That comparison—how you “measure up” to your peers, your neighbors, or even a number you once read in an article—is normal.

But it’s not always helpful without context. Retirement Planners Loren Merkle and Chawn Honkomp discussed what those averages really mean and, more importantly, how to start focusing on what matters: your own retirement goals and strategies.

The Comparison Trap

“There’s so much information out there that can be really vague,” said Chawn. “You move along through your career, and you get to the stage of life where you start thinking about planning and you’re wondering, how are you doing? Are we doing better than average, less than average?”

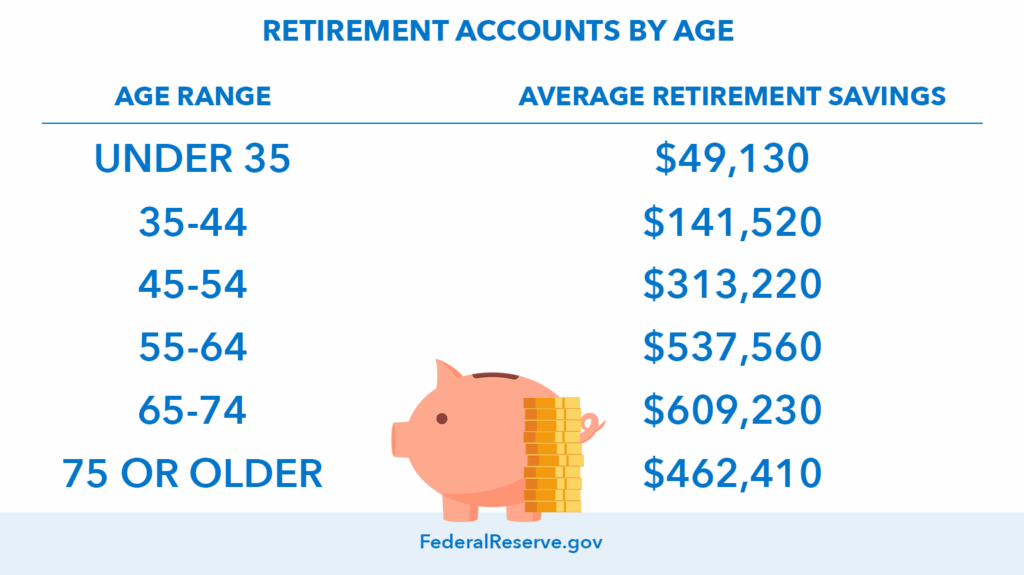

Host Molly Nelson walked through some national savings averages—like a Federal Reserve survey showing that the average American age 55–64 has around $537,000 in retirement savings.

Loren added, “Wherever you’re at compared to those numbers, you’re probably better off than what you were 15 years ago, which means you are moving in the right direction.” He emphasized that savings benchmarks have improved as more people shift from pensions to personal savings. “There’s been an incredible increase of awareness, and tools that people now have to save for retirement.”

Still, the natural follow-up question often becomes: Do I have enough?

There’s No Magic Number

One of the most common myths in retirement planning is that you need to hit a certain number—$1 million, $2 million, $3 million—to retire comfortably.

“It’s that magic $1 million number,” said Chawn. “It feels good to have that seven-digit balance. But when we put the whole plan together, we’ve seen people with $850,000 retire with a strong plan in place —and people with $3 million who might run out of money based on their lifestyle and spending.”

Loren echoed that idea. “It’s not about just hitting a number. It’s about having a strategy.” In other words, it’s not how much you’ve saved, but how you plan to use it.

