Nearly half of retirees say they retired earlier than planned, according to a Mass Mutual Retirement Happiness Study. This blog explores the nuances of planning for early retirement. We delve into why individuals often retire earlier than planned and the steps to craft a comprehensive retirement plan that can help you be ready for a retirement that may happen earlier than planned.

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

In an ever-evolving work landscape, the prospect of early retirement has become a reality for many. Whether driven by choice or necessity, retiring earlier than anticipated requires strategic planning and financial foresight. Let’s explore how you can position yourself for a confident and rewarding early retirement.

Understanding the Early Retirement Trend

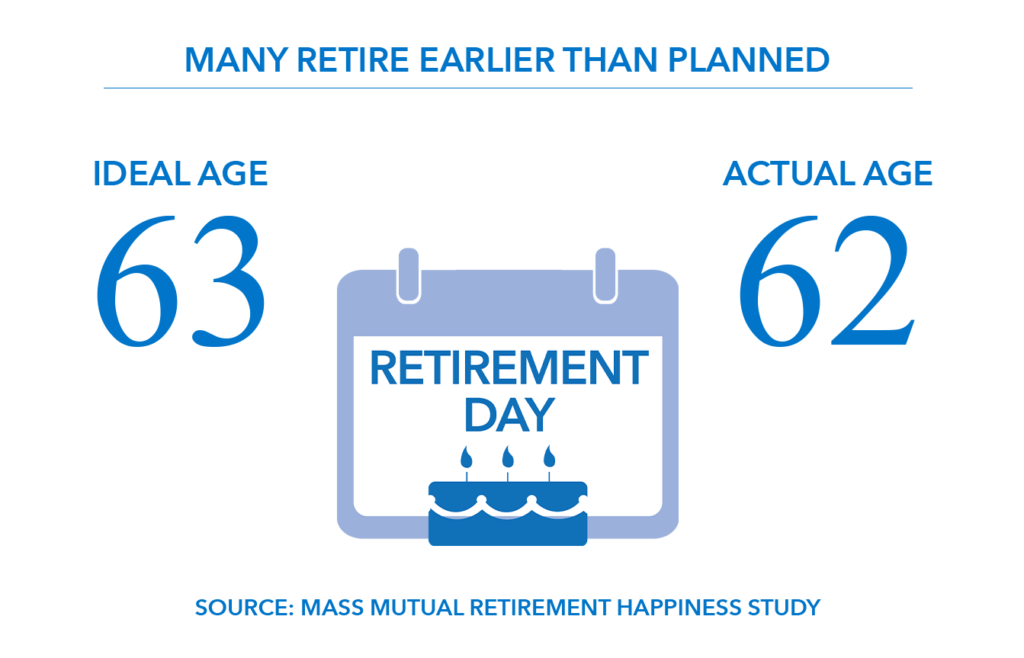

A Mass Mutual Retirement Happiness Study discovered that while 63 was the ideal retirement age for many individuals, the actual retirement age commonly turned out to be 62.

