In this episode of Retiring Today, Loren Merkle and Chawn Honkomp discuss the important mindset shift when it comes to taxes in retirement. They break down the current mindset, the need for control, and the value of thinking long term to save money on taxes.

These experienced Retirement Planners cover:

– The current mindset about taxes before retirement

– The need for control over your retirement income

– Understanding provisional income and its impact on taxes

– The importance of diversifying income sources for tax efficiency

– Thinking long term to save money on taxes

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

TRANSCRIPT

Molly Nelson [00:00:02]:

Retirement is a mindset shift. Everything changes, including the way you should think about taxes. We talk about the change in get you ready right now on retiring today. This is Retiring Today. I’m here with Loren Merkle and Chawn Honkomp, they are both CERTIFIED FINANCIAL PLANNERSTM and Certified Financial Fiduciaries®. And Chawn is also a CPA. So today, guys, we’re launching a series called the retirement mindset shift. Because Loren and Chawn, you sit down with people nearly every day, and you talk to them, Loren.

Molly Nelson [00:00:44]:

And they’re getting ready for this exciting, but sometimes nervous mindset shift.

Loren Merkle [00:00:49]:

And that’s one of the challenges, because this timeframe should be extremely exciting for everybody. But more times than not, people come to us, and they’re not expressing their excitement. They’re expressing the anxiety over all these concerns and decisions that they now have to make that they’ve never had to make before.

Molly Nelson [00:01:07]:

Yeah, everything’s new in retirement, Chawn. So today we want to focus on taxes, but we know that there’s a lot of things that people have never had to do before, decisions that they have to make. And it’s all new.

Chawn Honkomp [00:01:17]:

It is. It’s a new stage of life. These are called the golden years for a reason. We want to feel really excited about what we have in front of us, but we got so many things. You got so many more decisions to make, questions that you’ve never faced before that you’ve never had to do before. And we know all of you out there, you only want to retire once. So we know we want to get it right and feel really confident as we face these questions in front of us.

Molly Nelson [00:01:37]:

Okay? So today, we want to help people. We want to discuss maybe their current way they think about taxes. We want to talk about the mindset shift and then give them some action steps. Hopefully, they’ll learn some stuff today about what to get ready for as they head into retirement. So, first, Loren, let’s talk about the current mindset. How do people sort of view taxes before retirement?

Loren Merkle [00:01:55]:

Before retirement? In the working years, you kind of think about taxes as just something that you have to pay, and you’re constantly talking to your tax preparer or CPA or anybody who’s going to listen. How do I decrease my current year tax bill? But inevitably, there’s a tax bill you have to pay. So you become accustomed to paying taxes. And a lot of times, that mindset stays the same when you transition to retirement. It doesn’t have to.

Molly Nelson [00:02:22]:

Yeah. So we’ve got the CPA over here. You’re not a practicing CPA anymore, but you spent some of your career in public accounting. So you guys call that term deferral. Let’s make sure people understand that that’s something that they’re focused on maybe in the working years, but we’re going to shift their mindset a little later in.

Chawn Honkomp [00:02:38]:

The show as we talk about deferral, really what we mean by that is let’s lessen the tax bill right now. So for the current year, maybe we’re going to do some pre tax 401(k) contributions. You don’t get taxed on that. So that’s deferring. Maybe we’re out there looking for as many expenses or write offs as possible. Again, that’s deferring. So when we talk about deferral, you know what that is, is let’s show the least amount of taxable income right now, which leads to you having the lowest tax bill possible for that current year.

Loren Merkle [00:03:06]:

And when you’re in that deferral mindset, sometimes people forget and it’s really easy. That deferral means you don’t pay taxes today. Yep, deferral. You’re deferring taxes until later. And for many people, for most of your accumulation years, your working years, that is the primary option you had to save for your retirement is the 401(k) plan. The Roth option or the tax-free option didn’t come around till much, much later. So many people have most of their money underneath this promise of an investment, not taxed today, but taxed later when you retire.

