Market volatility. The phrase alone is enough to make some people uneasy — especially those approaching retirement. After all, when headlines scream about the “biggest drop in decades,” the instinct to hit the brakes is strong. But is that the right move?

In this blog, we’ll explore how volatility works, why emotional reactions can quietly sabotage a retirement plan, and how staying invested — even during downturns — can lead to better long-term outcomes. Retirement Planners Loren Merkle, and Clint Huntrods, offer their insights on how to ride out the ups and downs with confidence.

Why Volatility Feels So Personal

“On the surface, market volatility doesn’t sound that bad,” Loren said. “Where it really gets bad is when you log into your 401(k) or IRA and see how it’s affecting your retirement savings.”

It’s not just the numbers — it’s the emotions they stir. When people see their accounts shrinking, even temporarily, fear can take over. And fear often leads to short-term decisions that create long-term consequences.

What Causes Market Volatility?

Market ups and downs aren’t always driven by logic. Clint explained that volatility can come from investor sentiment just as much as economic events.

“If there are more investors buying than selling, the market goes up. If more are selling, it goes down,” he said. “Sometimes that’s not even based on fundamentals — it’s just how people are feeling.”

Loren added that major events — like 9/11 or the COVID-19 pandemic — add layers of uncertainty. “And when there’s uncertainty, the markets are going to have increased volatility.”

The Cost of Missing the Best Days

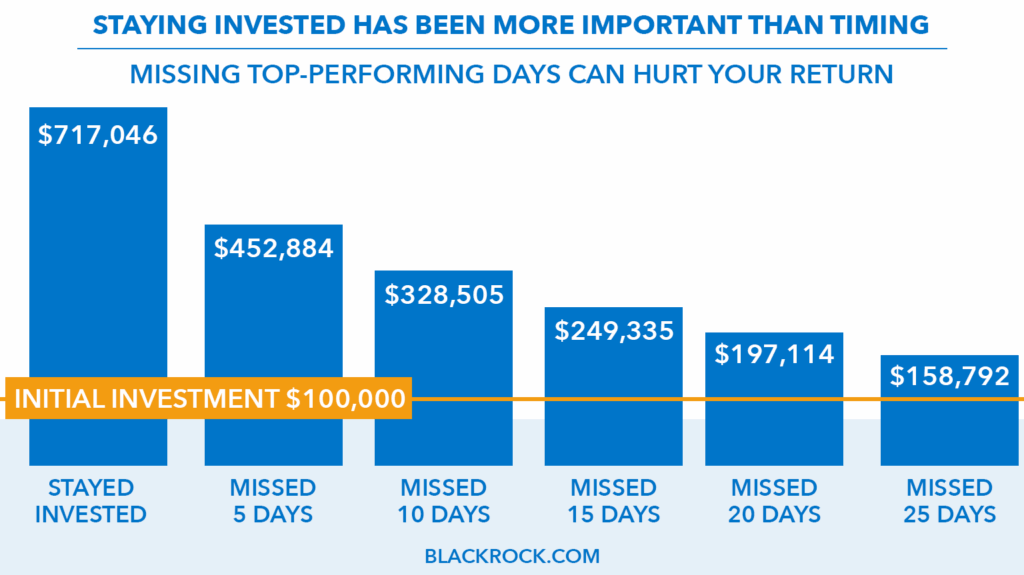

Clint shared a hypothetical example based on research from BlackRock, a global investment company, showing how missing just a few good days in the market can drastically affect your returns.

The example shows that over the past 20 years, an investor who stayed fully invested in the S&P 500 would have potentially grown to approximately $717,046 based on historical data from the S&P 500 over the past 20 years.

But missing just a few key days made a big difference:

- Missed 5 best days: $452,884

- Missed 10 best days: $328,505

- Missed 15 best days: $249,335

- Missed 20 best days: $197,114

Missed 25 best days: $158,792

Loren summed it up with a powerful reminder: “Volatility equals opportunity. And market volatility is actually very predictable — not in cause or timing, but in the fact that we’ve always come out of it.”

