Retirement isn’t just about leaving the workforce—it’s about entering a new phase of life, and getting organized is one of the best ways to ensure your retirement journey is smooth and enjoyable. Much like preparing your home for a new chapter, organizing your financial life ahead of retirement helps create confidence and clarity. By following a retirement checklist, you’ll reduce stress and set yourself up for a fulfilling retirement.

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

1. Start with a Vision

Before you touch a single document or account, take a step back and decide what you want your retirement to look like. Are you dreaming of frequent travel, picking up new hobbies, or simply spending more time with family? Defining your retirement vision helps clarify your financial goals and ensures your plan suits your lifestyle.

As experienced Retirement Planner Loren Merkle points out, having a vision is about finding your new purpose. Your day-to-day activities will look dramatically different than during your working years. Take time to answer, “What will keep me fulfilled?” and put your vision down on paper. This will guide your subsequent organizational steps and make the entire process more meaningful.

2. Declutter Your Financial Life

Just as a house accumulates clutter over decades, so does your financial portfolio. Many people switch jobs every few years, leaving old 401(k)s or insurance policies scattered across institutions. Start by collecting all your account statements and policies, then evaluate whether each still serves a purpose.

Loren helps families and individuals define the role of each account. For example, does that old 401(k) have a special withdrawal provision, or is it now just another retirement asset? By deciding why you’re keeping each account, you’ll make more informed decisions about whether to retain, consolidate, or discard it. Physically organizing your paperwork is part of this process, but the real goal is to simplify your investments and know exactly what each account does for you.

3. Consolidate Where Possible

Multiple retirement accounts can become a headache—not just at tax time, but for tracking investment performance and managing withdrawals. Consolidating accounts, such as rolling over old 401(k)s into a single IRA, can be helpful in retirement.

Retirement planners commonly find that clients feel more organized and better prepared after consolidating their accounts. Not only do you reduce paperwork, but you also often gain access to a wider range of investments and exert more control over your funds. As Loren explains, consolidation doesn’t mean sacrificing diversification. In fact, a thoughtfully constructed IRA can be even more diversified than a handful of scattered employer plans.

4. Downsize Risks

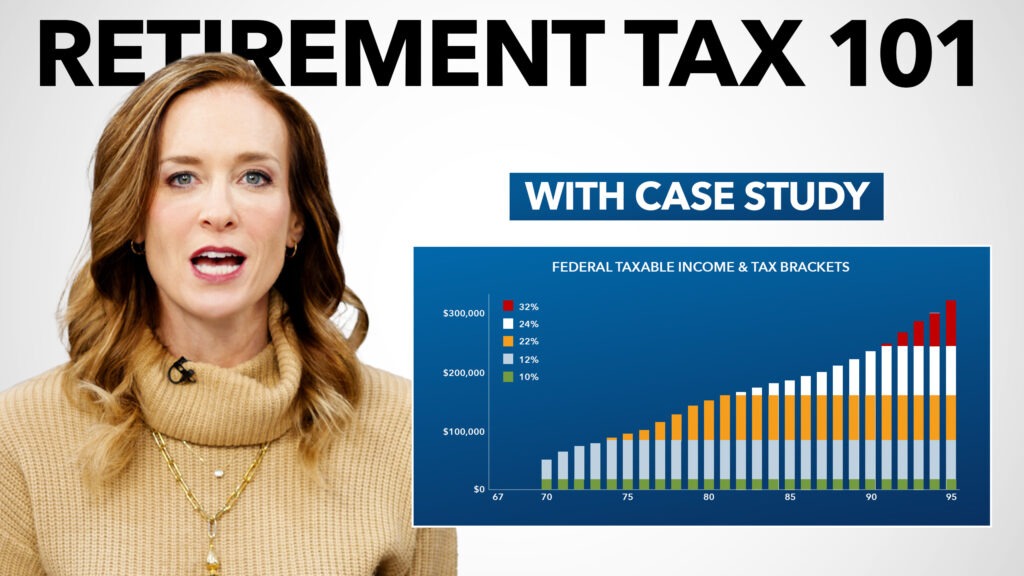

Risk in retirement looks different than during your working life. Market volatility, unjustified fees, inflation, tax changes, and rising health care costs can all threaten your nest egg if not proactively managed. Loren advises that now is the time to carefully review risk and adjust strategies to fit your retirement horizon.

