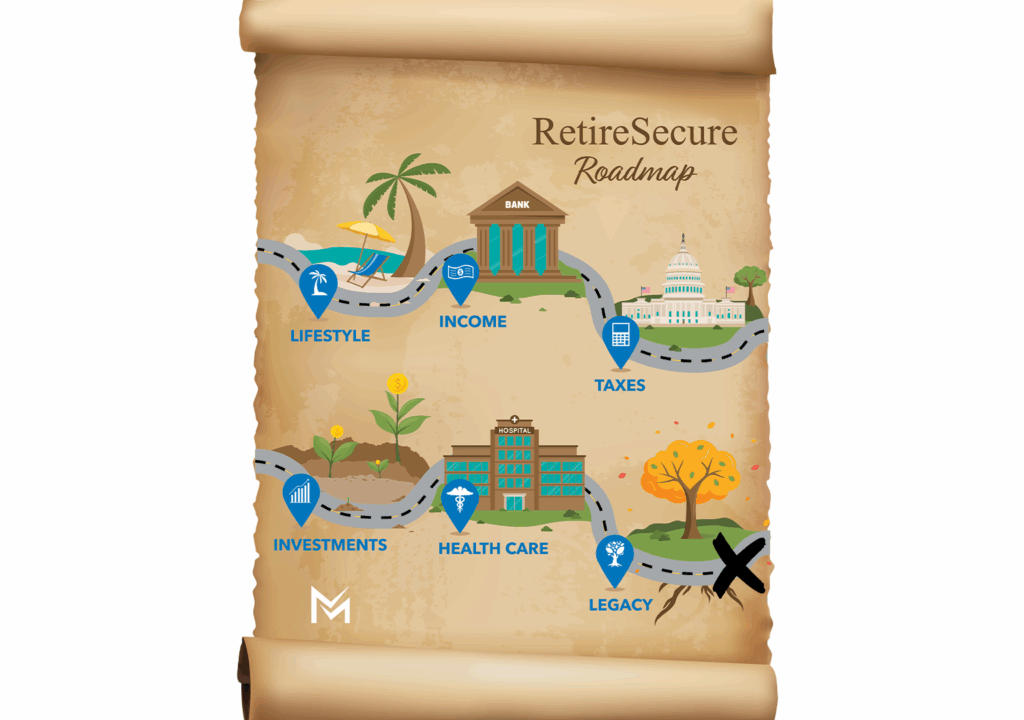

Our journey takes place inside the Cave of Questions because retirement often begins with more questions than answers and figuring out where to start can feel like navigating a dark cave. While inside, we discover that a map is a great place to begin—a guide to steer our travels.

That map is the RetireSecure Roadmap, a visual representation of the personalized retirement plans we help families and individuals build. Each planning milestone connects to the others to answer key questions and paint the picture of what belongs in a comprehensive retirement plan.

Lifestyle

The starting point is deciding how you’ll fill your time in retirement. Even if the day is five or ten years away, it’s still a great foundation for the rest of your plan.

If you’re 55 and wondering whether your savings will last, start by mapping the life you actually want and including those plans in your written retirement plan.

As Loren Merkle puts it, “Something so important as the rest of your life, your retirement, you want to make sure it is written down.” He adds that “you have somewhere between a 35 % – up to a 40% chance of achieving your goals… if you have it written down.”

That clarity around lifestyle becomes the blueprint for everything that follows.

INcome

From there, build an income plan that matches how you plan to live.

Chawn Honkomp says, “We need to make sure people know how much they have to have in a typical month, average month, to cover everything they want to do.”

Loren reminds us the goal is durable, paycheck-like cash flow: “Imagine building a plan for steady income that’s designed to support your lifestyle not only at point of retirement, but also five, 10, 15 years down the road.”

Chawn explains the structure, “We’ve got to think about these guaranteed sources that people have, whether it’s the Social Security…and if you do have any pensions that’s part of your income plan.”

TAXES

The next stop on the map is taxes. Like an Indiana Jones corridor, a wrong turn here can be costly.

Loren calls taxes “one of the biggest wealth eroding factors,” and says, “it’s not uncommon that some families we work with have identified potential six-figure tax savings over a 20-year retirement through planning strategies.”

