Retirement doesn’t always follow a perfect timeline. A buyout, layoff, health change—or even just the calendar—can speed up big decisions. Retirement Planners Loren Merkle and Haley Gutschenritter explain how to quickly get your arms around income, taxes, Social Security, and health care— so you can take confident next steps without derailing your retirement vision.

When retirement comes sooner than you think

Sometimes you pick your retirement date. Other times, it picks you—because of a buyout, a round of layoffs, or life happening at home. That’s why the final 24 months can feel like a sprint: decisions about paychecks, benefits, taxes, and timing start piling up, and many of them are interdependent.

Loren said retirement has a way of sneaking up. “It really feels like it does sneak up. You need to start figuring out how to take this money out, which is a completely different equation than when you were putting money in.” His point: saving for retirement is not the same as spending in retirement, and the transition requires a different mindset.

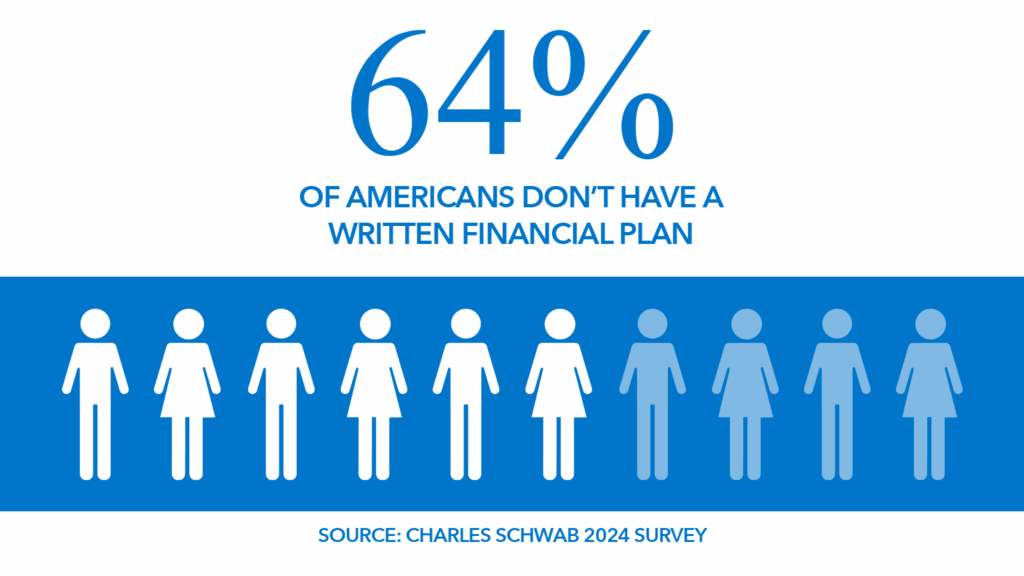

The reality check: many people hit this moment without a roadmap. Loren cited a 2024 Charles Schwab survey, “64% of people go into retirement without a written plan.”

His reason for encouraging pre-retirees to put together a written plan is practical: “It’s easier to pivot when you already have a foundational plan in place.” A written plan lets you adjust a few levers when life changes instead of re-doing everything from scratch.

Do I Have Enough—And Will My Lifestyle Hold?

Taking action before retirement starts begins with a clear picture of what your life will actually cost—not just the bills, but the fun you’re planning for.

Haley often helps pre-retirees answer this question: “what does it cost to afford the lifestyle that you want in retirement?” For many people, “you’ve been getting a paycheck coming in every single week or every two weeks, and you never really had to budget your expenses,” she explains. But Haley says things are going to look much different and you want to get a true sense of not just your fixed expenses, but also what retirement fun looks like for you.

Loren recently pressure-tested a retirement plan where “They were planning on spending $6,000 a month” and then, after a check-in, “he said, well, maybe $12,000 a month is what it’s going to take.” The exercise was to see “what does it look like if he’s not spending $6,000 a month, but he’s spending $12,000 a month?” Running both numbers made the trade-offs plain and kept long-term goals in view.

The Sneaky Tax Time Bomb

Haley warned that overlooking taxes can be costly. “Taxes are one of the most often overlooked costs to anyone’s retirement.” The danger often shows up when Required Minimum Distributions begin. “There’s this sneaky tax ticking time bomb that’s set to go off at the age of 73. And that sneaky tax time bomb is called Required Minimum Distributions.”