Molly Nelson [00:03:44]:

Do you guys ever find it a little ironic? I mean, one of the big selling points of the 401(k) is whatever you put into that 401(k), you get to reduce that on your taxable income. But when you get to be about 65 and that 401(k) has grown, it’s not such a big selling point anymore.

Loren Merkle [00:03:59]:

If you’re over 50 in 2023, you can contribute $30,000 to a 401(k) plan. If you deferred, right. Didn’t pay taxes on that $30,000, that’s $30,000 you didn’t pay taxes on this year. But you’re going to allow that money to grow, grow, grow, and all of the growth is going to be tax deferred. So when you retire, that $30,000, depending upon your timeframe and how well the investment does, might have grown to $60,000, $90,000 that now you owe tax on all of that at your ordinary income tax bracket. So it seems like it might be a good deal. And for some people, in some situations, it certainly has been. But there’s other deals to make.

Molly Nelson [00:04:39]:

Okay, so we want to help people get ready for the mindset shift. So how should we think differently about taxes as we head to retirement mindset shift number one, you have more control than you think. And Chawn, for this one, for me, is exciting, but a little overwhelming for people.

Chawn Honkomp [00:04:52]:

When I think about this shift, to me, it’s really about while we’re working, paycheck coming in, not a lot of decisions to make. You’re working your 40 plus hours a week, and you’re really trading your time for that income and that paycheck. But now, as we move into this retirement stage of life, we do have a lot more control. And with that control comes decision points. Well, now, instead of that reoccurring, very sound known income that hits your bank account every two weeks or however often you get paid, now you have to build that income plan and make all of these decisions, which is great because you have control. You get to look at all of these retirement assets that have been accumulated and make these decisions and control when you get the income, how much. And now you get to have your thumb on that and build what that looks like for you in that retirement stage of life.

Loren Merkle [00:05:40]:

That reminds me of a recent conversation I had where a gentleman came in and he goes, Loren, I’ve been working for 40 plus years. I’m ready. I am done working. I’m ready to be done working. However, I’ve always done this myself. I’ve always managed my investments, my contribution strategy, and it has really been a set it and forget it strategy where I’m focusing on my career and my family, putting money away for this later day, he said, but now that I’m ready, I’m here, and I’m starting to realize that taking money out of these investments, delivering that income, taking control and making all these decisions that you just alluded to is way different, way more complex, way more complicated. He said, I can’t do it by myself anymore. That feeling is out there in a really immense way for a lot of people.

Molly Nelson [00:06:26]:

I bet a lot of people can relate to that. And we’re talking about you talking about the control of income, right? So you’re looking at these different retirement savings accounts of where to take the money from. And there is a pretty close correlation between where you take the money from and what you pay in taxes.

Chawn Honkomp [00:06:40]:

And that’s a big focus of what we’re talking about today, is that tax liability. And how do you control your tax liability? Everybody out there wants to pay the least amount of taxes possible. Nobody wants to pay any extra and we’re all okay paying our fair share. But now with that control and the different types of assets that maybe someone has accumulated during their working years, now you have more options to choose. Where do you take? Do you take distributions from pre tax accounts? Do you take distributions from a Roth? What about when we turn on Social Security or maybe any other potential guaranteed income sources? All of this factors into what your tax picture looks like for a given year. And then when you turn some of these sources on, that is forever. So now that’s a part of each future year, too. And now that’s where, as we focus about taxes, we want to be thinking about that long term tax plan and how we help you be the most efficient possible with all your retirement assets.

Molly Nelson [00:07:31]:

I know what you might be thinking. I have control over what I pay in taxes. Well, yeah, kind of. Chawn and Loren, they’re not crazy. They’re going to explain it. So stay with us because I think it’ll become crystal clear here in the next few minutes. But I’m sure some of the things you heard you might have questions about. Here’s a great opportunity to get your retirement questions answered.