The key, Chawn says, is a long-term view, “just because you might have a lower taxable income in retirement, which is an assumption most people make, that does not guarantee a lower marginal tax rate.

Investments

Your investment plan should reflect this new phase of life and your withdrawal needs.

Loren points out that generic advice isn’t enough: “that’s why all of the investment plans that we put into place are customized to what your situation is,” and before the next downturn, “you have a good understanding of how much risk you’re taking.”

Chawn adds that, “there’s different strategies that now are a fit for you at age 55 and beyond that can continue to add value to your retirement plan no matter what kind of market conditions we have in front of us.”

Health care

Health care planning belongs on the main route, not a side trail.

A big part of deciding if you’ve saved enough is projecting expenses ahead. If you plan to retire before Medicare eligibility, which plan will bridge the gap? Chawn says for many, COBRA or the marketplace can fill that gap, allowing them to retire earlier than expected because they’ve planned for the costs and built them into their retirement plan.

Cost is unavoidable, but as Loren notes, “Having a plan equals preparedness.”

Legacy

Legacy is the last stop on our Indiana Jones–inspired quest. Though it comes last here, it’s still a vital part of retirement planning.

“Everybody wants to be able to leave whatever assets are remaining in the most efficient manner,” and, “it’s never too soon to develop that legacy plan,” said Chawn.

Loren frames the purpose simply: “Legacy planning is really about passing along what you value most to whom you value most.” Outdated paperwork can be costly; he recalls a case where “it took this gentleman three months, three months plus to gain access to over a million dollars of retirement savings.”

Hourglass of time

All along this journey, time is the real treasure.

Chawn says, “That’s where time becomes everybody’s largest asset in retirement, even more so than the dollars.” Loren adds, “Time is not promised.”

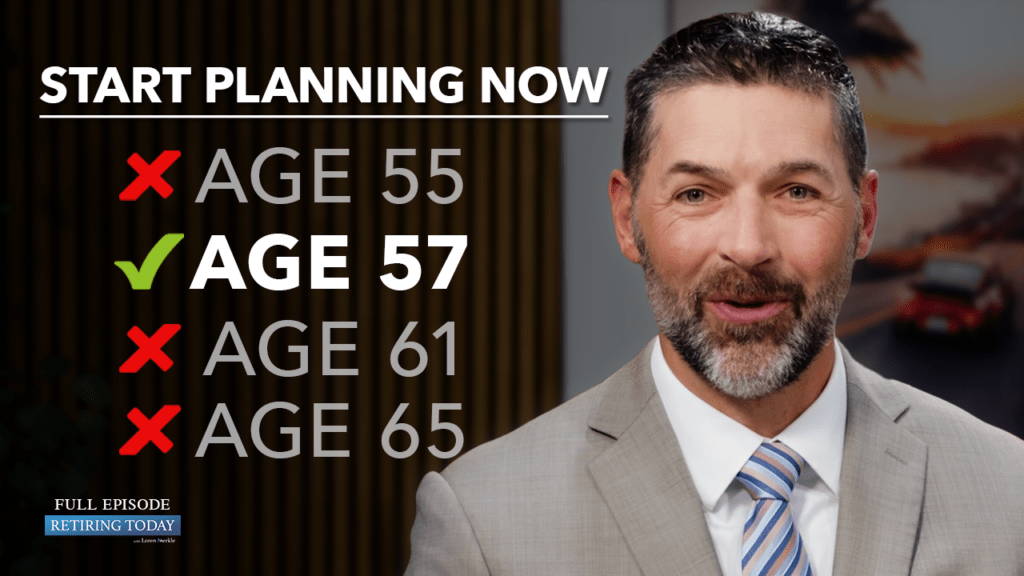

That’s why answering the question at 55 is far better than waiting until you’re already retired. If you find out you don’t have enough saved to live the lifestyle you want, you can make small tweaks at almost any age to improve your situation.

The quest is important, and unlocking the planning milestones now can help the sands of the hourglass work for you, not against you.

Watch the full episode on YouTube and learn about what belongs in a comprehensive retirement plan.