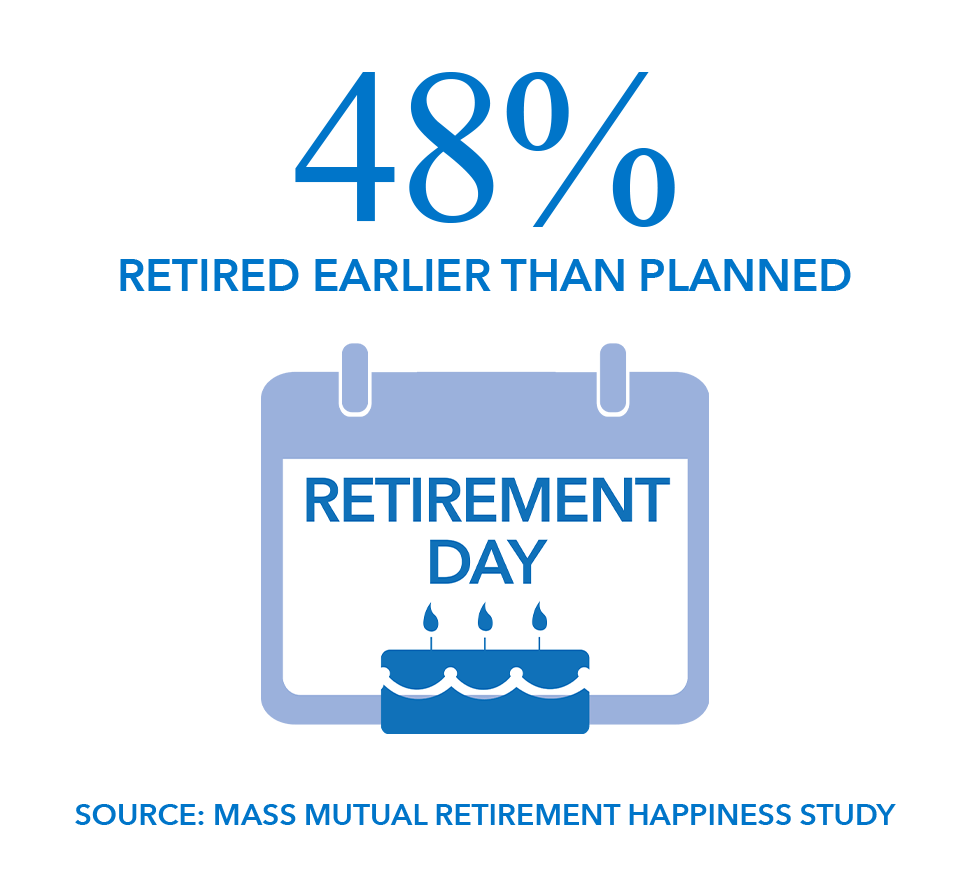

In fact, nearly half (48%) of retirees found themselves leaving the workforce ahead of schedule due to various factors, such as workplace changes, financial capability, health issues, and the desire for relaxation or escape from burnout.

Delving deeper into these statistics, 33% of retirees pointed to changes at work as a catalyst for early retirement. Twenty-eight percent retired because they could afford to, and another 25% cited illness or injury. Finally, 25% wished for more leisure time.

Only 10% retired later than planned, with the most common reasons being to increase their wealth (41%) and satisfaction with their job (38%).

These findings highlight the need to prepare for potential early retirement scenarios.

The Power of a Retirement Plan

An illuminating aspect of early retirement is having a concrete plan. Only 36% of people reportedly have a formal written plan, according to the 2024 Schwab Modern Wealth Survey. With a structured final roadmap, potential uncertainties can transform into assured decisions.