Haley used a real-life example of a couple – she changed their names to Terry and Lynn and some of the details to protect their privacy. For “Terry and Lynn” Required Minimum Distributions (RMDs) would have pushed them into a higher tax bracket and left them with a lifetime tax bill of about $640,000. But with strategic Roth conversions, the story changed. Haley said they implemented a strategy aimed at potentially reducing their lifetime tax liability by roughly $177,000.

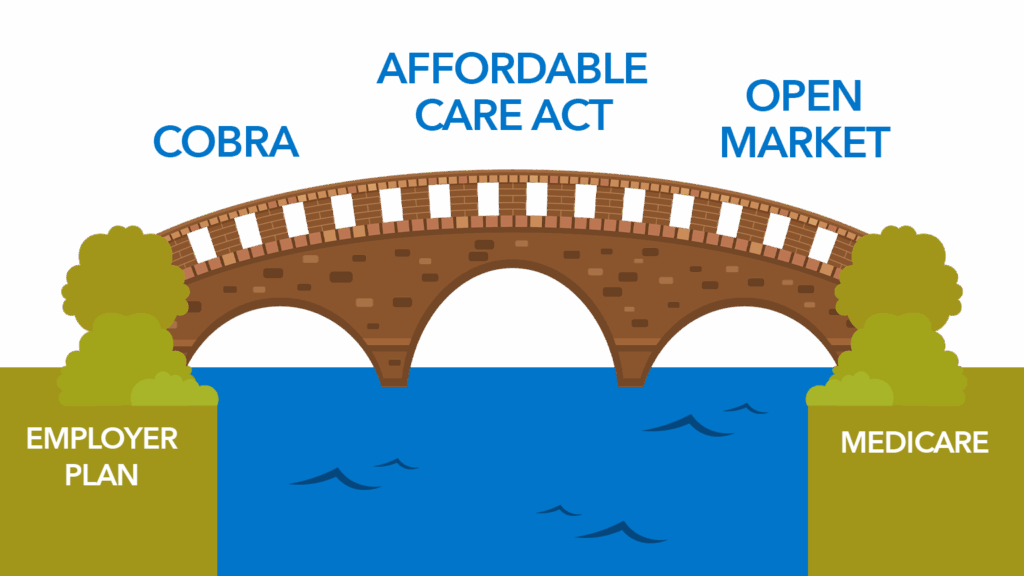

Health Care: Strategies Before Medicare

Retiring before 65 creates a health care gap. Loren explained, “Now we need this gap insurance to cover you from age 63 to 65. Because the health care environment is constantly changing.” Options like COBRA, marketplace plans, or Affordable Care Act coverage can help bridge the years until Medicare.

Haley added that income decisions affect premiums. “What you do from an income standpoint is going to impact what you pay for health care.” Higher taxable income can mean higher health insurance costs.

Social Security: Retirement Date vs. Filing Date

Some assume retirement and Social Security go hand in hand, but Haley clarified that’s not always the case. “There are actually a lot of options when it comes to electing Social Security.”

Loren said the range of choices can be surprising—pointing out that a married couple may have up to 81 different Social Security filing combinations. That’s why a customized written retirement plan should include a thoughtful analysis of these options and how they can affect the income plan throughout retirement.

Quick-action Checklist (when retirement arrives fast)

- Get your baseline: Tally fixed costs and fun money; test today’s number against higher inflation.

- Stage your income: Map which accounts fund the first 24–36 months to reduce sequence-of-returns risk.

- Plan for taxes: Consider whether Roth conversions could help reduce future Required Minimum Distributions.

- Bridge health care: Price COBRA vs. marketplace subsidies; re-check Medicare annually.

- Time Social Security: Compare several filing ages/combos in the context of your whole plan.

A Plan Makes It Easier to Adjust

Retirement often comes sooner than anticipated, whether by choice or circumstance. The good news is that most adjustments aren’t dramatic. With a clear plan, even unexpected timelines can be navigated more confidently—especially when changes are made in the right order.

Watch the full episode on YouTube and learn about how you can feel confident taking the next steps without derailing your retirement vision.