A common saying is you need a million dollars for retirement, but what does that actually mean for you? In this blog, you’ll meet Tom and Sandi. They have $1 million saved for retirement at age 65, and in the first iteration of their retirement road test, that money was projected to run out by age 79. Rather than panicking or giving up on retirement altogether, we put their plan through a series of adjustments, testing different strategies to see what could work for their retirement.

This is a hypothetical case study, but these are strategies to consider and test in your own retirement plan. These are the strategies we explore with pre-retirees to help support greater clarity and confidence as they enter their next chapter.

Putting $1 Million to the Test

For many retirees, reaching the $1 million mark feels like a finish line. After decades of saving, the assumption is that number should be enough. But when Tom and Sandi step into retirement at age 65, they discover that the question isn’t how much they saved — it’s how that money supports the life they want to live.

As Retirement Planner Loren Merkle explains, the pressure is real. He says, “the stakes are so high,” because people are thinking about “the next 20 to 30 years of not earning money but wanting to have fun,” and, as he puts it plainly, “we all know fun costs money.”

Meet Tom and Sandi

Tom and Sandi are both 65 and ready to retire. As Loren describes it, they’ve been working “for over 40 years,” and while they don’t have to retire at 65, they “really want to retire at age 65.” They’ve saved $1 million for retirement and have another $1 million in home equity. Like many couples, they’ve heard that saving $1 million might be enough — even if they’re not quite sure how.

Retirement Planner Chawn Honkomp describes their mindset clearly, saying they’ve always heard that “you save $1 million at age 65, that should work,” but he also acknowledges that but even couples who reach that milestone can still feel uncertain. That uncertainty is what puts them on the retirement road test.

Putting the Numbers on Paper

Once Tom and Sandi’s lifestyle goals are translated into dollars, the picture becomes much clearer. In this hypothetical example, their core monthly lifestyle spending is $6,500, or about $78,000 per year, covering everyday expenses like housing costs, food, utilities, and entertainment.

On top of that baseline, they plan for additional retirement expenses. Health care is estimated at $7,200 per year for each of them, or $14,400 annually, with the expectation that those costs will grow over time. Travel is another priority during their early retirement years, with $24,000 per year budgeted for what are often called the go-go years – the early years of retirement when you are often most energetic and active.

They also have special goals they want to fund along the way, including a big trip with their grandkids and helping with their grandchildren’s college expenses.

Social Security timing plays a key role in the plan. Sandi plans to claim her benefit at age 67, when she will receive $2,300 per month. Tom plans to wait until age 70, increasing his benefit to $3,900 per month and creating a larger survivor benefit for Sandi.

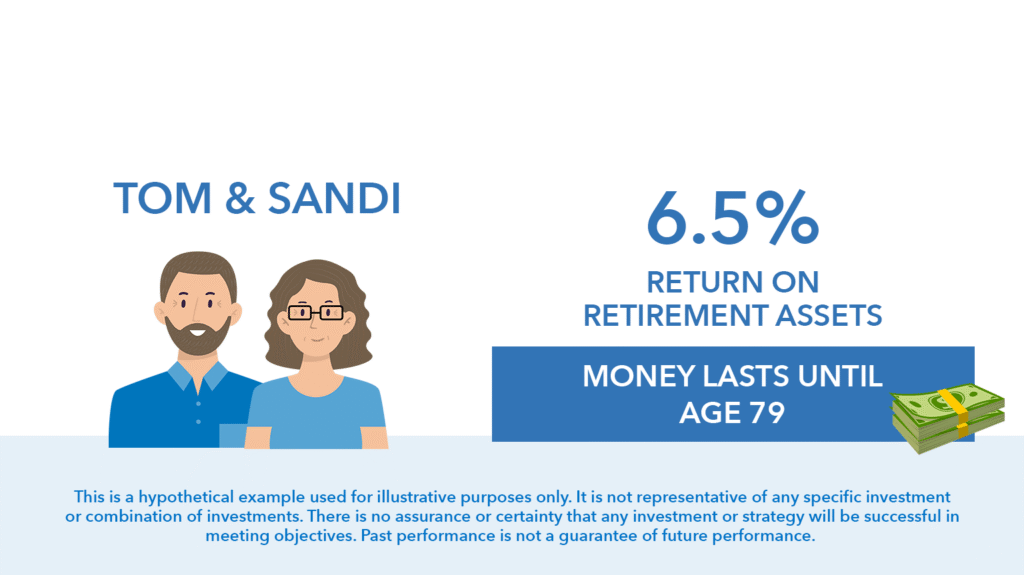

When all of these factors are projected using a 6.5% average rate of return, the early years of retirement rely heavily on their investment portfolio. Initially, they need to withdraw roughly 13% per year to cover their lifestyle and goals.

