When it comes to retirement, some of the most common beliefs about investing sound true—but in reality, they can lead you down the wrong path. Misconceptions about the stock market, savings accounts, bonds, or even the 4% rule can cause retirees to make costly mistakes.

To help separate truth from fiction, Retirement Planners Loren Merkle and Haley Gutschenritter tackled eight of the most common investment myths.

#1 The stock market is too risky for retirees.

Fiction

“The stock market, we need it,” Haley explained. “It’s a powerful tool for retirees because we need to balance growth within their overall portfolio. Otherwise, their portfolio could safely lose to inflation.”

Loren acknowledged that downturns can feel unsettling, recalling events like the dot-com bubble, the Great Recession, and COVID-19. “Way back in the 80’s, the market was down below 1,000. And then look at where the S&P 500 is now. That is a tremendous amount of growth. You can use that market to your advantage…if you use it how it’s designed.”

Even in retirement, with lifespans stretching 20 years or more, growth remains essential.

#2 It’s safer to keep money in a savings account

Fiction.

Savings accounts feel secure, but they can erode long-term wealth. “Over the long-term, it could actually be more harmful for you to keep your money in a savings account because you would be safely losing value on that cash to inflation,” Haley said.

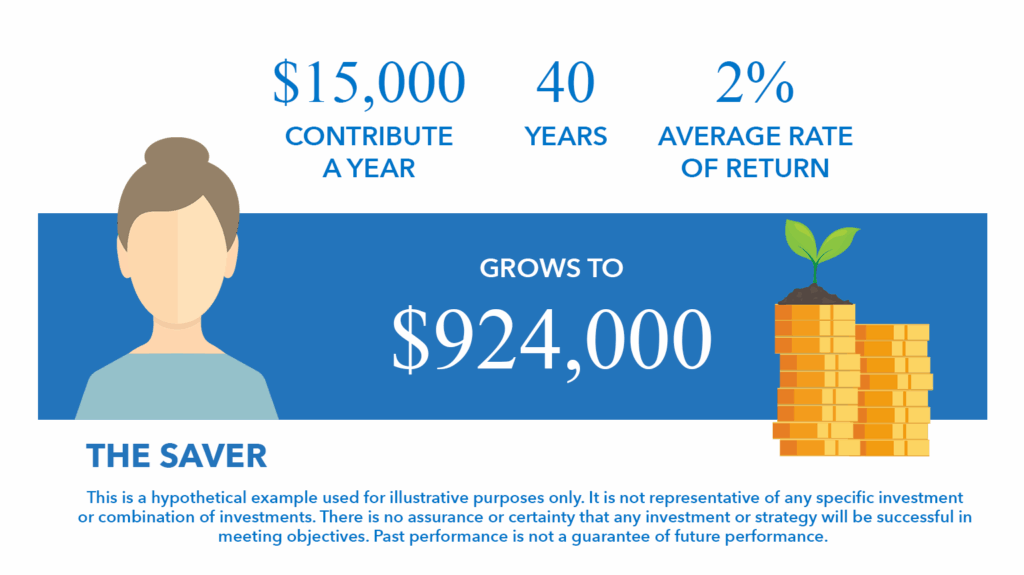

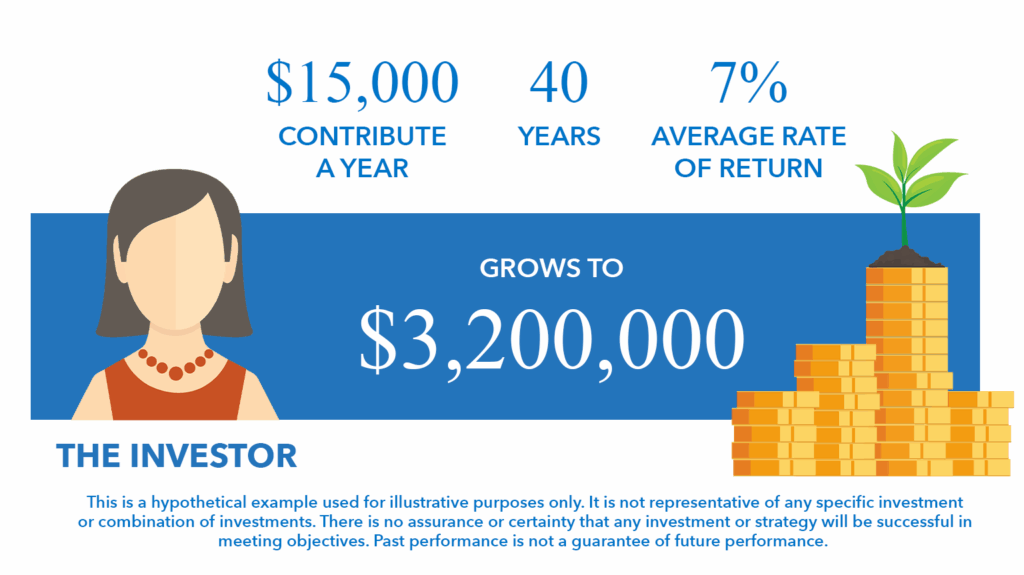

Loren illustrated the difference with a hypothetical example of The Saver vs. The Investor. The Saver contributes $15,000 a year for 40 years at a 2% average rate of return and would accumulate about $924,000.

The Investor incorporates a more diversified portfolio – with stocks, bonds and some cash, averaging a 7% rate of return. The Investor would end up with $3.2 million, in this hypothetical example.

A diversified portfolio earning 7% could grow to $3.2 million—far more than $924,000—supporting a comfortable lifestyle in retirement and may offer the potential to leave a legacy.

#3 Bonds are always safer than stocks

Fiction.

Haley pointed to 2022 as proof, noting that even traditionally safe assets like Treasury Bonds lost 13% that year—arguably the worst year ever for the bond market.

Loren added, “Some of them were down over 30% in that timeframe. So, you think about a traditionally safe category…but 2022 comes around and all of a sudden, your portfolio can experience a significant, unexpected decline.”

