This blog explores how long $1 million might last in retirement under different spending scenarios, and why assumptions around lifestyle, inflation, taxes, and market volatility matter more than the headline number.

A Question Nearly Everyone Asks

One of the most common retirement questions sounds simple: If I have $1 million, how long will it last? But as Retirement Planner Loren Merkle explains, that question quickly opens the door to much bigger issues.

“The biggest fear of people going into retirement is how much money do I need to have? Am I going to run out of money before I run out of time?” Loren says.

How much you can spend, how your portfolio is built, and how it reacts when markets don’t cooperate all play a role. “How your portfolio is designed, the amount of risk, how it’s going to react when things don’t go well in the market is going to be a determining factor,” Loren says.

Why the Number Alone Isn’t Enough

Many people fixate on a savings target, but Retirement Planner Clint Huntrods says the number itself doesn’t tell the full story.

“So often people have a number in mind. Maybe it’s a million, maybe it’s $2 million,” Clint says. “But they don’t necessarily know what that means specifically to them.”

What matters more is how that number fits with real life: Social Security, pensions, spending habits, and long-term goals. “We’re always wanting to help families understand (the impact) custom to them,” Clint says, “their Social Security, if they have a pension, their spending need.”

Starting With Lifestyle, Not Math

Before stress testing a portfolio, Loren says planning has to start with lifestyle.

“We do have six pillars to our RetireSecure Roadmap,” he says. “The first pillar is the lifestyle, and we’re going to start there.”

That’s intentional. “Whatever lifestyle you want in retirement will be a big determining factor of how much money you need to take out of your portfolio,” Loren explains.

Answering that question isn’t easy. “When every day is a weekend, how much is that weekend going to cost you compared to what you’ve really been living?” he says.

A Practical Way to Estimate Spending

One of the first steps Loren recommends is surprisingly simple.

“Take a look at what the last 12 months of your lifestyle as you know it today has cost you,” he says. “Add that number up.”

The total often surprises people. Loren suggests building from there. “Maybe add a little bit more to that because again, every day of the week is going to become a weekend,” he says.

That spending number becomes the foundation for the rest of the plan.

Inflation, Growth, and Taxes Matter

Even solid spreadsheets can miss critical assumptions. Clint says inflation is often overlooked.

“We ask, well, what number did you use for inflation? And they say, you know what? I forgot entirely about that,” he says.

Growth matters too. “Sometimes families think that just the assets they have are just going to start to come down in retirement,” Clint says. “But when you apply that growth rate, it doesn’t necessarily mean that if they started with a million dollars, it just slowly whittles down.”

Taxes also play a major role. “If you have a million dollars saved and it’s all pre-tax, you’re not going to be able to get all that million dollars,” Clint says. “If you had saved a million dollars, Roth, well, you can get to all those dollars (on qualified distributions) without tax implication.”

Putting $1 Million to the Test

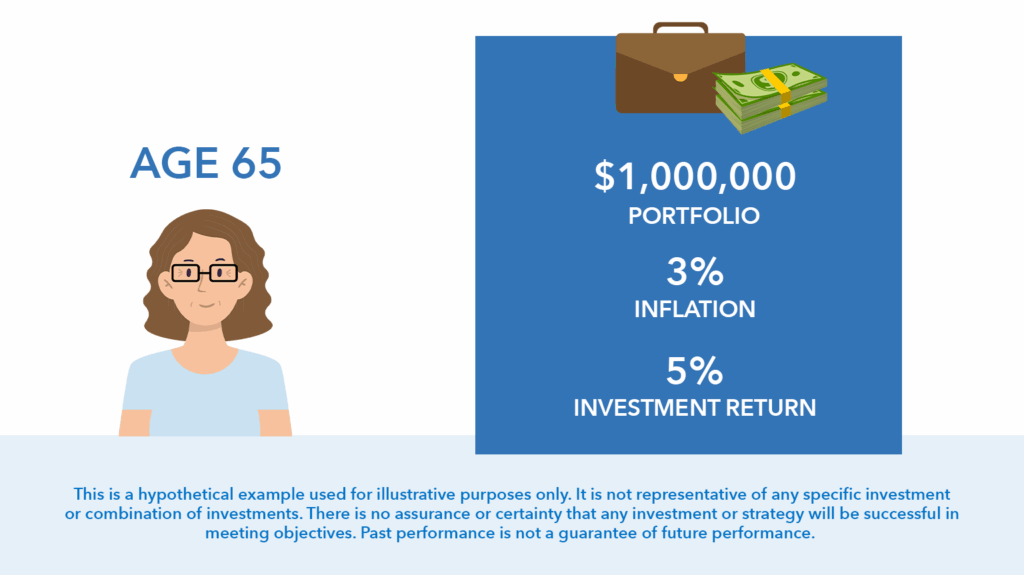

To see how spending affects longevity, a hypothetical scenario was run using these assumptions:

- Starting age: 65

- Beginning balance: $1 million

- Inflation: 3% annually

- Investment return: 5% annually

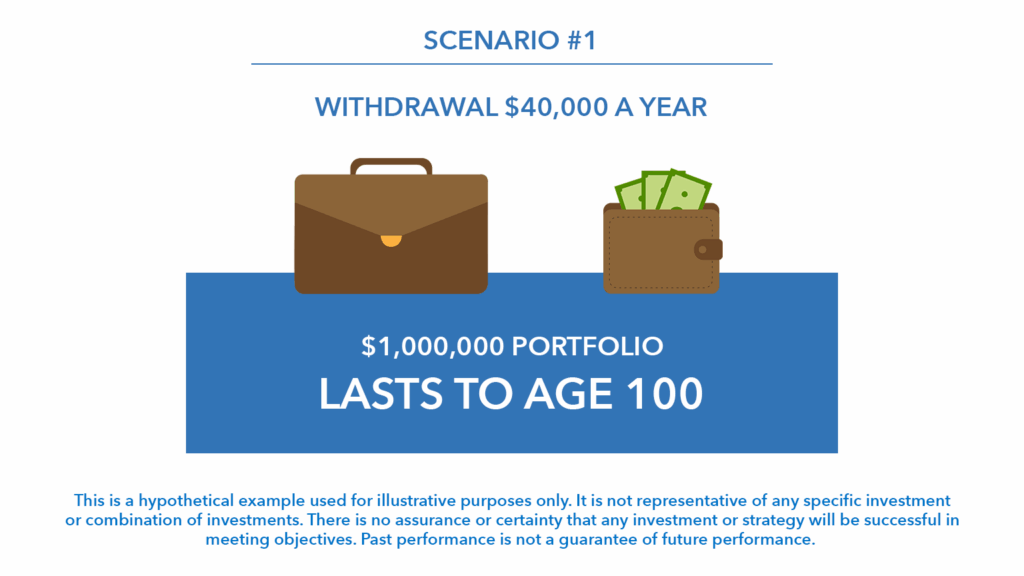

Scenario 1: $40,000 per year

The money lasts 36 years, to age 100.

“That sounds really good,” Loren says, but he also cautions that real life isn’t a straight line. “What happens at age 85 and you need excess spend capability because you now need long term care?”

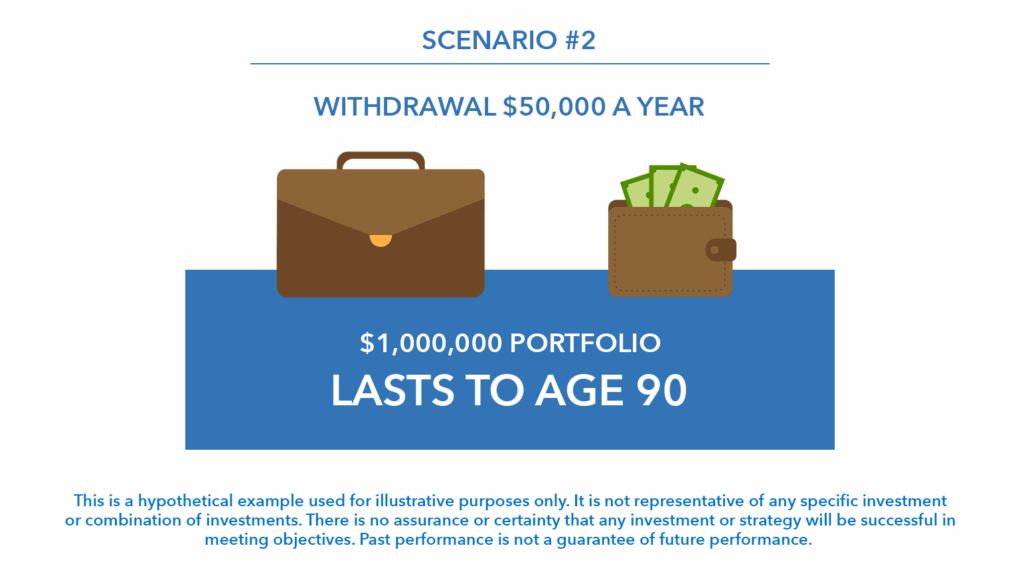

Scenario 2: $50,000 per year

The portfolio lasts 26 years, to age 90.

“So, you start out retirement taking $10,000 a year more,” Loren says, “and it runs out now 10 years sooner.”

