Retirement laws continue to evolve as Washington rewrites the tax code and adjusts long-standing rules. Retirement Planners Clint Huntrods and Loren Merkle explain how recent legislation affects tax brackets, Required Minimum Distributions, inherited IRAs, and long-term planning — and why flexibility matters more than ever.

Taxes: The Quiet Threat to Retirement Wealth

For many retirees, taxes quietly take a larger bite than expected.

“The number one wealth eroding factor when it comes to retirement planning and taking retirement income is taxes,” said Retirement Planner Clint Huntrods.

According to Clint, recent legislation affects nearly everyone. “The one big beautiful bill has an impact on almost everybody’s retirement tax situation.”

Tax Brackets and the Impact of Staying Put

One of the most significant outcomes of the legislation was the extension of existing tax brackets.

“One of the positive things, where you can say there is some beauty to this is that it has extended the Tax Cuts and Jobs Act tax brackets,” said Retirement Planner Loren Merkle.

Without that extension, Loren explained, “a lot of those brackets would have gone up beginning in 2026.” He outlined what was avoided: “The 12% bracket would have gone to 15%, 22% would have gone to 25%, 24% would have gone to 28%.”

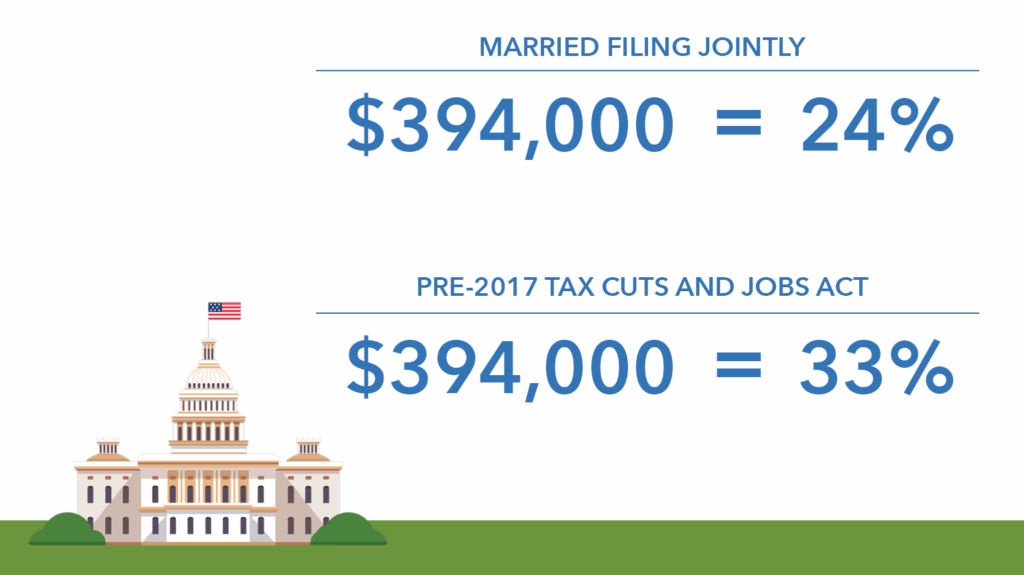

The difference shows up clearly in real numbers. “If you take a married, filing jointly couple, they’ve got $394,000 that can get them all the way up into the top of that 24% tax bracket without clicking into the 32% tax bracket,” Loren said. Before those changes, “that would have put them in the 33% tax bracket (prior to the Tax Cuts and Jobs Act).”