This also includes considering the risks of taxes and long-term care. Remember, in retirement, you control many of your income sources and tax strategies. Creating tax diversification (funds in taxable, tax-deferred, and tax-free accounts) gives you flexibility to minimize the tax impact each year.

5. Discard Outdated Products

Interest rates and financial products change over time. That annuity or CD you purchased ten years ago may no longer offer a competitive yield. Take stock of all interest rate driven products to determine if replacing or “discarding” one with a newer product could deliver greater income or security.

Fees, benefits, and usage all matter; there’s no one-size-fits-all answer, so review each product’s role in your broader plan. Stay open to updating your holdings as the financial landscape evolves.

6. Update Beneficiaries and Estate Plans

Life stages change, and so should your beneficiary designations and essential documents like wills or trusts. Don’t leave this for your heirs to untangle. Regularly check and update beneficiaries on all accounts, especially if you’re consolidating or if your family situation changes. Having an up-to-date estate plan gives both you and your loved ones confidence and peace of mind.

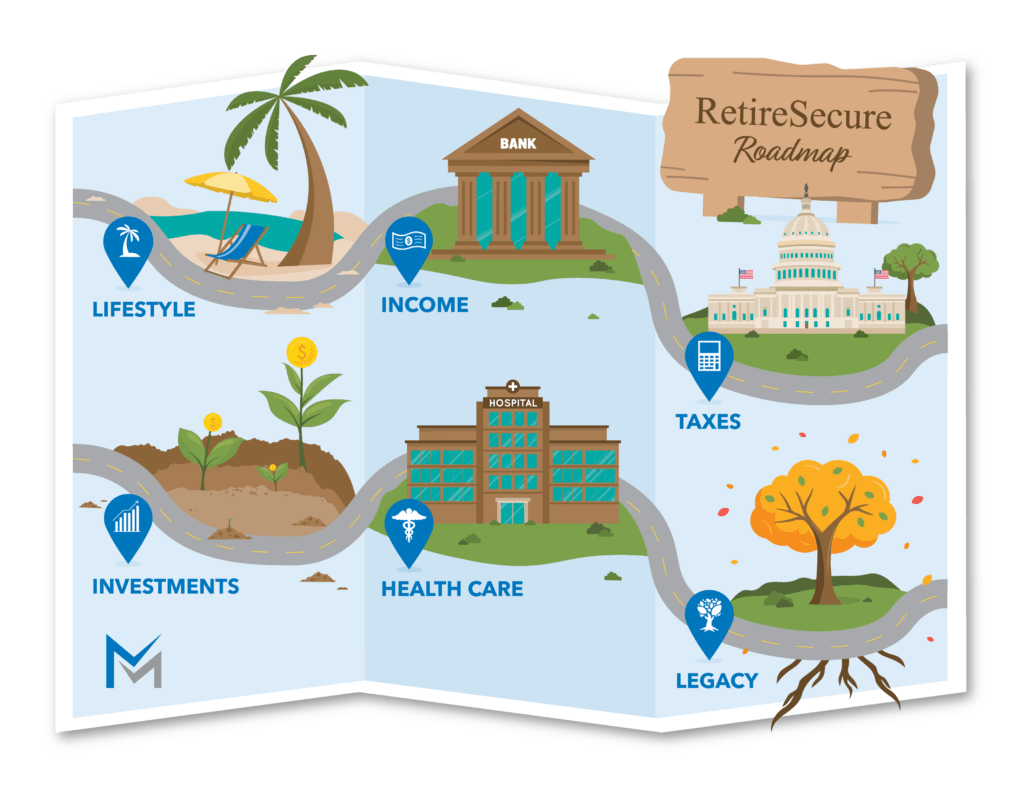

7. Pull it All Together with a Customized Retirement Plan

Finally, don’t stop at organization—build a comprehensive retirement plan that integrates your lifestyle vision, income needs, tax strategies, investment approach, health care, and legacy wishes. We help families and individuals build these customized plans, which we call a RetireSecure Roadmap, an all-encompassing framework covering all six essential pillars: Lifestyle, Income, Taxes, Investment, Health Care, and Legacy.

Creating a structured plan provides you with a detailed, actionable guide that can help you worry less and enjoy retirement more.