The result of that first projection highlights important challenges: using these hypothetical assumptions, Tom and Sandi run out of money at approximately age 79.

A Challenging First Result

Using an assumed 6.5% average rate of return, Tom and Sandi’s $1 million portfolio runs out around age 79. As Loren explains, with withdrawals running between 11% and 13%, “their portfolio is not going to last until 100,” and in this scenario “it’s going to last until about age 79.” That’s well short of the average life expectancy for someone who reaches age 65.

Chawn is candid about what this first version of a plan often reveals, noting that “this is not a unique scenario where the first iteration of your retirement plan doesn’t look as rosy as what you want it to look like.” It can be unsettling, but it’s also the starting point for better decisions.

Testing the Tough Options

With the initial outcome on the table, Tom and Sandi explore adjustments. Working longer improves the numbers significantly, but Chawn acknowledges that adding three more years of work feels daunting for people who are already emotionally ready to retire.

Cutting spending helps, but not enough. Removing $24,000 a year in travel could improve the outlook slightly, yet Chawn admits it doesn’t move the needle far enough for this couple. Reducing their monthly lifestyle could make the money last longer, but he notes how difficult that feels when retirees worry about “pinching pennies every single week, every single month.”

Small Changes, Big Impact

What becomes clear is that retirement planning isn’t about one drastic move — it’s about layering smaller, thoughtful decisions. As Loren puts it, “the little changes can make big changes overall,” especially when a plan is projected out over a 20 or 30-year time frame.

Adjusting Social Security timing, modifying expenses incrementally, or combining multiple strategies can reshape the outcome without sacrificing everything that makes retirement meaningful.

The Role of Tax Planning

One of the most powerful levers is long-term tax planning. Chawn explains that many retirees overlook taxes while saving, only to realize later how much control they actually have. He points out that if less of Tom and Sandi’s portfolio goes to taxes, “that means more of that million-dollar portfolio is in their pocket.”

If your retirement savings is invested in a traditional 401(k) or a traditional IRA, that’s money that has never been taxed. Chawn stresses the importance of exploring long-term tax planning strategies that can help you be more intentional about when and how taxes are paid, focusing on making informed decisions based on long-term projections.

Rethinking Investment Risk

Investment strategy also evolves in retirement. While growth still matters, volatility carries more weight when money is being withdrawn.

Chawn explains that increasing risk could boost returns, but a downturn at the wrong time could do real damage. He underscores the need for balance, saying retirees need income they can rely on “no matter what happens with the crazy markets,” especially when recessions are a normal part of a 20 to 30-year retirement.

Using Home Equity Strategically

Another option for Tom and Sandi involves their home. Loren explains that in this hypothetical example, by downsizing and freeing up additional assets, Tom and Sandi could end up with “a 20% higher starting retirement portfolio,” moving from $1 million to $1.2 million, which helps support both immediate lifestyle needs and long-term goals. By downsizing and freeing up $200,000 after taxes and fees, they increase their retirement portfolio by 20%.

Chawn notes that while this move alone may not solve everything, combined with tax planning, investment strategy, and income planning, it helps shift uncertainty toward better-informed decisions. What once felt like a dead end becomes, in his words, “a real path” forward.

From Uncertainty to Confidence

Tom and Sandi’s road test shows that saving $1 million is an achievement — but it’s not a guarantee. Retirement confidence comes from understanding how all the pieces work together and seeing how small, informed changes may help extend financial longevity and support peace of mind.

The lesson is simple but powerful: the earlier the testing begins, the more options retirees have to shape the future they’ve been working toward.

Watch the full episode on YouTube and learn more about strategies to consider and test in your own retirement plan.