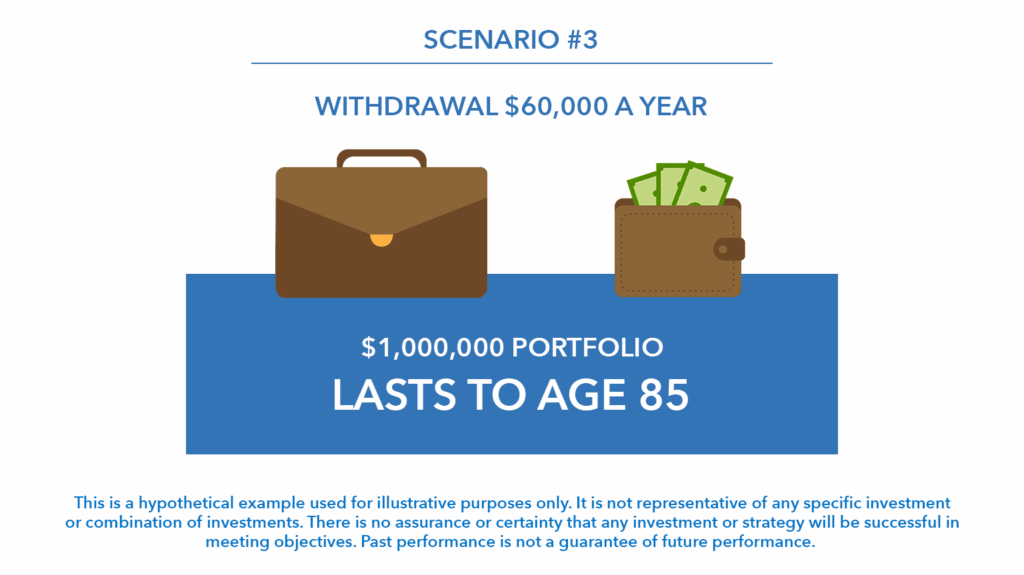

Scenario 3: $60,000 per year

The money lasts 21 years, to age 85.

“The amount that you take out is so important to how long this million dollars lasts,” Loren says. “You can see already through the first three examples how big of a difference it makes.”

This scenario also highlights legacy concerns. “At age 85, they don’t have anything left from an investment portfolio to leave from a legacy standpoint,” Loren notes.

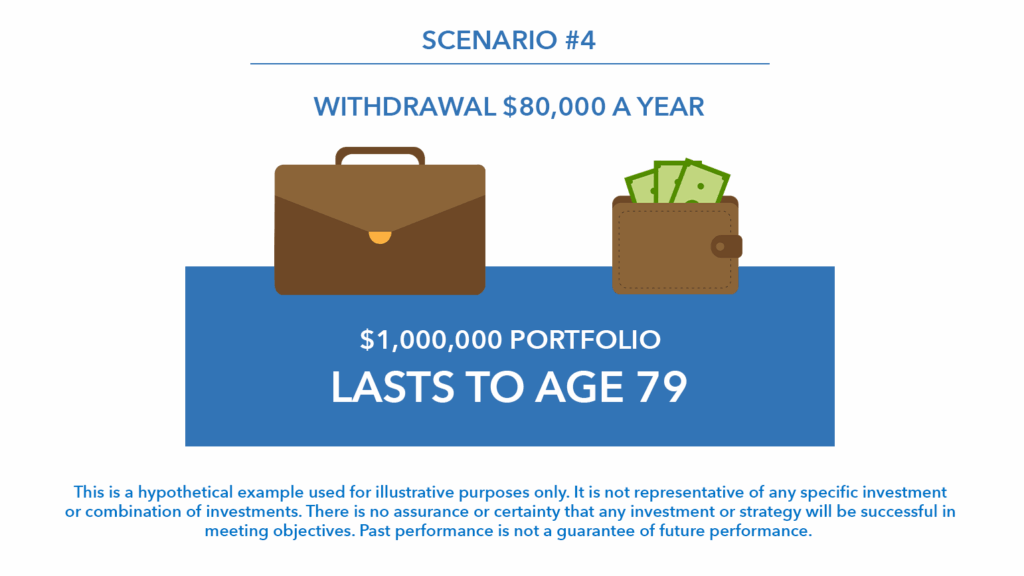

Scenario 4: $80,000 per year

The money lasts just 15 years, to age 79.

“You can just see how impactful those extra dollars each year are,” Clint says, especially once inflation compounds over decades.

Retirement Spending Isn’t a Straight Line

Loren says retirement typically unfolds in phases.

“We noticed there’s three distinct phases,” he explains. “The go-go years, the slow-go years and the no-go years.”

Spending is often the highest early on when new retirees spend money on hobbies and travel. Later, costs may decline before potentially rising again due to health care or long-term care needs.

Stress Testing for Market Volatility

Beyond spending, portfolios also need to be tested against market downturns.

“So many people have no idea how their portfolio is going to react,” Loren says. “The stress is way more elevated when you’re dependent upon that portfolio.”

He gives a simple example. “You have a million dollars. What happens when we go through a bad scenario? That million dollars could lose $200,000. Now you have $800,000 left.”

Clint adds that downturns are inevitable during a 20 to 30 year retirement. “We know there’s going to be a recession that’s going to happen. It’s just a matter of when.”

Confidence Comes from Seeing the Tradeoffs

The takeaway isn’t that $1 million is too little or too much. It’s that small changes in spending can dramatically alter outcomes.

“Having this knowledge going into retirement will help you accommodate your lifestyle needs,” Loren says, “but also give you the confidence that you’re not going to run out of money.”

The real question, it turns out, isn’t just how much have you saved? It’s how do you want to live—and what does that really cost over time?

Watch the full episode on YouTube and learn more about retirement spending.

All investments involve risk. Past performance is not indicative of future results and there can be no assurance that any investment or strategy will be profitable, suitable for your situation, or successful in meeting objectives.