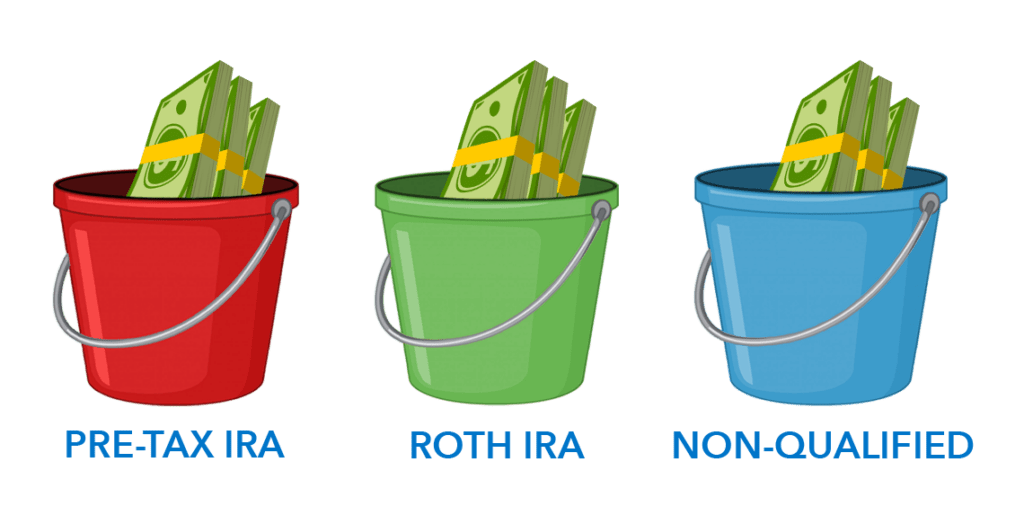

When planning for retirement, there’s often a lot of focus on growing your nest egg through diversified investments, but what about diversifying your taxes? This is about strategic and long-term tax planning that could lower your tax bill and maximize your retirement income.

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

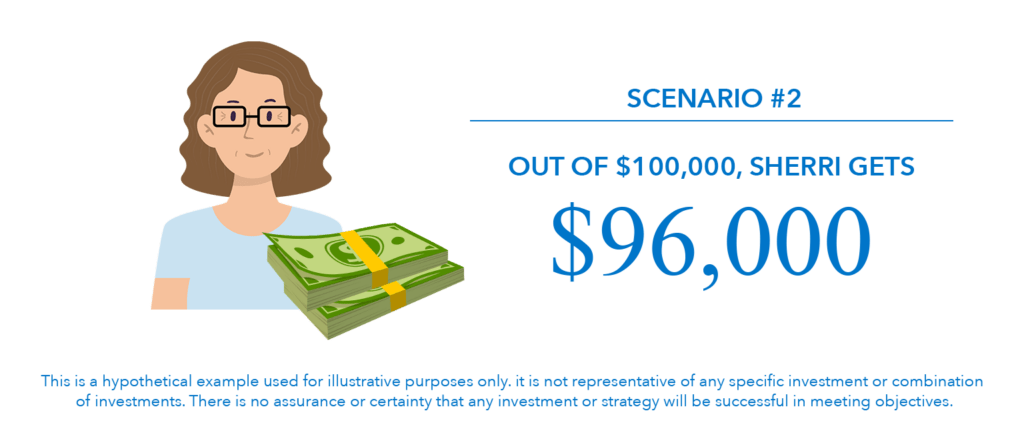

We explore the concept of tax diversification, illustrated by the hypothetical scenario of a woman named Sherri who has planned for retirement income and identified that she needs to take $100,000 from her retirement investments to fund her desired lifestyle for one year. Through three scenarios, we see how different distributions from various tax buckets can significantly impact her net spending power.

Scenario One: Traditional IRA

In this scenario, Sherri draws her entire $100,000 retirement income from a traditional IRA. Since all withdrawals from this account are subject to ordinary income tax, Sherri’s spendable income is reduced to $87,000 after taxes. This method is common due to familiarity with traditional IRAs and 401(k) plans, but as the planners explain, it’s not the most efficient strategy.

Scenario Two: Introducing Roth Conversions

Here’s where Sherri starts getting creative. Now, she distributes her income between a pre-tax IRA and a Roth IRA – a move made possible by prior Roth conversions. By taking $50,000 from her pre-tax IRA and another $50,000 tax-free from her Roth IRA, Sherri increases her net income to $96,000. This scenario showcases how Roth IRAs can enhance retirement income through tax-free qualified distributions.

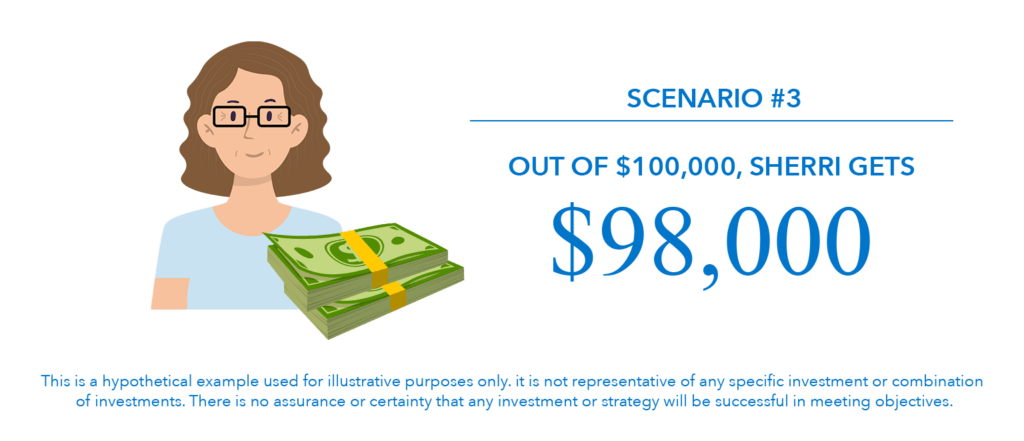

Scenario Three: Tax Diversification

In the third scenario, Sherri maximizes her tax diversification by incorporating a third bucket: non-qualified accounts, which might include brokerage accounts or bank savings.

She strategically withdraws $30,000 from her pre-tax IRA, $40,000 from her Roth IRA, and $30,000 from her non-qualified accounts.

This approach leaves her with $98,000 of net spendable income, underscoring the power of strategic planning.

Each scenario underscores the critical role of planning ahead for tax efficiency. Roth conversions, which allow for transferring funds from a traditional IRA to a Roth IRA while paying taxes in the year you do the conversion, can be a game-changer. This strategy allows for tax-free growth and qualified distributions later, making it particularly attractive for those aiming for financial flexibility in retirement.

Retirement Planners Loren Merkle and Chawn Honkomp also stress the importance of a long-term tax strategy, distinct from annual tax filings. Instead of focusing solely on minimizing taxes each year, they advise considering how to minimize taxes over the course of your entire retirement. This involves projecting future tax scenarios and potential changes to tax laws that might affect retirement funds.

Click here to watch the full episode “Three Ways to Lower Taxes in Retirement” on YouTube!