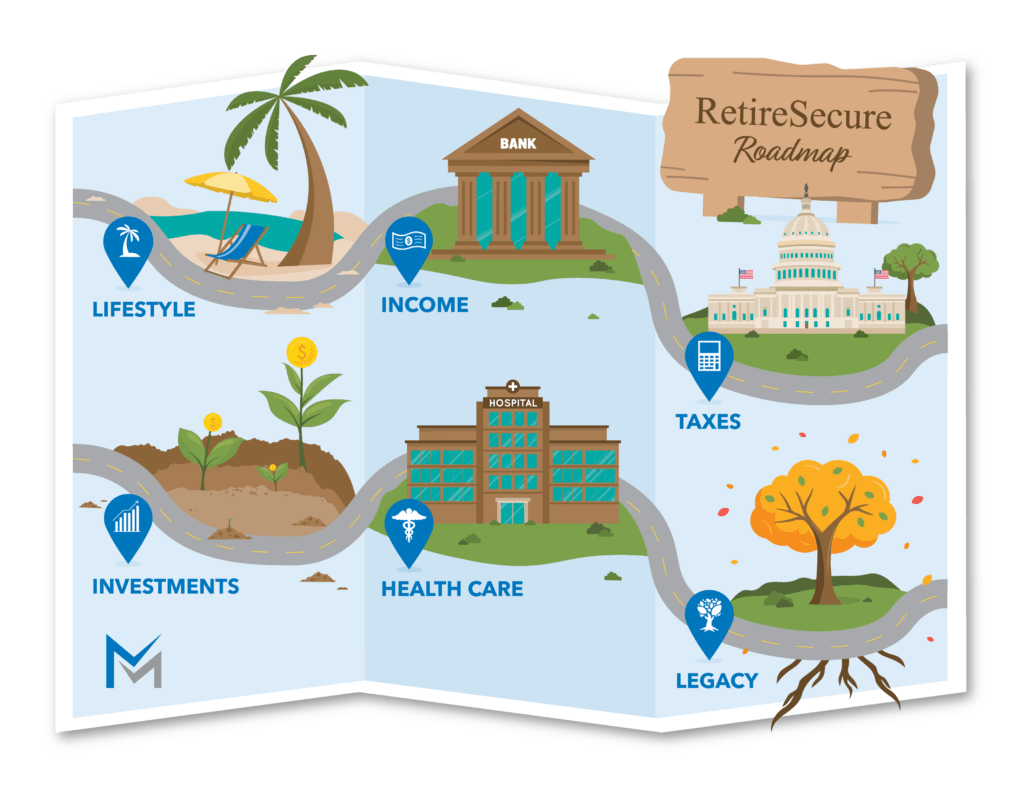

Retirement Planner Chawn Honkomp shared the story of a couple he’s been working with to build a customized retirement plan. This story illustrates how a customized plan, which we call a RetireSecure Roadmap helped Mike and Diane (we changed their names for the example) retire earlier than planned.

Mike and Diane

Initially, Mike aimed to retire at 64 and Diane at 62. However, through ongoing consultations and refinements of their financial plans, Mike retired a few months earlier than planned, at 64. Diane made an even bolder decision to retire at 60, two years ahead of schedule. Key to their accelerated timelines was their confidence in financial readiness and their desire to spend quality time together.

Having a retirement plan provided this couple with the ability to make informed decisions, converting insecurity into security in their decision.

Building the Foundation for Early Retirement

For many, the pathway to early retirement is built on a few crucial steps:

1. Live Planning: It involves continuously updating your plan to take into account current market conditions, tax rates, and investment performance. Regular check-ins ensure that the plan remains relevant and grounded in today’s financial landscape.

2. Investment Diversification: Establish a diverse portfolio that balances growth with security. By incorporating alternative strategies and safe investments, retirees can ensure resilience against market volatility, making retirement income streams reliable.

3. Debt Management: Addressing debts before retirement can significantly bolster financial health. Reducing or eliminating liabilities like mortgages or loans can enhance cash flow, reducing the monthly income requirement.

4. Tax Planning: Understanding the tax implications of withdrawals from retirement accounts is essential. Calculating your potential tax liabilities can help in crafting withdrawal strategies that minimize taxes over the long haul.

Leveraging Social Security and Pensions

Social Security can account for a significant portion of retirement income. Making informed decisions on when and how to claim benefits is crucial. For those with pensions, understanding the options and setting up the payment schedule is vital for integrating these funds into a broader retirement income strategy.

Ultimately, all these strategies underline the importance of having a comprehensive plan—one that encompasses the six essential pillars: lifestyle, income, taxes, investments, health care, and legacy. We call this a RetireSecure Roadmap.

Conclusion

For many, retiring earlier than planned is a reality, whether by choice or necessity. Having a comprehensive written plan can help make this transition as smooth as possible.

Click here to watch the full episode “Can You Retire Earlier Than Expected?” on YouTube!

Source: Mass Mutual Retirement Happiness Study , 2024 Schwab Modern Wealth Surveye