Worried your 401(k) or IRA will lead to a surprising tax bill in retirement? Learn why taxes can be higher after you stop working—and what proactive strategies can help you save hundreds of thousands of dollars.

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

If you’re like most people, you’ve been diligently saving for years—stocking away funds in tax-deferred accounts like 401(k)s or IRAs. But many don’t realize that while you’re building this nest egg, you could be setting yourself up for a big tax surprise in retirement. According to Retirement Planners Loren Merkle, CFP®, and Clint Huntrods, PhD, proper tax planning is critical—not just for you, but also for the loved ones who may inherit your money.

Let’s break down why taxes in retirement are so different—and how you can take control to avoid handing a huge chunk of your savings to the IRS.

Why Taxes Change After You Retire

During your working years, your tax situation seems fairly straightforward. You earn income, withhold taxes from your paycheck, and perhaps contribute pre-tax to your 401(k) or IRA (if eligible). Your options for reducing your tax bill are relatively limited—maybe a deduction for charitable giving, but not much else.

But retirement is a different story. “If you create a tax plan before you head into retirement, you will have much more control over what you’ll pay,” says Loren. That’s because retirees often draw from multiple sources: Social Security, tax-deferred accounts, after-tax brokerage accounts, and perhaps Roth IRAs. Each is taxed differently:

- 401(k)s, IRAs, and Traditional Pensions: Withdrawals are taxed as ordinary income. If you saved heavily into these accounts, as many do, you might find yourself still in a high tax bracket when you start taking distributions – sometimes even higher than during your working years!

- Social Security: Many retirees are surprised to find that up to 85% of their Social Security benefits can be taxable, depending on “provisional income” (a formula combining other taxable income and half of your Social Security).

In 2025, for Social Security benefit taxation, provisional income limits are $25,000 for single filers and $32,000 for married couples filing jointly. Up to 50% of Social Security benefits may be taxable if provisional income is between $25,000 and $34,000 for single filers or $32,000 and $44,000 for joint filers. If provisional income exceeds $34,000 (single) or $44,000 (joint), up to 85% of benefits may be taxable.

- Brokerage Accounts: Gains are taxed at capital gains rates. Hold investments over a year, and you may qualify for favorable long-term capital gains rates.

- Roth IRAs: Qualified distributions from a Roth IRA are completely tax-free. You can withdraw your original contributions or converted amounts at any time without taxes or penalties. However, to withdraw earnings tax-free, you must meet two conditions: you must be at least 59 1/2 years old and your Roth IRA must have been open for at least five calendar years. In the case of a Roth conversion — where you move money from a traditional IRA to a Roth IRA — you will pay income taxes on the amount converted in the year of the conversion. After that, the converted funds and any future growth can be withdrawn tax-free, provided you meet the age and five-year requirements.

The “Ticking Tax Time Bomb” of RMDs

One possible trap: required minimum distributions (RMDs) from tax-deferred accounts. At age 73 (for most people) the IRS forces you to begin taking—and paying taxes on—RMDs, whether you need the income or not. “You’re mandated to take distributions from those balances, all taxable at your ordinary income rate,” Loren warns. If your investments keep growing, the amount you must withdraw (and the taxes you pay) can increase each year, potentially pushing you into higher and higher brackets.

Clint stresses planning: “Don’t wait until you are 70… That limits your opportunities.” Instead, start thinking about your future tax picture in your 50s and 60s, or even as soon as you retire, to take advantage of tax-saving opportunities.