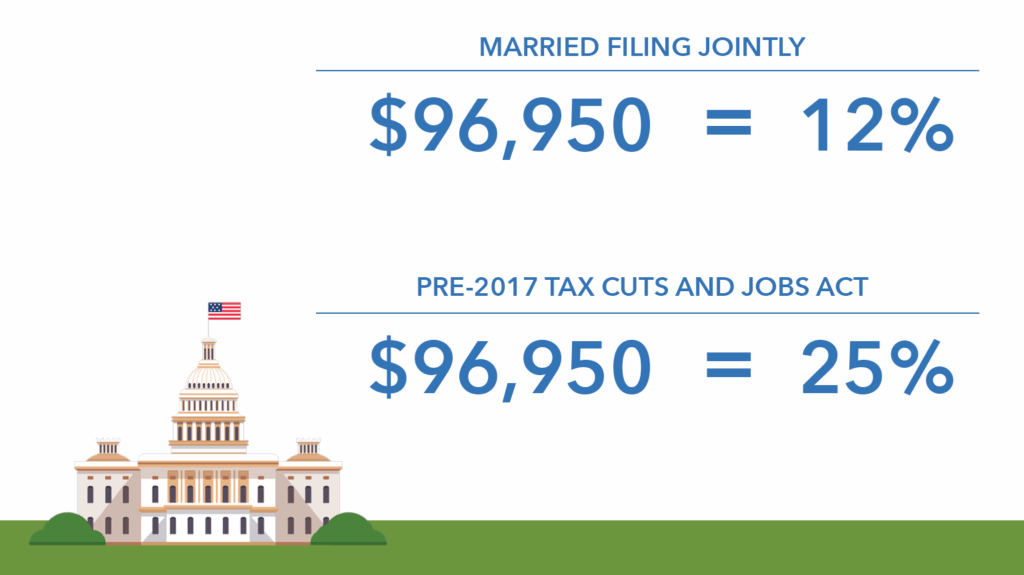

Clint noted that even at lower income levels, the gap is meaningful. “At the top of the 12% tax rate, you’re married, filing jointly. Income would be $96,950,” he said. Under prior rules (before the Tax Cuts and Jobs Act), “that same level of income would have put you in the 25% tax bracket.”

The Senior Bonus Deduction: Helpful, but Conditional

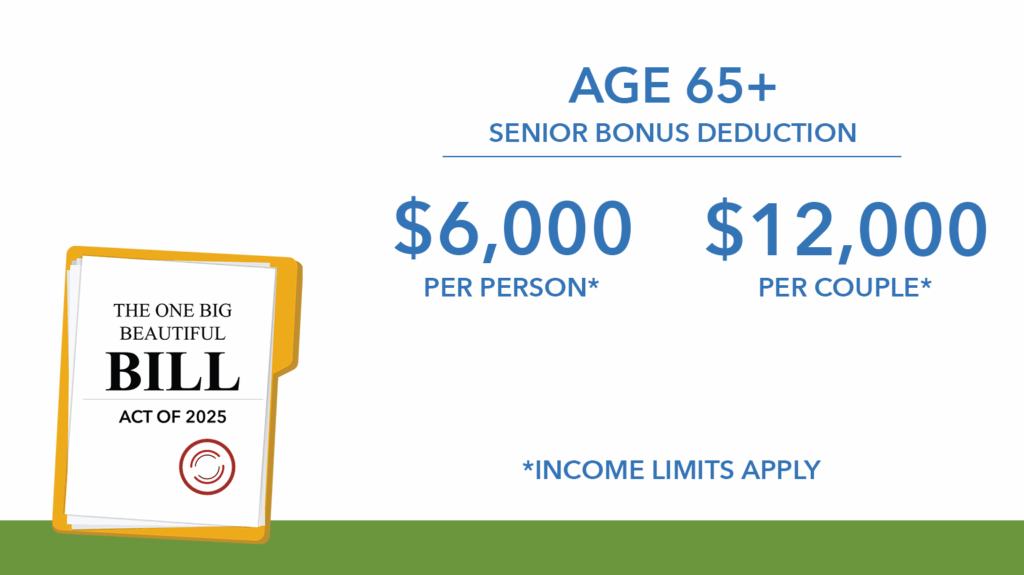

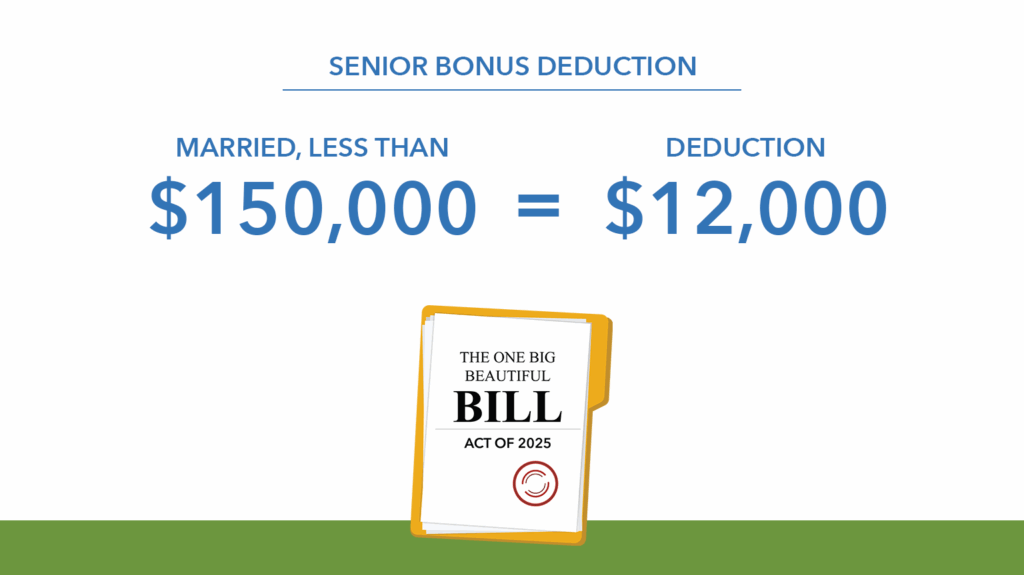

Another key provision of the One Big Beautiful Bill is the senior bonus deduction, which applies to individuals age 65 and older.