Molly Nelson [00:07:48]:

It’s a 15 Minute Retirement Check-Up Call. You can go to MerkleRetire.com right now if you’d like to schedule a time and a date that works for you. You can talk about taxes, you can talk about income. Or you can just make the call and Loren or Chawn or one of the retirement planners will ask you questions about where you’re at in your retirement journey. We’ll continue talking about the mindset shift when it comes to taxes and retirement. Next.

Voice Over [00:08:14]:

Do you wonder if you have enough saved for retirement? Will your money last as long as you do? Will taxes, health care costs and inflation derail your retirement? Get answers. Schedule a 15 Minute Retirement Check-Up Call today. We can cover a lot in 15 minutes, including strategies you can implement now to start your retirement journey. Schedule a call at MerkleRetire.com the first step to a confident retirement starts with a simple phone call.

Voice Over [00:08:44]:

Do I have enough saved for retirement? When should I take Social Security? Which Medicare option is best? How do I plan for inflation? Sometimes the road to retirement starts with more questions than answers. We’re here to help. Join us for our upcoming Journey to Retirement workshop. Get answers and start your retirement journey with confidence. Our online workshop includes information on Secure Act 2.0 and changing retirement rules. Visit RetireWithMerkle.com to register for an upcoming workshop. Your retirement journey starts now.

Molly Nelson [00:09:22]:

This is retiring today I’m here with Chawn Honkomp and Loren Merkle. We are talking about how retirement is a mindset shift. We want to get you ready for that mindset shift. And we’re talking today specifically about taxes. Mindset shift number two, don’t use the default settings.

Chawn Honkomp [00:09:38]:

The biggest thing that we wanna be thinking about, and that what you wanna be thinking about as you shift from those working years to retirement timeframe, the same decisions from a tax standpoint that you made while you were working, those aren’t necessarily the same decisions you want to make in retirement. So we don’t wanna default to those same settings and default to those same decisions. It is time for a tax mindset shift.

Molly Nelson [00:09:59]:

Yeah, you have more control.

Molly Nelson [00:10:01]:

We promised to explain how you have more control in retirement. And Loren Merkle, I think you are gonna do just that.

Loren Merkle [00:10:06]:

For us, control is you have to investigate all the options available to you so you know which control levers to pull. An individual came into the office recently, and she was talking about how she wanted to take control. She was investigating. She said, Loren, I’ve been investigating Social Security, and I came across this term, wait for it, provisional income.

Molly Nelson [00:10:27]:

The CPA over here knows that term.

Loren Merkle [00:10:29]:

And I was just smiling ear to ear, because I don’t think in my 25 year history of doing this, somebody has actually came to me with provisional income. Usually it’s Chawn.

Chawn Honkomp [00:10:38]:

It’s us.

Loren Merkle [00:10:38]:

Yeah.

Molly Nelson [00:10:39]:

Bringing it to them. Yes, normal people, we don’t talk about provisional income on a daily basis like you guys do.

Loren Merkle [00:10:44]:

No, but she really wanted to know. And so what she said is, I still don’t understand what it is. And more importantly, how does that apply to me? Should I have to pay attention to this term, provisional income? So we got a great example of exactly that. What is provisional income? And more importantly, what does it mean to you? And how should you be considering provisional income as a part of your overall tax and income plan? So, here we go. This is provisional income. First, you have to look at what your adjusted gross income is. So if you’re in retirement, most of what’s going to go into your adjusted gross income is your taxable income sources, probably a pension, 401(k) plan, pretax, 401(k), pre tax IRA. That is going to be adjusted gross income.

Loren Merkle [00:11:27]:

Add that to your non taxable interest. For most people, this could be municipal bond interest. It’s not taxed federally. But you do have to include it in your provisional income equation. And then here comes the tricky part. Use one half of your Social Security income, not the full Social Security income. But this is the provisional income equation. Your adjusted gross income, non taxable interest.

