Roth IRAs can feel a bit mysterious, but understanding how they work—and the rules around them—can make a real difference in your retirement planning. In this blog, we’ll clear up confusion around Roth IRAs, highlight their powerful benefits, and explain key rules like contribution limits, income thresholds, and the important “five-year rule.” Knowing these details helps you make smart, informed choices that maximize your savings and minimize your taxes down the road.

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

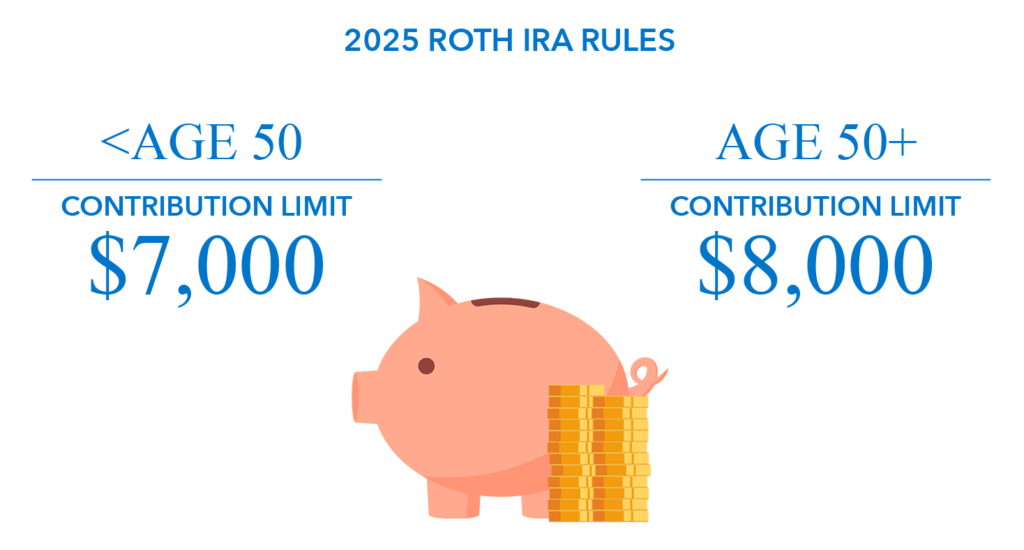

Roth IRA Contribution Limits: What You Need to Know for 2025

Roth IRAs have only been around since 1998, which means many pre-retirees like you may have the bulk of their retirement savings in traditional, pre-tax accounts. Roth IRAs, by contrast, are funded with after-tax dollars—but here’s the big payoff: as long as you follow the rules, your withdrawals—including earnings—are completely tax-free in retirement.

For 2025, contribution limits are:

- Under age 50: $7,000 per year

- Age 50 or older: $8,000 per years (thanks to a “catch-up” provision)

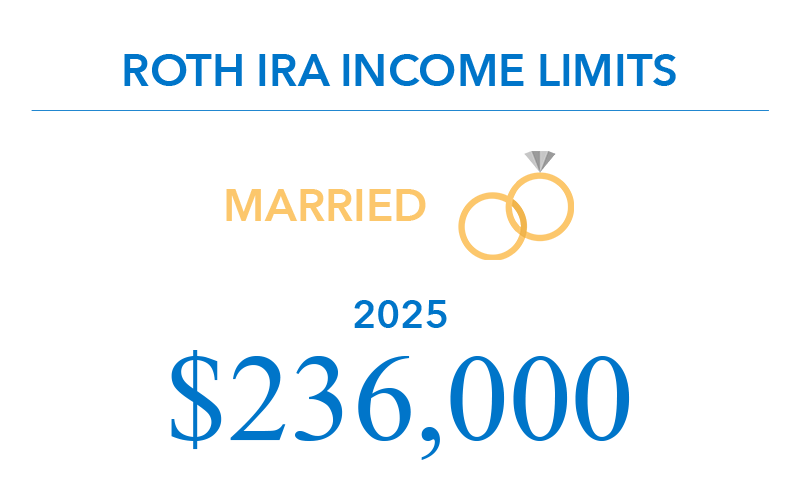

Income Limits For Roth IRA Contributions (2025)

Your ability to contribute to a Roth IRA depends on your modified adjusted gross income or MAGI.