“The senior bonus is probably one of the biggest talking points,” Loren said. “[The senior bonus] has increased the standard deduction for individuals who are 65 or older, $6,000 per person.”

For married couples, Loren explained, “you could have up to $12,000 stacked on top of your existing standard deduction.” That deduction affects “any distributions that are coming from taxable accounts, any distributions that are coming from those pre-tax accounts,” and even how Social Security is taxed.

Clint explained that the deduction is subject to Modified Adjusted Gross Income, “If you’re a married couple, if you make less than $150,000, you get the full $6,000 per individual,” he said. Above that level, “it starts to get phased out,” and by $250,000, “that $12,000… is not available to you.”

The senior bonus deduction is available from 2025 to 2028.

Roth Conversions and Strategic Trade-Offs

Those income limits can complicate Roth conversion decisions.

“In a Roth conversion, you’re voluntarily taking some money from your pre-tax account, paying the tax bill this year,” Loren said. “Once it’s in the Roth bucket, it’s going to grow tax-free.”

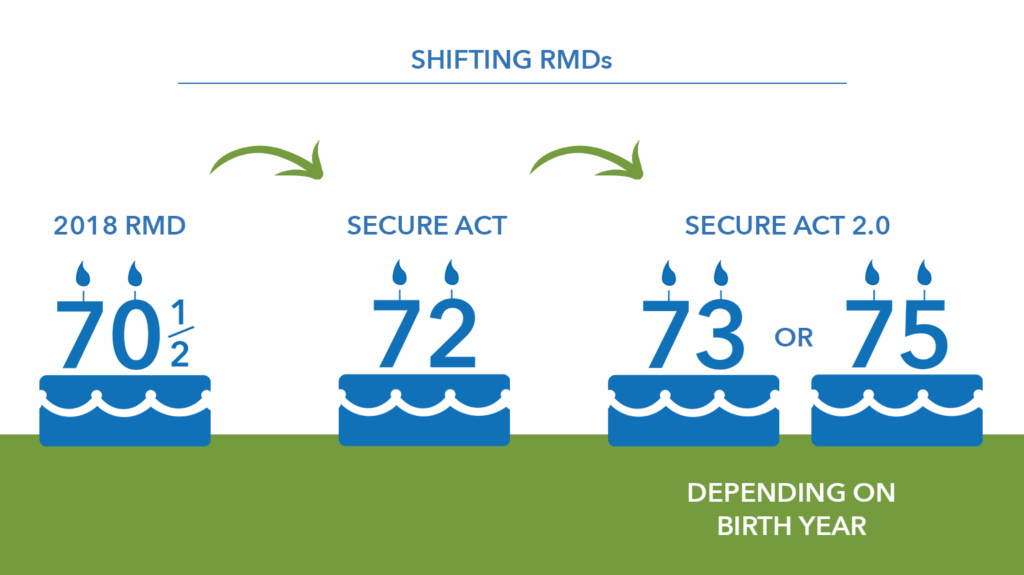

Required Minimum Distributions: Constantly Changing

Rules around Required Minimum Distributions (RMDs) have shifted repeatedly in recent years.

“When we save money in those pre-tax accounts, there is a point where the government says, hey, you’ve deferred taxes long enough,” Loren said. That point now occurs at “73 or 75, depending on your birth year.”

Clint emphasized how much those rules have changed. “In 2018, the Required Minimum Distribution age for almost everybody was still age 70 and a half,” he said, before moving to 72 and then higher ages under newer legislation.