Loren Merkle [00:11:57]:

One half of your Social Security income equals provisional income. Now, what do we do with this? We come up with this number, and then we have to apply it to special Social Security tax brackets. If you are a single filer, this is what your bracket is. Take your provisional income number. If that number is less than $25,000, that means you pay 0% federal tax on your Social Security income. If it’s between 25 and 34, up to 50% of your Social Security income will be subject to tax. If it’s in excess to $34,000, up to 85% of your Social Security income will be subject to tax. If you file taxes married, then if your provisional income is below $32,000, 0% federal tax.

Loren Merkle [00:12:48]:

Between 32, 44, up to 50% in excess of $44,085 of your Social Security income is subject to tax. So let’s look at an example of how provisional income impacts what you pay in actual taxes. In this example, we have a single filer. Let’s call her Jill. Jill files taxes.

Loren Merkle [00:13:13]:

She has Social Security income. Already elected, she receives $24,000 a year of Social Security income. However, she needs $72,000 of income to live on to afford her lifestyle, which means she needs $48,000 to come from her investable assets. And she has pre tax 401(k) plans and pre tax IRAs. That’s where she’s going to take that $48,000 from. So let’s determine what Jill’s provisional income looks like. So remember, we’re not using the full $24,000. We are just using $12,000 for the provisional income number.

Loren Merkle [00:13:54]:

We add that to the $48,000, which means in this scenario, Jill’s provisional income is $60,000. So we take that number, we take the $60,000, and then we apply that to her single filing Social Security tax brackets. You can see it’s in excess of $34,000, which means in this scenario, up to 85% of Jill’s Social Security is going to be taxed. But what if. What if Jill did some planning, was intentional, took control over what her tax situation was, and then she applied it in an intentional way to her income plan? This is what could take place for Jill. She still needs $72,000. But instead of just having the pre-tax income sources from the pre tax IRA and 401(k), she also has a Roth IRA or Roth 401(k) plan. Any of the distributions, any of the income she takes from the Roth IRA will be tax-free and does not go into the provisional income equation.

Loren Merkle [00:15:05]:

So let’s add up her provisional income in this scenario, $12,000 from Social Security income. That remains the same. Again, the $28,000 does not go into this. So we add the twelve to the $20,000 that equals $32,000 provisional income. Apply that to the Social Security tax brackets, which means not 85% of her Social Security is going to be subject to federal tax, but only up to 50% will be subject to Social Security tax. So what does this mean to Jill? What does this mean to you if you apply this in your situation if it could mean more money. And when we’re talking about retirement and delivering retirement income, this is what we’re talking about. How do we, from the same resources, increase spendable income, decrease total taxable income, and then you can enjoy the lifestyle that you’ve been looking for a little bit easier.

Molly Nelson [00:16:08]:

I’ve got two takeaways. As I was watching A, the IRS does not make anything easy. I was just thinking, you’ve got gross income, net income, modified adjusted income, AGI. Now I have to think of provisional income as well.

Loren Merkle [00:16:21]:

Well, and provisional income isn’t used for anything else. There is nothing else you will use that equation for, except for to determine what you pay on federal tax from your Social Security income.

Molly Nelson [00:16:33]:

Thank you very much. IRS. And the second thing I was thinking was, I want to get in the Jill situation. I’m going to get in the paying less on my Social Security benefit. And also, it’s worth noting that a lot of states, Chawn, do not tax Social Security benefits. So this was a federal conversation. But a lot of states just say, we’re not going to tax your Social Security benefits at all.

Chawn Honkomp [00:16:53]:

That’s part of somebody’s plan that we all need to be aware of. You know, what state do you reside in? What does that look like? What does the federal tax picture look like? And one of the big takeaways from this example, example Loren touched on was about that efficiency. If you do the plan, you can put yourself in a position to save money. Is there anybody here that doesn’t want to save money?

Loren Merkle [00:17:11]:

I like it.

Chawn Honkomp [00:17:12]:

I’m sure a lot of people out there want to save money. So the goal there with doing this tax plan is about what you get to keep and spend. And if you position yourself to be able to keep more of your Social Security, pay less federal tax on it, that’s a good thing, and that’s returned. That’s efficiency, and that’s value by, out of, you know, value from having a retirement plan.