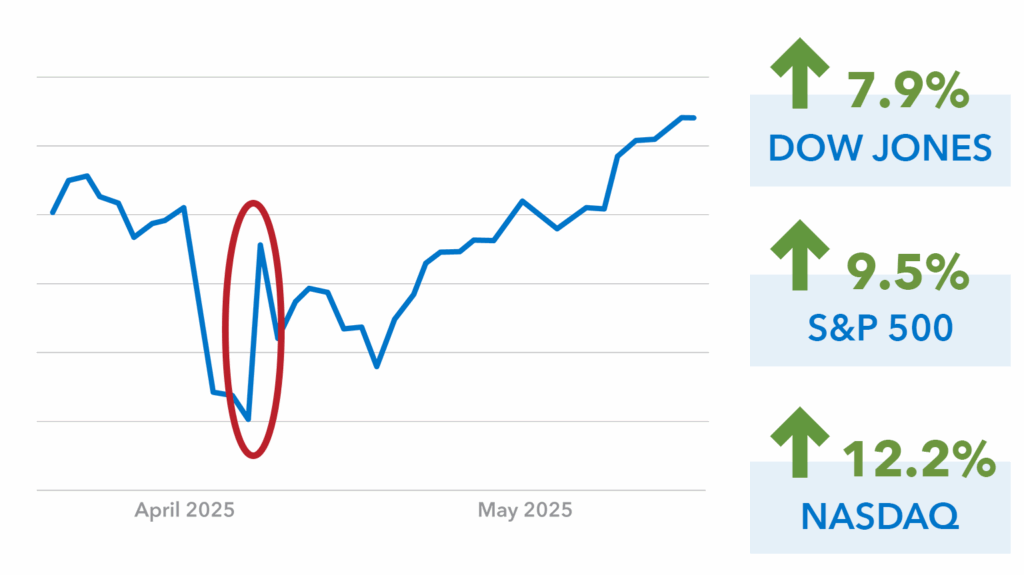

A Real Example: April 2025

Clint highlights how this dynamic played out in April 2025. By April 8, the market had fallen 19% — teetering on the edge of a full bear market after news of new tariffs. The headlines were grim, investor confidence was shaken, and many were considering moving to cash to avoid further losses.

But the very next day delivered one of the strongest market rebounds in years. Major indexes surged — the Dow jumped nearly 8%, the S&P rose 9.5%, and the Nasdaq climbed over 12%.

April 9th Market Rebound:

Source: BlackRock.com

This sharp turnaround illustrates just how quickly markets can recover — and why staying invested, even during periods of uncertainty, can make a significant difference in long-term outcomes.

Volatility Feels Personal — But It’s Predictable

Market volatility becomes especially stressful when it directly impacts retirement savings. Seeing account balances drop — even temporarily — can trigger fear and uncertainty, leading some investors to make reactive decisions that may harm their long-term strategy.

Loren explains that these emotional reactions are common, particularly during major global events like the COVID-19 pandemic or 9/11. Events like these create widespread uncertainty, a key driver of volatility — and when it strikes, retirement accounts like 401(k)s and IRAs often take noticeable hits.

Understanding this pattern can help pre-retirees prepare emotionally and financially for inevitable market fluctuations. Volatility may feel alarming in the moment, but historically, it has been a temporary — and predictable — part of long-term investing.

Having a Plan Makes All the Difference

Loren explains how proactive strategies can support both protection and growth, explaining that the market declines, a comprehensive retirement plan allows you to shift a portion of your money back into the market to take advantage of lower prices. Then, when the market rises again, you may be able to capture gains by reallocating profits to more conservative assets —essentially preparing for the next opportunity before it arrives.

He adds that this approach isn’t just about cushioning losses — it’s about developing a process that can help you respond to market shifts with consistency.

“On a frequent, consistent basis, you may have opportunities not only to protect yourself with that type of dollar-cost averaging strategy, but to take advantage of it.”

By building strategies like these into a retirement plan in advance, retirees can act with clarity and confidence when volatility hits — rather than reacting emotionally.

Click here to watch the full episode “Why Staying Invested Matters: Navigating Market Volatility” on YouTube!