Averages Don’t Tell Your Story

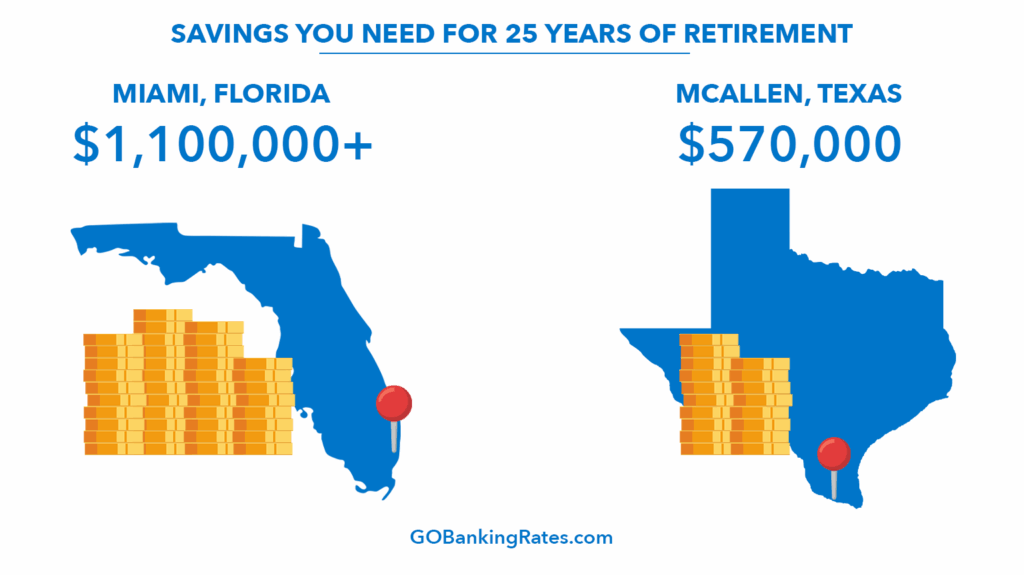

Relying on national averages can be misleading. “If you live in Miami compared to a small town in Iowa, it’s going to cost you more,” Loren said. One study showed a 25-year retirement in Miami might require $1.1 million, while in McAllen, Texas, it could cost just $570,000.

What You Really Need: A Plan

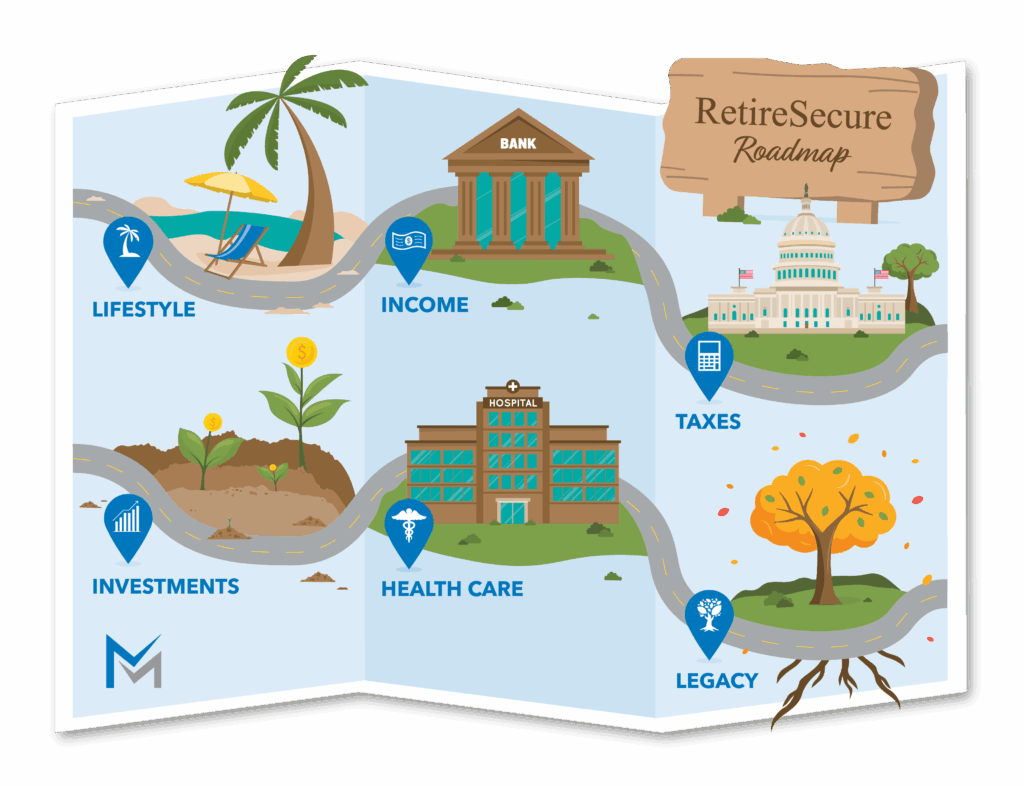

If there’s one takeaway from the discussion, it’s this: savings are just one part of the picture. To help you feel more prepared for retirement, you need a personalized plan that factors in lifestyle, income, taxes, health care, investments, and legacy.

“Because we’ve always been taught over our entire saving career that our retirement plan is our 401(k) plan, it’s our IRA,” said Loren. “You first have to have that revelation that your, your savings is not a retirement plan.”

Chawn compared it to solving a puzzle. “You open that box and see a thousand pieces—it can be overwhelming. But then as you get going, you’re going to get that clarity and that information to help you with this stage of life.”

Planning for the What-Ifs

Unexpected costs and life changes are part of retirement. That’s why the plan must be flexible.

“Uncertainty is always going to be present,” said Loren. “We build that into the plan early on. Whether it’s an unexpected health event or a tornado blows the roof off your house, things are going to happen.”

He also described how the income portion of a plan needs to be detailed—from how much you need each month to which accounts it should be pulled from, and how taxes might affect those withdrawals.