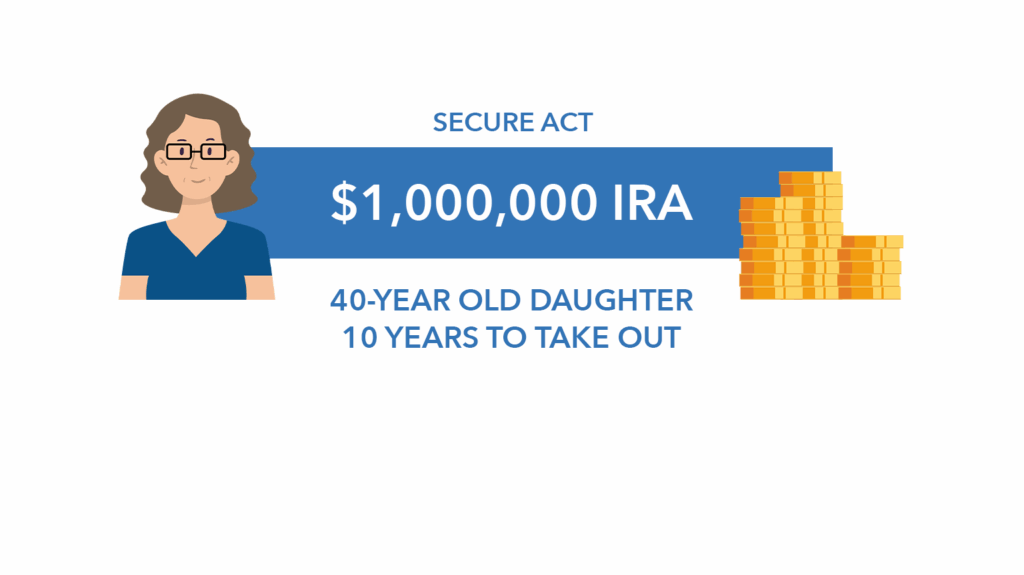

Inherited IRAs and the 10-Year Rule

One of the biggest shifts in retirement law affects heirs.

“Prior to the Secure Act,” Clint said, a 40-year-old inheriting a $1 million IRA could take distributions over her lifetime.” Adding that hypothetical, that distribution could be about $4,000 a year.

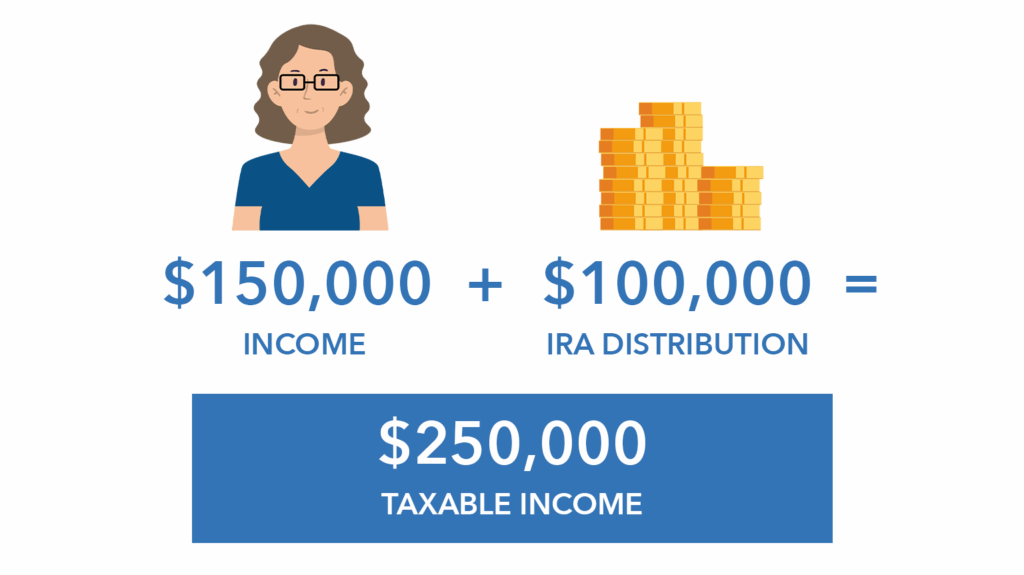

Today, “your 40-year-old daughter has only 10 years to take that million dollars out of the IRA,” Clint explained. If spread evenly, “she has to (hypothetically) take $100,000 (a year) instead of the $4,000.”

That change, he said, “changes the game significantly.”

Loren noted that families are often caught off guard. “Sometimes families have seen… they had an inherited IRA before that Secure Act was passed,” he said. “So then when they inherit something new more recently, they think, oh, I can stretch that too.”

Legacy Planning Through a Tax Lens

The type of asset passed on can matter as much as the amount.

“It might make sense for those IRA assets to go to the church,” Loren said, since nonprofit organizations are not taxed on those distributions. Non-qualified assets, he added, “could be great to go to her nieces and nephew and be a much more tax efficient way.”

Clint summed up the strategy clearly: “Any of the money from the IRA that goes to the church goes tax free. Any of the money that goes to the nieces and nephews from the non-qualified also goes tax free.”

“Taking otherwise taxable events, turning them into tax free,” he said, “that’s power.”

Planning for Uncertainty

Legislative changes, government shutdowns, and market reactions all add uncertainty.

“Government shutdowns have taken place since 1976,” Clint said, “and they will continue to take place as long as the current budget legislation is in place.”

What matters most, Loren noted, is preparation. “We know what those lead times are going to be like,” he said, explaining how proactive planning can help prevent disruptions to retirement income and benefits.

Watch the full episode on YouTube and learn more about retirement laws as they continue to evolve.