In this episode of Retiring Today with Loren Merkle we cover important strategies to help you plan for the possibility of an extended retirement, emphasizing the need to anticipate a longer lifespan than previous generations.

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Recent data from the Social Security Administration highlights that men and women reaching the age of 65 today can expect to live to about 84 and 86.5 years old, respectively. Furthermore, one in three people turning 65 today will live to see their 90th birthday, with one in seven reaching age 95.

Retirement Planners Chawn Honkomp and Loren Merkle stress that the possibility of longevity increases the necessity for long-term planning and the importance of preparing financially until age 100 to ensure adequate coverage for health care and other retirement expenses.

There are significant concerns that must be addressed regarding longevity planning.

1) Addressing the Fear of Running Out of Money:

Many pre-retirees worry about outliving their savings. Developing a retirement income plan can help ease these concerns.

2) Special Considerations for Women:

Due to higher life expectancies, women need to be particularly diligent about planning for longevity. Couples often tell us, “I just want to make sure my spouse is taken care of when I’m gone.”

3) Planning Horizons:

Our comprehensive planning process aims to account for a lifespan up to age 100 to provide you with the utmost financial confidence. This conservative approach helps ensure that your assets can support you throughout your retirement, regardless of how long it lasts.

This includes mapping out spending for various phases of retirement: the go-go years (active with fulfilling experiences like travel and hobbies), the slow-go years, and the no-go years (when health care costs can be highest).

4) Managing Inflation:

Inflation is a persistent concern, especially given recent economic fluctuations. Addressing this within a retirement plan involves multiple strategies, such as social security optimization, building a recession-resistant portfolio, and implementing tax-efficient strategies.

5) Health Care Planning:

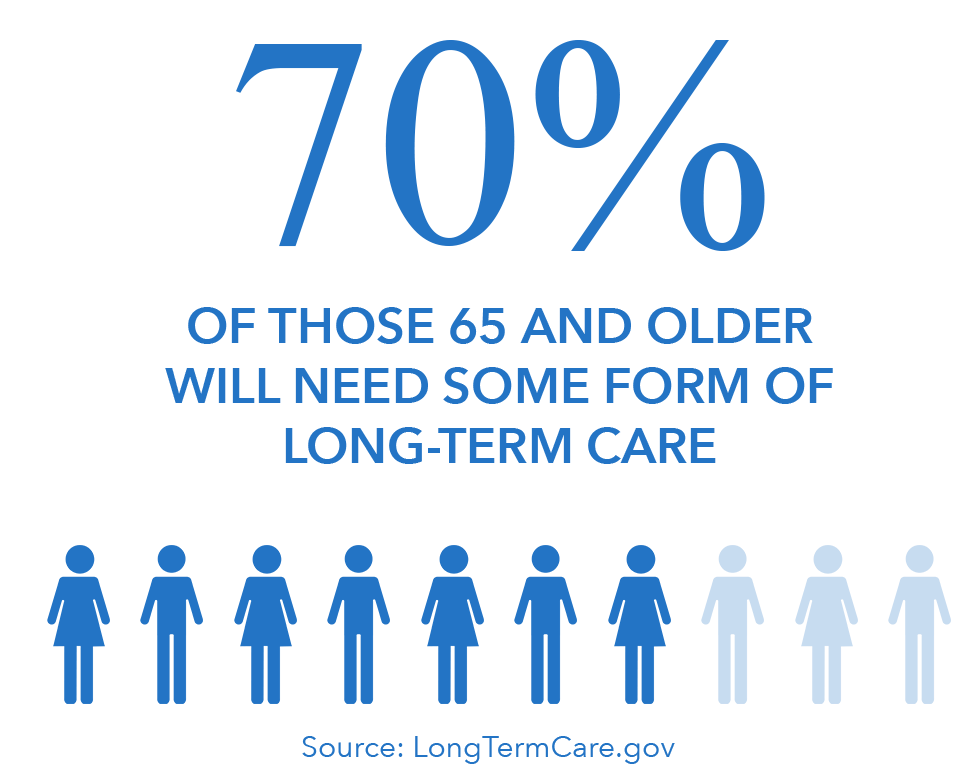

Health care, particularly long-term care, is another crucial factor. Statistics show that about 70% of those turning 65 today will need some form of long-term care. Accounting for these potential expenses early on can protect against significant financial strain later.

Long-term care costs vary greatly depending on the type of care and location. Genworth Financial has been conducting a cost of care survey since 2004. The latest data gathered from 383 cities and towns in 50 states found the following median U.S. costs:

- In-home health aide: $6,483 a month

- Assisted living community: $5,900 a month

- Nursing home private room: $10,646 a month

Conclusion

In conclusion, planning for a longer retirement requires a blend of foresight, adaptability, and long-term thinking. By addressing all potential aspects from lifestyle to legacy, and incorporating inflation and health care considerations, retirees can pave a path to a secure and fulfilling retirement. It’s not too early to start considering these important strategies for your future.

Click here to watch the full episode “Can You Retire Earlier Than Expected?” on YouTube!

Source: SSA.gov, LTC.gov, CareScout.com