This blog breaks down five common beliefs about taxes in retirement, helping you separate fact from fiction. With direct insights from Retirement Planners Loren Merkle and Haley Gutschenritter, it covers topics like Social Security taxation, Roth IRA rules, RMDs, and the impact of relocating — highlighting how tax planning may influence your retirement income picture.

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

1. “My taxes will be lower in retirement.”

Fiction.

Many people assume that once the paycheck stops, their tax bill will drop. But that’s not always the case.

“For some people, you retire, you’re going to be in a lower tax bracket,” Loren said. “But for many people, you are in a higher tax bracket right away or the same (tax bracket) right away when you retire.”

The reason? Retirees still need income—and if most of that income comes from tax-deferred accounts like traditional IRAs or 401(k)s, that money is taxed as ordinary income, just like a paycheck.

Haley explained, “If you don’t want your lifestyle to change, you often need the same amount of income coming out of that tax-deferred account.”

2. “Social Security benefits may be tax free.”

Fact.

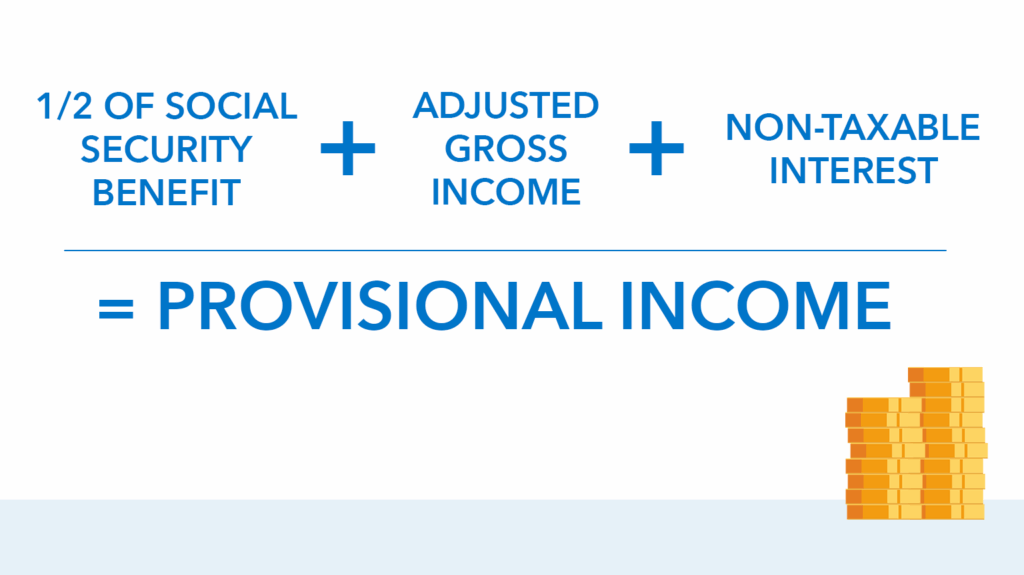

Social Security can be tax-free—but only under certain circumstances. Haley explained that “Social Security can be taxed up to 85% and that’s going to be dependent on your income, but also dependent on your tax filing status.”

If your provisional income exceeds $44,000 for joint filers (or $34,000 for single filers), up to 85% of your benefit could be taxable. And despite the rule being established back in 1983, those income thresholds have never been adjusted for inflation.

“Many people do end up paying taxes on their Social Security income,” Loren noted. “Even though this has been in legislation since 1983, many people feel like Social Security income is not taxable.”

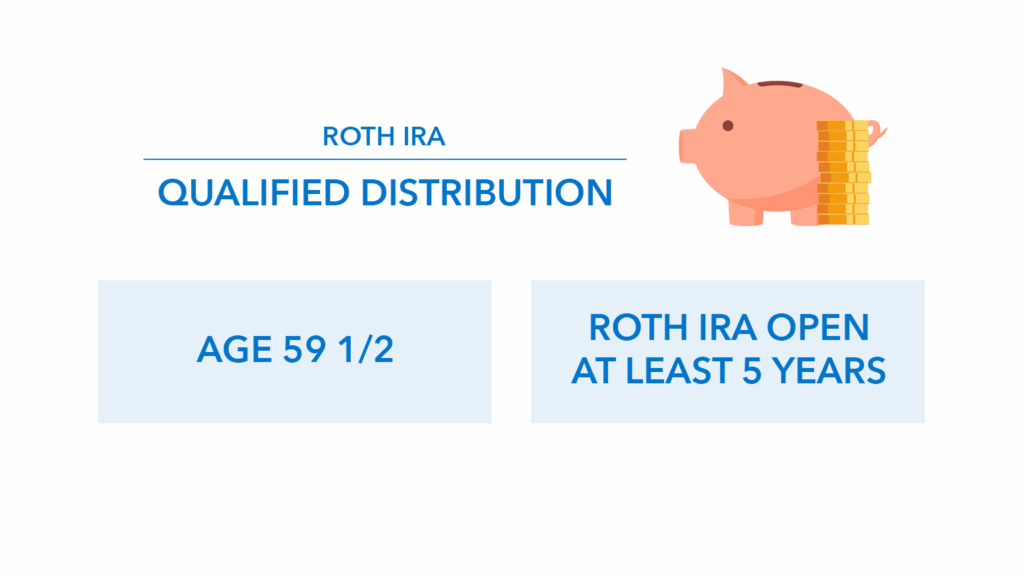

3. “Qualified Roth IRA distributions are tax free.”