Loren Merkle [00:17:32]:

And if, if you ask the families and individuals that we work with, if we were to ask all of them, very few actually are aware of provisional income or certainly don’t know what it means. They don’t, you don’t have to know that. That’s what we do. That’s what we do for the families and individuals we work with. Pay attention to the things that you’re not aware of because you’ve never been exposed to it. And then we apply it to your situation to impact or affect in a positive way what the bottom line really is.

Molly Nelson [00:18:00]:

And today we’re focusing on taxes. But when you head into retirement, there’s a lot of things that you have to rethink, including health care, legacy planning, income planning. Here’s a great resource for you. It’s our rethink retirement series at your fingertips. Look at that website on your screen. You’re going to get a lot of access to a lot of great information when it comes to rethinking retirement. But we’ve got more to talk about when it comes to taxes. Next.

Voice Over [00:18:30]:

Do I have enough saved for retirement? When should I take Social Security? Which Medicare option is best? How do I plan for inflation? Sometimes the road to retirement starts with more questions than answers. Were here to help? Join us for our upcoming Journey to Retirement workshop. Get answers and start your retirement journey with confidence. Our online workshop includes information on Secure Act 2.0 and changing retirement rules. Visit RetireWithMerkle.com to register for an upcoming workshop. Your retirement journey starts now.

Voice Over [00:19:01]:

Anytime I have even the smallest question about my accounts or what effect the latest tax law might have on my situation. The Merkle Retirement Planning team is always there and quick to help. I’m so glad they treat you like, well, like family. I’m so happy to have such an excellent team working for my future and ensuring I do the best to achieve my financial goals.

Voice Over [00:19:26]:

Merkle Retirement Planning your retirement starts here.

Molly Nelson [00:19:41]:

This is Retiring Today. I’m here with Chawn Honkomp and Loren Merkle, and we’re talking about rethinking retirement because it is a mindset shift. Let’s talk about mindset shift number three. When it comes to taxes, you need to think long term.

Loren Merkle [00:19:53]:

Need to think long term because hopefully your retirement is going to span a decade or two. Maybe. Maybe that is long term. One of the biggest questions that we get for families and individuals who come to us is how do I save money on taxes?

Molly Nelson [00:20:08]:

Yes, everybody wants to save money.

Loren Merkle [00:20:09]:

Everybody. You’ve been paying taxes your whole career, and you’re wondering in retirement now, with a finite amount of resources where you have to deliver your lifestyle from the money you’ve saved, you want to ink every bit out of that money. One way is to decrease taxes. It’s top of mind for most pre-retirees and retirees.

