Understanding Social Security is important as it plays a significant role in retirement planning. We help you make sense of the facts and provide insights into optimizing Social Security benefits to help you navigate this important income decision.

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Why social security decisions matter

The conversation began with Retirement Planners Loren Merkle and Chawn Honkomp emphasizing the importance of making informed Social Security decisions. Chawn noted, “It’s a huge decision with a lot of complexity and confusion” – a sentiment many pre-retirees can relate to. With more than 81 Social Security options available for married couples, this crucial decision shapes your financial security during retirement.

Fact or fiction: Addressing Common myths

In the episode, Loren and Chawn engaged in a game of “Social Security Fact or Fiction,” tackling several statements about Social Security.

Fact or fiction: social security will run out of money before i retire

Both Loren and Chawn identified this as fiction, acknowledging the widespread concern but emphasizing the current legislative options available to sustain Social Security. Loren explained that while the federal government has to make some tough choices, there are various mechanisms they could employ, such as adjusting the taxable income cap or increasing the full retirement age. This ensures a level of continuity for those already benefiting from Social Security or approaching eligibility.

fact or fiction: a surviving spouse, at full retirement age or older, generally gets 100% of the worker’s basic benefit amount

This one was deemed generally true but with nuances. Loren highlighted this benefit as one of the least understood aspects, bringing to light its complexity based on multiple factors like age, eligibility, and marital status. A surviving spouse does typically receive the higher of the two benefits if both were already claiming, but the specifics can vary significantly.

fact or fiction: an ex-spouse’s benefit comes out of your own benefit

Both planners quickly labeled this as fiction, clarifying that an ex-spouse drawing a benefit based on your income doesn’t reduce your benefits at all. Loren reassured viewers that such claims are entirely separate, with no impact on either party’s benefits.

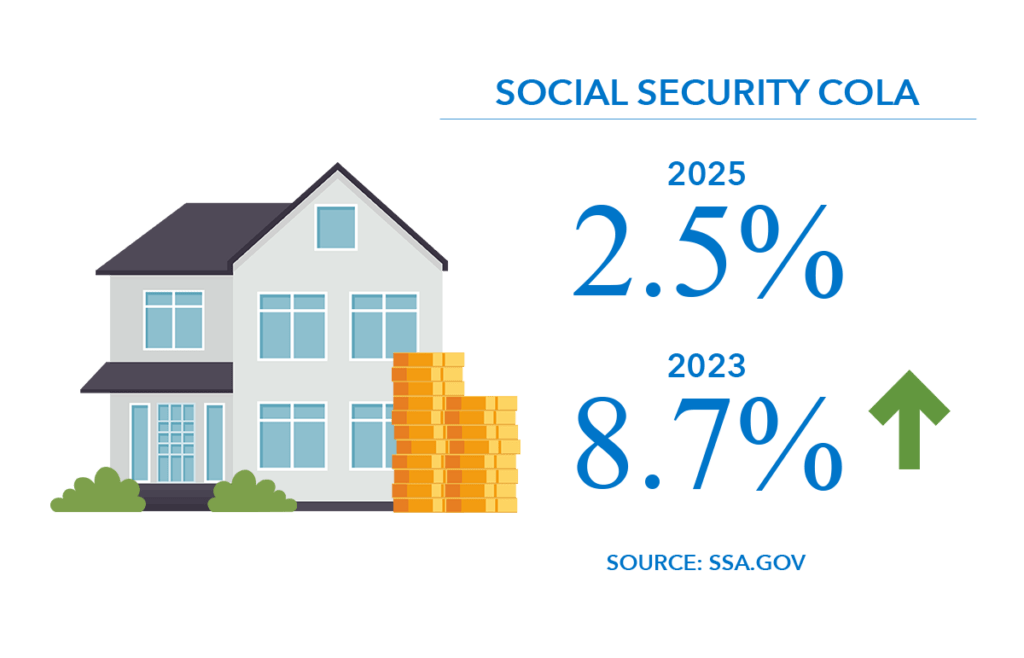

fact or fiction: The annual COLA increase is guaranteed

For 2025, the Cost of Living Adjustment (COLA) is 2.5%, contrasting with 8.7% in 2023. Loren pointed out that COLAs help counterbalance inflation but aren’t guaranteed. Periods with 0% COLA increase, like 2010, 2011, and 2016, serve as a reminder of this variability.

Earnings test

Fact or fiction: i won’t pay taxes on my social security benefits

Social Security benefits might be taxable depending on your other income sources and filing status. Loren and Chawn explained that a well-crafted tax strategy could minimize or even eliminate these taxes. In 2025, for married couples filing jointly, up to 85% of their benefits could be taxable if their combined income is above $44,000. For single filers, up to 85% of their Social Security benefit could be taxable if their provisional income is above $34,000. Early planning is essential to navigate these thresholds efficiently.

Conclusion

This episode of “Retiring Today with Loren Merkle” provided important insights into Social Security’s complexities. Understanding these nuances can help you maximize this retirement benefit.

Click here to watch the full episode “Debunking Social Security Myths” on YouTube!

Source: SSA.gov