#4 I can just live off the dividends and never touch my principal

Fiction.

“You have to have a very, very large portfolio in order to live off the dividends,” Haley explained. “And the reason why is because dividends may pay around 2% to 3% on your total portfolio, if they’re dividend paying stocks. So, if you have a portfolio that’s $500,000, that might produce about $10,000 a year of annual income and $10,000 a year is just not going to go far.”

Loren cautioned that dividends can be cut when markets struggle. “We go through timeframes like 2008, that 18-month recession when the world was on fire… companies that were paying you a 4% to 5% dividend now slash those dividends and some of them cut them off altogether.”

If you depend solely on dividends, a reduction can translate directly into a reduction in your lifestyle—something no retiree wants to experience.

#5 I should avoid taking money from investments when the market is down.

Fact.

“The key component is planning ahead,” Haley said. By preparing withdrawals six to 18 months in advance, retirees can set aside a short-term income bucket invested for stability. When the market dips, they can avoid selling at a loss and still have income available.

“You don’t want to guess. You want certainty,” Loren added. “Certainty can help foster confidence — and that confidence can contribute to a more fulfilling retirement.”

He explained that building a recession-resistant portfolio helps provide that certainty. “When the market blows up, yes, your portfolio as a whole will probably be down, but it shouldn’t be down anywhere close to what the market is. And again, you still have that income piece of your portfolio that you can take your income from and not have to worry about hurting the other elements of the portfolio because you have to sell when you’re down.”

#6 I can just follow the 4% rule and never run out of money.

Fiction.

“You might be okay using the 4% rule, but you don’t know if you’re going to be okay,” said Loren. When it comes to something as important as the rest of your retirement, you want certainty.”

He explained how quickly things can change. “Let’s say you have a retirement portfolio of $1 million. You take 4% out, your lifestyle income from that portfolio is $40,000. But then here comes the recession. The market takes a big hit. Your million-dollar portfolio now drops to $750,000. And if you’re staying true to the 4% rule, you’re just taking 4%, which means it’s no longer $40,000. It’s only $30,000 of income, which means your lifestyle took a hit.”