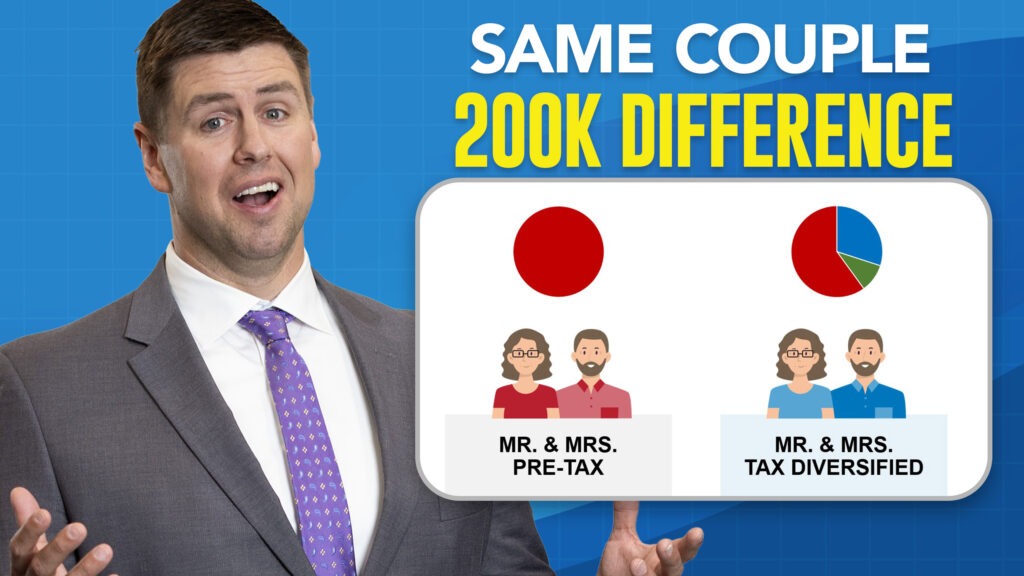

Molly Nelson [00:20:29]:

And part of thinking long term is not thinking about just filing each year. It’s kind of thinking about having tax diversification. And this is where the CPA is like, oh, I want to show everybody how to do this. So some people are really interested in what does tax diversification look like.

Chawn Honkomp [00:20:44]:

Diversification means having these different vehicles and being able to make different decisions as we go through our retirement journey. And if you’ve done the proper planning, you can have up to four different income sources during your retirement. And there’s good ways and bad ways that you, you can use that. And these different sources have tax advantages and tax disadvantages of their own. So let’s take a look at the different retirement savings buckets that are available to you. All of us are most familiar with the first one you think about your pension, your 401(k), your IRAs, these are all the traditional types of retirement buckets. They haven’t been taxed yet. When you take them out in the future, they’re going to be subject to tax.

Chawn Honkomp [00:21:26]:

A second retirement income source is Social Security. We talked a lot about Social Security in our prior segment, and Loren talked about how you have different opportunities to be more efficient with your Social Security and pay less in taxes on your Social Security. The third option would be your Roth retirement buckets. You’ve got your Roth 401(k)s and your Roth IRAs. We know that these buckets haven’t been available to all of us for as long as the traditional buckets. You know, the Roth 401(k), Roth IRAs, they are newer than the traditional savings buckets. And then the last bucket is the non-qualified. And that’s not an everyday term.

Chawn Honkomp [00:22:03]:

So really what the non-qualified is means it’s a non IRA type of account or a non 401(k) type of account. And just like your bank accounts, your bank accounts are considered non-qualified accounts or any brokerage accounts that you might open. If it’s an individual or joint account, those are considered non-qualified accounts. With our folks today being on rethinking retirement and trying to have a mindset shift when it comes to taxes, we’re really focused on the pre-tax and traditional buckets. Along with the Roth buckets, we know all of that pre-tax savings that you have, as you take those distributions in retirement are going to be subject to ordinary income. So this is going to feel very similar to when you were still in your working years and collecting that paycheck. You’re going to be paying federal taxes. Depending on the state that you live in, you’re going to be paying state taxes as well.

Chawn Honkomp [00:22:57]:

When we take a look at the Roth buckets that we have, these are at our favorite tax rate. These are completely tax-free. And when I say that tax-free, I really mean when we take those distributions, when we made the contributions into those Roth buckets, that’s when we were subject to the taxes. So you did pay tax on those balances. But once we get contributions into the Roth buckets, they are going to have an opportunity to grow in the markets, and that growth is never subject to tax in the future. So you have a, you know, every balance, every single dollar that you have saved in those buckets are going to be completely tax-free, which really helps mitigate your tax rate risk. So how you save money is to have this proper plan. Let’s have really strong tax diversification, which gives us more control on where to take income from, how to take it from in retirement.

Molly Nelson [00:23:50]:

And people might be wondering, okay, a, do I have those buckets or how do I get them?

Loren Merkle [00:23:54]:

Most of the families and individuals that we work with, they don’t know all of that. They don’t want to know all of that kind of stuff. That’s where the teamwork comes with our partnership, because we take care of that for them. But I can tell you, they don’t have to know, but they feel it. They live it. They get to see the results of what control can have from an impact standpoint as far as what they get to spend from what it is that they’ve saved.

