Planning for retirement is often seen as a daunting task, filled with more questions than answers. In a special edition of “Retiring Today with Loren Merkle” we take a whimsical yet informative journey along our own yellow brick road to plan for retirement with Dorothy (host Molly Nelson), the Lion (Retirement Planner Loren Merkle), and the Tin Man (Retirement Planner Chawn Honkomp).

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

The Yellow Brick Road to Retirement

The Lifestyle Plan | Shaping Your Dream Retirement

The first stop on our journey to the Emerald City is lifestyle planning. What have you always wanted to do but never had the time for? Whether it’s traveling, spending quality time with grandchildren, indulging in hobbies, or simply relaxing, now is the time to put these dreams into a retirement plan. Developing a plan for how you will spend your time in retirement is the first step to kicking off a fulfilling retirement and developing a comprehensive plan to pay for it.

The Income Pillar | Creating Financial Stability

One of the foremost concerns for anyone approaching retirement is creating a steady flow of income. Transitioning from a regular paycheck to drawing from retirement savings and Social Security requires meticulous planning. In the show, Loren Merkle highlights that integrating Social Security options (which can be as many as 81 different choices for a married couple) with your investment income is crucial. Planning for income should also factor in market volatility. A well-constructed income plan will help you feel confident that you will not outlive your savings and that you can maintain your desired lifestyle.

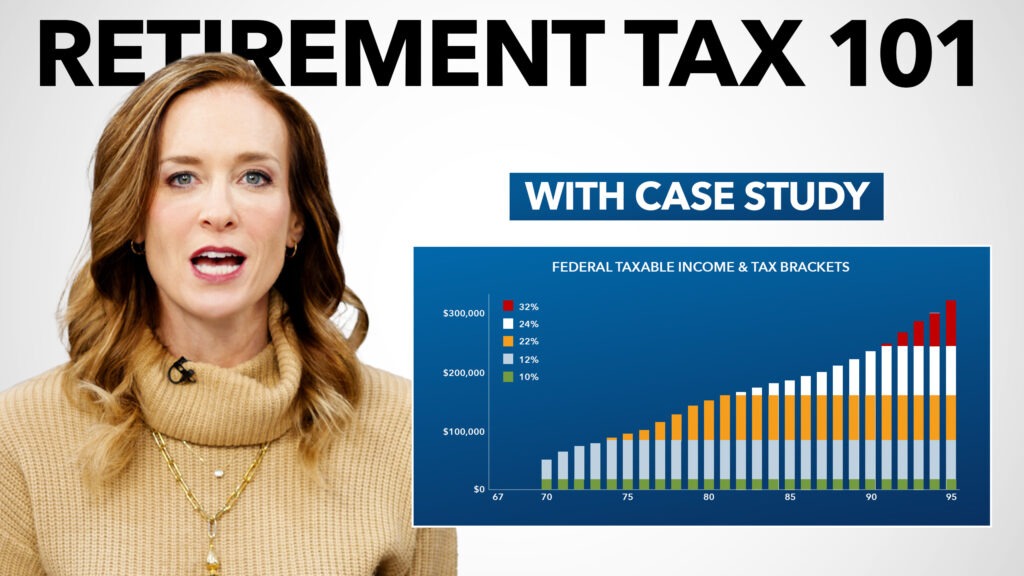

Tax Planning | Minimizing Your Tax Burden

Paying taxes during your working years is straightforward, but retirement brings new complexities. As Loren and Chawn discussed, without proper tax planning, a significant portion of your hard-earned savings could be consumed by taxes. Even a million-dollar retirement portfolio could incur a tax bill of over $500,000 throughout retirement. Developing a long-term tax plan can help reduce this burden, keeping more money in your pocket to enhance your retirement experience.

Investment Strategies | Protect and Grow Your Wealth

Once you’ve navigated lifestyle, income, and taxes, the next stop of our yellow brick road is investments. As you approach retirement, your investment strategy needs to shift from accumulation to preservation and income generation. This means taking a closer look at the level of risk in your portfolio and reallocating investments to support stability and growth. Chawn stresses the importance of understanding how much risk you can afford to take and making informed decisions to protect your assets from market downturns.

Health Care | Safeguarding Your Future

Health care becomes a significant concern as we age, and planning for it is essential. With studies suggesting a 70% likelihood of requiring long-term care and costs rising above $315,000, having a strategy in place is crucial. Options like traditional long-term care insurance or hybrid policies that blend investments and long-term care coverage can provide peace of mind. Additionally, navigating Medicare can be overwhelming, but seeking the help of a professional can simplify decision-making and help you find the right coverage.

The Legacy Plan | Leaving a Lasting Impact

The final stop on our yellow brick road is legacy planning. Updating wills, establishing trusts, and securing powers of attorney are components of a solid legacy plan. Doing so can help keep your assets managed according to your wishes, rather than leaving them to default legal processes that may not align with your intentions.

Conclusion | Reaching Emerald City

The comprehensive retirement planning journey may seem overwhelming but breaking it down into these six pillars to build the detailed, written plan we call a RetireSecure Roadmap can help you retire confidently.

Click here to watch the full episode “We’re Off To Plan Retirement! Part 1” on YouTube!

–

Source: Fidelity.com, LongTermCare.gov