Legacy planning isn’t always top of mind when preparing for retirement, but overlooking it can have costly and stressful consequences. You’ve worked hard to build your wealth—now it’s time to make sure it’s protected and passed on according to your wishes. In this blog, Retirement Planners Loren Merkle and Chawn Honkomp share five common legacy planning traps—and how to avoid them.

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

1. Incorrect Beneficiary Designations

A simple oversight—like not updating a beneficiary—can create major complications.

“Beneficiary designations are one of the most powerful and simple legacy planning tools,” said Loren. “Which is also why they’re one of the most overlooked.”

Life changes—like marriage, children, new jobs, or account updates—can render old designations outdated or incorrect.

Loren shares the story of a man in his mid-50s who came in for a visit just three months after his wife had passed away. Still deep in grief, he was also dealing with the unexpected financial stress of not having access to her two 401(k) accounts—each worth $500,000—because no beneficiaries had ever been designated.

Instead of receiving the funds quickly, he was forced to navigate through a complex and delayed process—at the worst possible time, amid grief.

To avoid this trap:

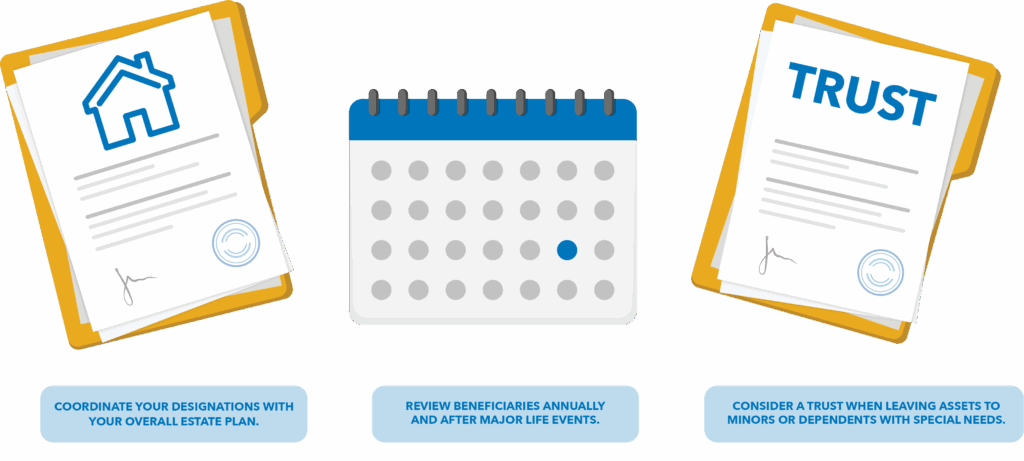

- Review beneficiaries annually and after major life events.

- Coordinate your designations with your overall estate plan.

- Consider a trust when leaving assets to minors or dependents with special needs.

2. Failing to Plan for Heirs

If you don’t have a structured plan in place, the state will make one for you—and it may not align with your wishes.

“It takes attention and intention,” said Chawn. “Start by identifying your goals and thinking through your family dynamics.”

Communication is also key. Loren says many families and individuals include heirs in the planning process.

“These conversations can be detailed or high-level, but they help ensure your heirs are prepared—not blindsided—when the time comes.”

3. Not Having a Will or Trust

About 32% of American adults have a will, according to a 2024 survey from Caring.com. And many who do have outdated documents.

“The most common response we hear is, ‘Yes, we have a will—but it was written when the kids were little,’” Loren explained. “That’s better than nothing, but it still needs updating.”

Without a will or trust, your estate will likely go through probate, a court process that can delay asset distribution and create stress for your loved ones.

The difference?

- A will must go through probate.

- A trust bypasses probate, offering more control and privacy.

Trusts aren’t just for the ultra-wealthy. Families with real estate, minor children, or a desire for more control over how and when assets are distributed often find trusts to be the right fit.

4. Lack of Power of Attorney

If you become incapacitated without assigning a financial or medical power of attorney, your loved ones may be unable to make decisions or access funds on your behalf.

“Life goes on even if you’re incapacitated,” Chawn said. “Bills still need to be paid.”

Without proper documentation, families can face challenges—from missed mortgage payments to delayed medical decisions.

Choose someone you trust. Loren notes it’s especially important for single individuals, but even married couples should be prepared for the unexpected.

5. Not Planning for Your Spouse’s Future

It’s one thing to want your spouse to be taken care of. It’s another to plan for it intentionally.

“Oftentimes we meet with widows whose spouse made a pension decision years ago without considering the survivor,” said Merkle. “Now that pension income is gone, and there’s a big hole in their lifestyle income.”

Social Security and pension decisions should be made with both present and future needs in mind. In some cases, life insurance can provide a tax-free benefit to the surviving spouse to offset lost income.

Loren shared a real example: “We helped a couple analyze their pension options and implement a term life insurance policy to provide protection for the survivor. It gave them more income now, and security for later.”

Legacy planning isn’t just about money—it’s about peace of mind. By avoiding these traps, you can ensure your wealth is protected, your loved ones are supported, and your wishes are carried out the way you intended.

Click here to watch the full episode “Avoid These 5 Traps That Could Impact Your Legacy (Estate Planning)” on YouTube!

Source: Caring.com