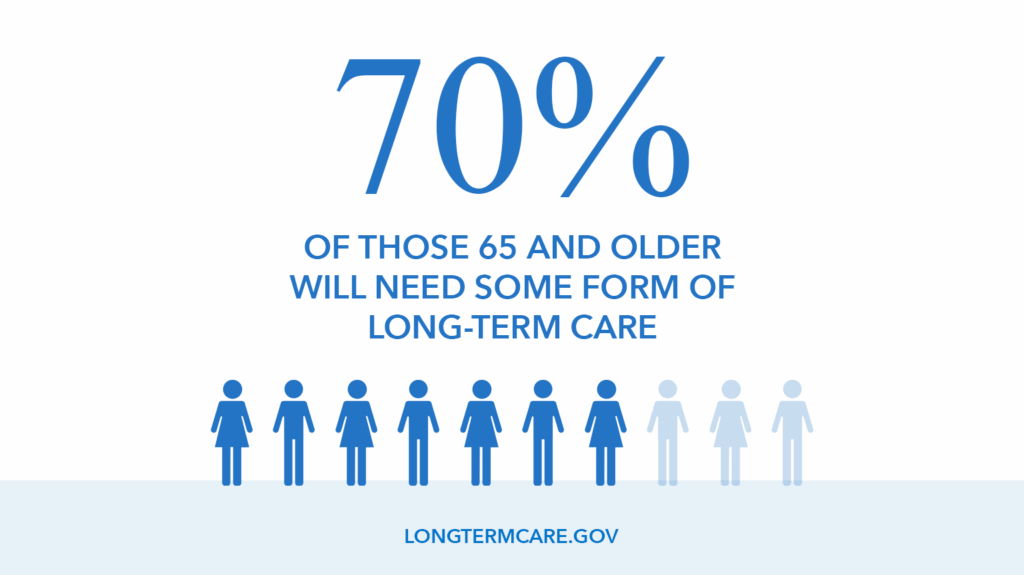

For many, the idea of long-term care feels like a distant concern—something to worry about later. But as retirement approaches, this topic becomes increasingly important. The numbers tell the story: research suggests that someone turning 65 today may face a nearly 70% likelihood of needing some form of long-term care during their lifetime. Yet many retirees are caught off guard when the need arises.

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Loren Merkle and AnnaMarie Morrow break down why having a long-term care strategy is essential—and how it can provide peace of mind for you and your loved ones.

“The best time to think about long-term care is before you need it,” said AnnaMarie.

What Is Long-Term Care, Really?

Long-term care includes a range of services designed to assist individuals who can no longer perform everyday activities on their own—like bathing, dressing, or eating.

According to the National Institute on Aging, long-term care encompasses a wide range of services designed to support individuals who are unable to perform basic daily living activities on their own. These services generally fall into three categories:

- Home-based care, such as homemaker services, nursing support, home health aides, and therapists

- Community and residential care, including adult day programs, senior centers, assisted living, and nursing home facilities

- Assistance with daily living, which can involve help with bathing, dressing, eating, and mobility

While many associate long-term care with nursing homes, most care begins at home. In fact, about 65% of people start with in-home support such as homemaker services, home health aides, or visiting nurses. Only 35% ever enter a facility, according to LongTermCare.gov.

The Cost of Care

The emotional impact of needing care is one thing—but the financial impact can be staggering. According to the 2024 Genworth Cost of Care Survey:

- The annual median cost of a home health aide is $77,792 per year

- Assisted living averages $70,800 per year

- A private room in a nursing home costs $127,750 annually

These numbers are a wake-up call, but they also raise a crucial question: how do you plan costs this significant without jeopardizing your retirement lifestyle?

A Hypothetical Story: Mark and Linda

To answer that, AnnaMarie walked through the story of a hypothetical couple, Mark and Linda, whose experience illustrates how planning can make all the difference.

Mark and Linda retired at age 68 with $1.2 million saved.

At 74, Mark suffered a stroke and required long-term care for two years. The care cost $10,000 per month, totaling $240,000—an amount that had to be withdrawn in addition to their regular retirement income needs.

Linda wanted to know what her options were to prepare for her own potential care needs. She reviewed several strategies:

Traditional Long-Term Care Insurance

Once the go-to option, these policies often come with steep and rising premiums. If you stop paying, the policy lapses and you lose the benefits.

Life Insurance Hybrid

This option allows you to advance the death benefit to help pay for long-term care. If you never need the care, your beneficiaries still receive a tax-free death benefit.

Investment Hybrid

This approach provides market-based growth potential and includes a long-term care component. If care is needed and you meet specific criteria (such as loss of two out of six daily living activities), funds can be accessed. If not, the investment remains part of your legacy.

“Regardless of which path Linda chose,” AnnaMarie said, “she was aware of her options, giving her confidence that she had support in place to manage potential future care needs and have that offset of risk.”

When most people think of long-term care, they think of insurance. But Loren emphasized that modern solutions go far beyond the traditional model.

“A lot of times when people start thinking about the high cost of long-term care and how they are going to plan for that, immediately their minds go to this expensive long-term care insurance because that’s what they’re familiar with,” he said. “That’s where some of these other new products really come into play, these new solutions to help provide the long-term care coverage that you need, but without the disadvantages of traditional long term care insurance.”

Even individuals who have been previously declined coverage due to health reasons may now have access to options with simplified or even guaranteed issue underwriting.

“Recently we’ve been in a lot of emotional visits where people didn’t know this was a thing,” AnnaMarie added. “Seeing that anxiety and relief wash away, when they realize they do have choices, the relief is visible. They’ve been living in quiet fear, and suddenly, there’s a plan.”

It All Comes Back to the Plan

Ultimately, the long-term care conversation isn’t just about what might happen—it’s about taking control. With a plan in place, you may feel more confident focusing on the joys of retirement.

“Only 30% of people enter retirement with a written, comprehensive plan,” Loren said. “All the sacrifice, the discipline it took for you to save… that took a lifetime. And now we’re talking about turning that lifetime of savings into the rest of your life of joy and fulfillment.”

When long-term care is thoughtfully integrated into your retirement plan, it’s not just a contingency—it becomes part of a strategy that may help support your future lifestyle and confidence in retirement.

Click here to watch the full episode “Are You Prepared For Long-Term Care?” on YouTube!

Sources: LongTermCare.gov, National Institute on Aging and Genworth and CareScout 2024 Cost of Care Survey