Haley called the 4% rule “a general rule of thumb” based on assumptions most people don’t even realize. “If one of those assumptions are off, maybe we have higher inflation, maybe health care costs are going up and it’s not baking that in, then the results can be drastically different. And you want to help ensure your money lasts as long as you do.”

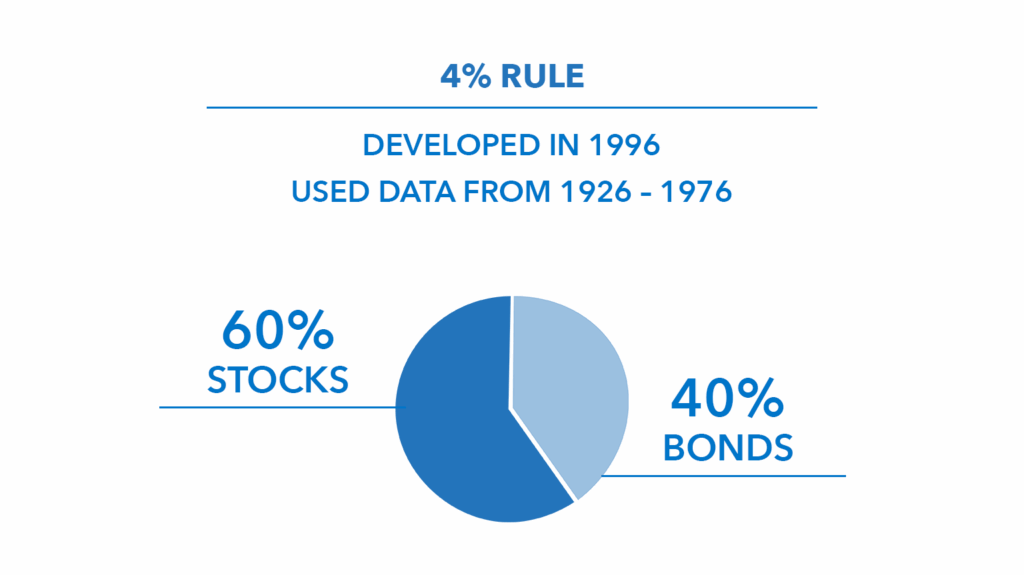

The 4% rule itself isn’t new. According to Bankrate, it was developed in 1994 using historical data from 1926 to 1976 and based on a 60/40 portfolio.

But today’s retirees face challenges that make it less reliable: higher inflation, lower interest rates, and longer life expectancies.

That’s why rules of thumb like the 4% rule can serve as a rough guideline, but they aren’t a substitute for a retirement income plan built around your lifestyle and goals.

#7. Market timing is key to high returns

Fiction.

Loren said the problem with market timing is that you have to make two good decisions—when to get out and when to get back in. “And oftentimes it’s that second decision. That’s really hard,” he said.

Haley added, “It’s really not the market downturns that are going to potentially blow-up retirement. It’s selling out at the wrong time…and really missing that rebound.”

#8 Annuities Are Always a Bad Investment

Fiction

“Well, a lot of times they get a bad rap,” Loren said. “The right annuity for the right person, the right situation can be highly effective.”

Haley agreed. “Annuities have a purpose… Is it there to provide income? Is it there to provide stable growth? It can have a purpose and a good one in your overall plan.”

And one of the biggest benefits can be a steady income, similar to a pension. Fewer people have pensions today than in past decades. About 15% of workers have access to a corporate pension, according to the U.S. Bureau of Labor Statistics.

“But by and large, people who are retired love a steady income stream that may be contractually guaranteed depending on the annuity type,” said Loren. “An annuity, a certain type of annuity can be that pension replacement if you don’t have a pension. Or it could be a pension enhancement if maybe your pension isn’t filling your income gap.”

Final Thoughts

From savings accounts to dividends to annuities, Loren and Haley showed how much of what people assume to be true about investing in retirement turns out to be fiction. Their message was clear: with a customized retirement plan, retirees don’t need to rely on rules of thumb or myths. They can invest with confidence, knowing their income and lifestyle are built on facts.

Watch the full episode on YouTube to learn how to protect your retirement from common myths.

Sources: Bankrate.com and U.S. Bureau of Labor Statistics