For Married Couples Filing Jointly (2025):

- Full Contribution: MAGI below $236,000

- Partial Contribution: MAGI between $236,000 and $246,000

- Ineligible: MAGI $246,000 or more

For Single Filers:

- Full Contribution: MAGI below $150,000

- Partial Contribution: MAGI between $150,000 and $165,000

- Ineligible: MAGI $165,000 or more

Understanding these thresholds is crucial. If your income is above the limits, you won’t be able to contribute directly to a Roth IRA—but don’t worry, strategic options like Roth conversions might still be available to you.

Understanding Roth IRA Withdrawal Rules

Not all withdrawals are created equal! Here’s how Roth IRA distributions work depending on whether you’re taking out contributions or earnings.

Contributions

Good news: Since you’ve already paid taxes on your contributions, you can withdraw those contributions at any time, at any age, without taxes or penalties.

Earnings

Earnings are a bit more complicated. To withdraw earnings tax-free, you need to meet two key conditions:

- You are 59 1/2 or older.

- The Roth IRA has been open for at least five tax years.

These are called qualified distributions.

What Counts as a Qualified Distribution?

Besides being age 59 1/2 or over and having the account open for five years, distributions are also qualified if:

- You are permanently disabled.

- You pass away (in which case your heirs can access the funds).

- You can take up to $10,000 for a first-time home purchase.

- You take withdrawals as a series of equal periodic payments.

The benefit? Qualified distributions are not part of your gross income – so you don’t pay taxes or penalties.

The Five-Year Rule: What it Means for Your Roth IRA

One of the most important – and often misunderstood – rules around Roth IRAs is the five-year rule. This rule affects when you can take tax-free withdrawals of earnings, and it applied to both contributions and conversions, but in different ways. Let’s break it down.

For Contributions

To withdraw earnings tax-free, your Roth IRA must have been open for at least five tax years, and you must be 59 1/2 or older (or meet other qualified distribution criteria).

Here’s the key:

The five-year clock starts on January 1 of the tax year you make your first contribution. For example, if you contribute to a Roth IRA anytime in 2025, your five-year period begins January 1, 2025, and you meet the rule on January 1, 2030 – even if you contributed in December.

Once this five-year requirement is met for any Roth IRA you own, it applies to all future contributions. That means you only need to satisfy the five-year rule once for contributions.

For Roth Conversions:

Conversions follow a separate five-year clock for each conversion.

Each time you convert money from a traditional IRA to a Roth IRA, that conversion amount must remain in the Roth IRA for five tax years before you can withdraw it without penalty (even it you’re over 59 1/2). If you withdraw conversion funds too early, you could face a 10% penalty – though no income tax, since you already paid taxes when you converted.

The rule is especially important if you’re considering Roth conversions close to retirement, or if you’re under 59 1/2.

Why it matters

- Starting your first Roth contribution early can help you clear the five-year rule sooner, unlocking tax-free earnings withdrawals in retirement.

- Planning conversions carefully ensures you won’t face penalties for early withdrawals.

- These clocks can overlap, so timing is everything – and working with a financial advisor can help you align the five-year rule with your retirement timeline.

Roth Conversions: A strategy worth considering

Let’s talk about Roth conversions – a smart way to get funds into a Roth IRA even if you don’t qualify to contribute directly. A Roth conversion involves moving money from a traditional IRA to a Roth IRA and paying taxes now so you can enjoy tax-free withdrawals later.

A few things to keep in mind:

- Conversions start a new five-year clock for those funds.

- There’s no limit on how much you can convert – but be mindful of how the extra income could affect your tax bracket.

- Strategic conversions can help reduce Required Minimum Distributions (RMDs) from traditional accounts later, which can lower your taxable income in retirement.

As Retirement Planner Loren Merkle explains, timing is everything – converting during lower-income years or before RMDs kick in can be a huge advantage.

Final Thoughts

Roth IRAs are powerful tools that can play a major role in securing a comfortable and tax-efficient retirement. Knowing the rules – like contribution limits, income thresholds, and the five-year rule – can help you use them to their fullest potential.

As Loren Merkle and Clint Huntrods emphasize, proactive planning, especially with the help of a retirement planner, can help you take control of your retirement strategy. The sooner you begin, the more opportunities you may have to harness the full power of Roth accounts and tax-free qualified distributions.

Click here to watch the full episode “Retirement Planners Explain Roth IRAs” on YouTube!