Molly Nelson [00:24:19]:

And one of the things you guys do help them do is diversify that. So they get the buckets. And then you also help with Sean, when to take the money from the buckets, because, remember, we’re spending money in retirement as well.

Chawn Honkomp [00:24:29]:

The diversification takes time. We don’t just retire and all of a sudden have all four types of income sources and all four different types of buckets that we talk about. So that’s where the power of having that plan really reflects. We’re planners. We know that the more time we have to build a plan and execute a plan, the more control that we’re going to have across your total retirement journey. That way you have more options to take the distributions, take the income from the right type of account for any given year, thinking about what those tax rates are going to be, thinking about what the markets are doing, and factoring all that in to try to be as efficient as possible with those total savings.

Loren Merkle [00:25:09]:

And in many cases, it very much is a juggling act, or at least it feels like it while they’re taking income from their savings. But they’re also doing the tax planning and shifting money from the pre-tax over to the Roth and doing those conversions all in the same year. So there can be a lot of moving parts that go into delivering the income that you need to have the lifestyle that you want, but also setting yourself up in the best position for the future, which in many cases can be shifting money from pre tax to the Roth IRA.

Molly Nelson [00:25:39]:

Loren, you just mentioned all the things you have to juggle in retirement, and there is a lot of stuff you have to rethink. We’ve got a great resource for you. It’s a bunch of workshops. It’s our rethink retirement series. You can go to the website on your screen right now and watch a workshop about taxes, what we just talked about. There’s some new information inside there. There’s one on income investment, legacy planning and health care. Because, Loren, there’s a lot of first time decisions and one time decisions and new decisions when it comes to retirement.

Loren Merkle [00:26:06]:

And decisions change because of legislation changes and life changes. And so what we’ve done over the last four months is we’ve worked really hard to put together some online workshops that people can view at their leisure. It doesn’t cost you any money to view these. You can sit on your couch, watch the online workshop, eat some popcorn, some snacks.

Molly Nelson [00:26:28]:

Get comfortable.

Loren Merkle [00:26:29]:

Get comfortable and learn about all the different ways that you can positively impact your retirement financial outcome.

Molly Nelson [00:26:37]:

And what we do in each one of these workshops, Chawn, is we kind of take the current way you might be thinking about things like we did today with taxes. And then we kind of help people look at how to shift their mindset when it comes to many of these aspects of retirement.

Chawn Honkomp [00:26:49]:

What we really enjoy with it is it gives us this opportunity to dive deeper on any one of these individual components that are part of the retirement journey. So now, whatever you might be thinking the most about or what might be leading to the most amount of questions for you, we’re able to give you more information and really get you going. One thing we hear all the time is from people is, well, where do I start? And if you can take, take step one, that’s going to put you in that much stronger of a position of building that plan, feeling that much more confident as you head into retirement.

Molly Nelson [00:27:18]:

The website is on your screen. It’s our rethink retirement series. You can go there right now and view those workshops. That’s why this series is great. There’s a lot of great information in the rethink retirement series and on this show. It’s retiring today, and we thank you for watching.

Voice Over [00:27:37]:

Do I have enough saved for retirement? When should I take Social Security? Which Medicare option is best? How do I plan for inflation? Sometimes the road to retirement starts with more questions than answers. Were here to help? Join us for our upcoming Journey to Retirement workshop. Get answers and start your retirement journey with confidence. Our online workshop includes information on Secure Act 2.0 and changing resources retirement rules. Visit RetireWithMerkle.com to register for an upcoming workshop. Your retirement journey starts now.

–––

We are an independent financial services firm helping individuals create retirement strategies using a variety of investment and insurance products to custom suit their needs and objectives. The content and examples shared are for informational purposes only and should not be construed as investment advice or serve as the sole basis for making financial decisions. Individuals are encouraged to consult with a qualified professional before making any decisions about their personal financial situation. Our firm is not permitted to offer legal advice. Investment Advisory Services offered through Elite Retirement Planning, LLC. Insurance Services offered through MRP Insurance, LLC.