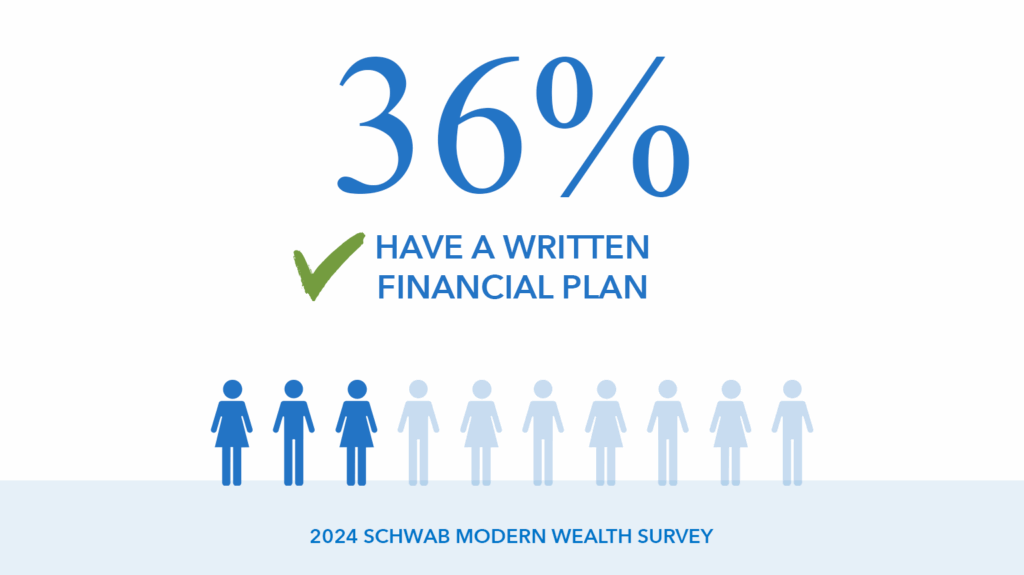

Despite the importance of retirement planning, only 36% of Americans have a written financial plan, according to a 2024 Schwab Modern Wealth Survey.

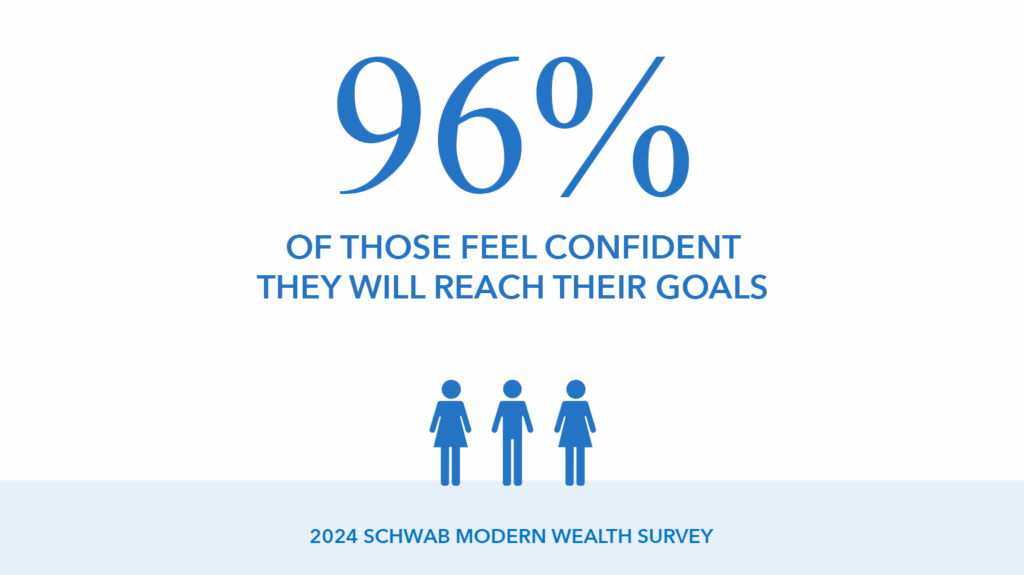

Among those who do, 96% say they feel confident about reaching their financial goals.

So why don’t more people have one?

- 43% say they don’t have enough money. But as Loren explains, that may be due to a misunderstanding of what a retirement plan actually is. “Your savings is not your retirement plan—it’s part of it,” he says. A written plan can help clarify whether you truly have enough and what steps you can take if you don’t.

- 25% say it feels too complicated. That complexity often comes from not knowing where to begin. As Molly Nelson points out, many people don’t realize what a retirement plan includes or how to put one together.

Ultimately, understanding what a written plan is—and what it isn’t—is the first step toward feeling more confident about retirement.

Loren and Chawn described their approach as building a Retire Secure Roadmap—a six-pillar strategy that includes lifestyle, income, taxes, health care, investments, and legacy.

“This thing is written in pencil,” said Shawn. “It’s never done. It’s going to continue to evolve.”

Click here to watch the full episode “How Does Your Retirement Savings Stack Up?” on YouTube!

Sources: FederalReserve.org, GoBankingRates.com, Schwab Modern Wealth Survey