Fact.

Roth IRAs are known for their tax-free withdrawals—but only if certain conditions are met. You must be over age 59½ and the Roth account must have been open for at least five years.

“If those two things are true,” said Haley, “then when you take withdrawals out of your Roth IRA, it will indeed be tax free.”

Loren added another key distinction: “Any contributions you put into the Roth IRA you can always take out as a qualified distribution, which means you’re not taxed or penalized.”

And while Roth IRAs offer powerful benefits, many people nearing retirement haven’t had time to build them up. That’s where conversions come in.

“Now the strategy is, how do you get this pre-tax money you’ve never paid taxes on before into the Roth the least costly way to you?” Loren said.

4. “RMDs only apply to traditional IRAs.”

Fiction.

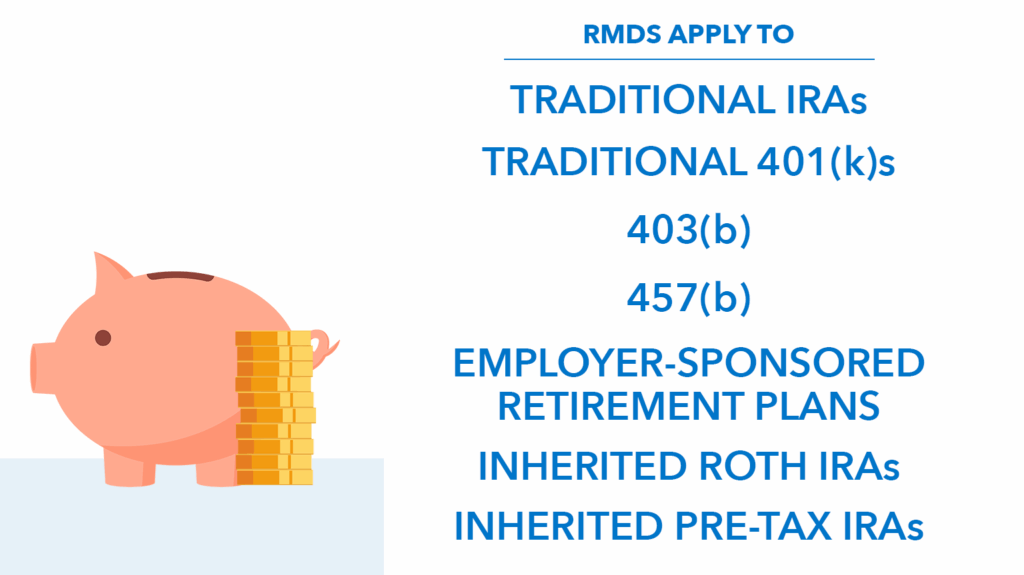

Required Minimum Distributions (RMDs) don’t stop at traditional IRAs. They also apply to other pre-tax retirement accounts and inherited accounts.

“RMDs are also applicable to inherited accounts,” Loren explained. “And over the timeframe of either your lifetime or a 10-year timeframe, depending on who you inherited the account from.”

Haley noted that people often overlook employer-sponsored accounts like traditional 401(k)s, 403(b)s, and 457(b)s. “You have to make sure that you’re taking out those mandates as well.”

5. “Moving to a no-income tax state eliminates taxes.”

Fiction.

States like Florida and Texas may not charge state income tax—but that doesn’t mean you’re tax-free.

“You can still be subject to federal income tax, property tax, and a whole array of other taxes,” Loren clarified. “So, it can be nice if the state eliminates income tax, but you still have to be aware.”

Some states—like Iowa—don’t tax retirement income at all, which can be an advantage. Haley pointed out, “That often means you may not pay state taxes on your traditional IRAs, pensions, or Social Security income—though federal taxes may still apply.”

The Big Picture: It’s All Connected

Taxes are just one piece of the retirement puzzle, and as Haley emphasized, the parts of your plan don’t exist in isolation.

“What you do in your income plan is going to affect your tax plan. What you do with your tax plan is going to affect your legacy plan.”

Understanding the rules, planning ahead for retirement taxes, and incorporating strategies into a comprehensive retirement plan may help you manage your tax exposure, reduce unexpected costs, and better align your income strategy with your retirement goals.

Click here to watch the full episode “Debunking Common Retirement Tax Myths” on YouTube!