by a factor based on your age and life expectancy, as determined by the IRS. Here’s what it looks like applied to a $1 million IRA at age 73.

The formula for calculating an RMD is:

The RMD for 2025 would be $37,735.85.

The Tax Implications of RMDs

Loren describes the onset of RMDs as a “ticking tax time bomb.” As retirees begin taking distributions, their taxable income rises, potentially pushing them into higher tax brackets. To illustrate, Loren shares the story of Paul, a hypothetical pre-retiree with a $1 million IRA at age 57.

Using a return assumption of 7% a year, without taking distributions, his IRA grows to $3 million. At age 75, his RMD would be $122,000. Loren mentions how this can be a big surprise for retirees, one that can push them into a higher tax bracket than anticipated in retirement.

Proactive Planning for Paul

Next, Loren asks, “What if Paul did some proactive, long-term tax planning?” In scenario B, Paul engages in strategic Roth conversions starting at age 57 up until age 75.

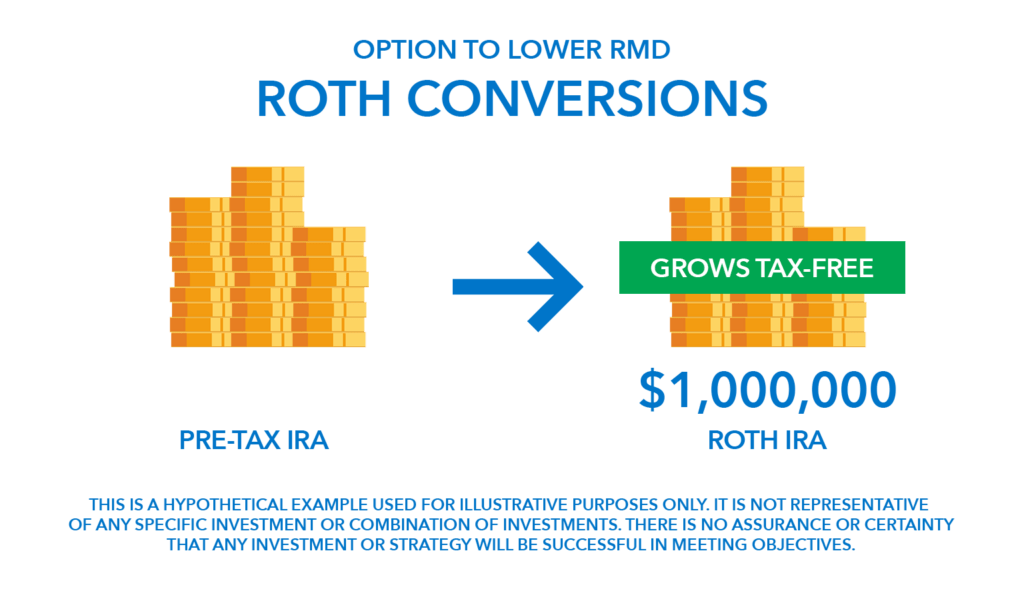

This involves transferring funds from a traditional IRA to a Roth IRA, where the money grows tax-free. Although taxes are paid on the converted amount in the year of conversion, this strategy can significantly reduce future RMDs and the associated tax burden.

In scenario B, Paul strategically converts $1 million from his traditional IRA to a Roth IRA over several years.

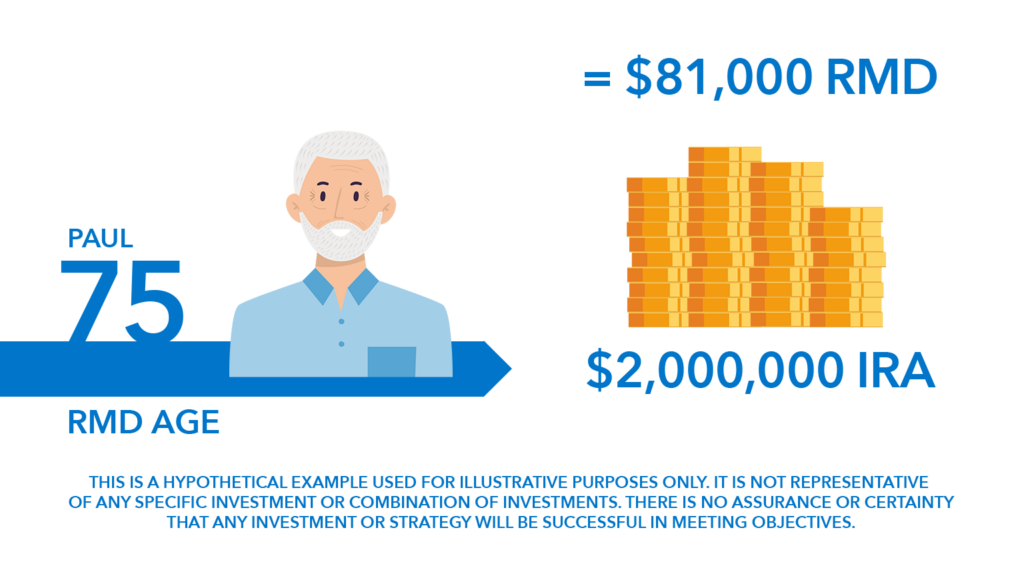

The balance of his IRA was reduced to $2 million at age 75 because of those Roth conversions.

So, instead of a $122,00 RMD, Paul is only required to take out about $81,000 at age 75, a $41,000 difference.

Loren points out that he not only lowered his RMD and taxable income, but that by converting some of his traditional IRA to a Roth IRA, that money grows tax-free and qualified distributions can be taken tax-free. Additionally, there is no RMD on a Roth IRA, increasing the control that Paul has over how and when he uses his money in retirement.

RMDs and Charitable Contributions

For charitably inclined retirees, Qualified Charitable Distributions (QCDs) offer another avenue to manage RMDs. Once a retiree reaches the age of 70 ½, they can donate up to $108,000 in 2025, directly from their IRA to a qualified charity. This amount counts towards their RMD but is excluded from their taxable income. This strategy not only supports charitable causes but can also minimize the tax impact of RMDs.

Penalties

If you fail to take the full RMD by the due date (typically December 31st), the IRS can impose a 25% excise tax on the amount you should have withdrawn. If you correct the shortfall within two years, the penalty can be reduced to 10%.

Conclusion

Navigating RMDs in retirement requires planning and regular review. Engaging in strategies such as Roth conversions and leveraging QCDs can provide retirees with greater control over their taxable income and help secure a more tax-efficient retirement. As rules and regulations continue to evolve, staying informed and seeking professional guidance can make all the difference in optimizing your retirement plan.

Click here to watch the full episode “What You Need to Know About RMDs in 2025” on YouTube!