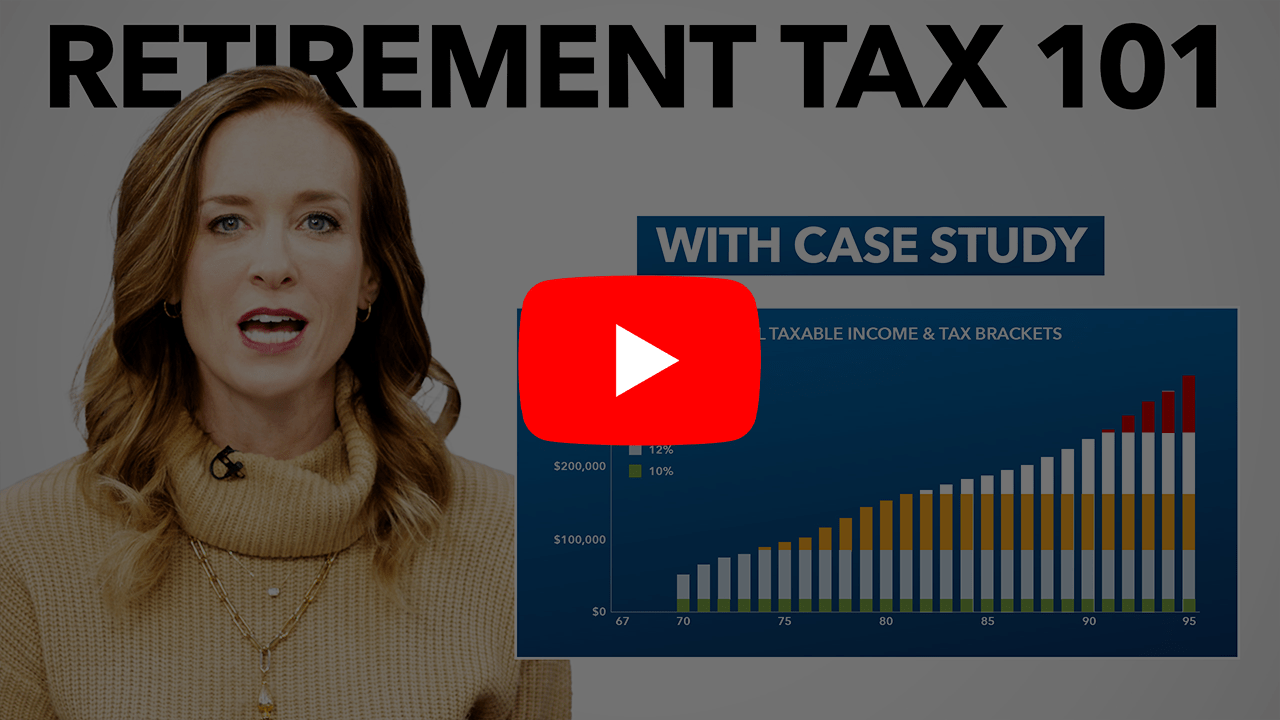

Case Study: How a Hypothetical Couple Saved $400,000 on Taxes

Consider this hypothetical example: A couple, both age 67, have $500,000 each in their IRAs and $100,000 in a non-qualified account.

For this example, we assume a rate of return of 7% on their investments. We are also assuming a Social Security benefit of $2,500 a month for each person and a 2% cost-of-living-adjustment or COLA on that Social Security benefit.

The couple determined they would need $90,000 of retirement income per year to fund retirement in the first 10 years and $75,000 a year after that.

Using a projection that they would both live to age 95. What do you think their tax bill could be over the course of their retirement?

If they do nothing and simply withdraw from their IRAs as needed (and later as required by RMDs), they could face a combined tax bill of $1.1 million over their retirement— the same as their total savings!

Why so high? Every distribution is fully taxable, and those withdrawals eventually push their income (and Social Security taxability) higher and higher.

This chart shows how RMDs increase the tax brackets they are in throughout retirement. The couple finds themselves in the 32% tax bracket later in retirement.

What if this hypothetical couple did some tax-planning prior to retirement?

By incorporating a Roth conversion strategy early in retirement, this hypothetical couple proactively converts some IRA dollars to Roth accounts while they’re in lower tax brackets—paying tax today to avoid much larger bills down the road.

This chart shows the couple paying a little more in taxes early in retirement. Their taxable income is lower later in retirement because qualified distribution from a Roth IRA are not taxed. The Roth conversion strategy allows them to avoid the 32% tax bracket.

Huntrods highlights, “They save $400,000 across their entire cumulative retirement tax bill by taking action early.” Not only does this lower lifetime taxes, it means more for them to spend or leave to heirs.

The Benefits to You and Your Heirs

Good tax planning isn’t just for your benefit. If you pass large IRAs to your kids, they may have to withdraw and pay tax on the whole balance within ten years—often during their own highest-earning years. A $100,000 IRA inheritance could easily result in $24,000 (or more) lost to taxes if your child is in the 24% tax bracket.

Strategies like Roth conversions or spending from different account types can potentially save both you and your heirs tens (or hundreds) of thousands of dollars.

Take the First Step

Don’t wait for RMDs to catch you off guard or for your kids to inherit a tax headache. Meet with a retirement planner who incorporates comprehensive tax planning, not just investment advice.

With a bit of proactive planning, you can defuse the tax time bomb and enjoy retirement with confidence—knowing you’ve minimized unnecessary taxes for yourself and those you love.

Sources: SSA.gov