Read about the six pillars of a retirement plan

What is a Retirement Plan? Hint: It’s Not Your 401(k)

Many people assume their retirement savings tell them everything they need to know about the future. This article explores why a 401(k) is only one piece of the puzzle and…

Retirement Road Test: $1 Million Portfolio

A common saying is you need a million dollars for retirement, but what does that actually mean for you? In this blog, you’ll meet Tom and Sandi. They have $1 million saved for retirement…

Will $1 Million Last? Stress Testing Retirement Spending

This blog explores how long $1 million might last in retirement under different spending scenarios, and why assumptions around lifestyle, inflation, taxes, and market volatility matter more than the headline number. A…

What Washington Changes Could Mean for Your Retirement

Retirement laws continue to evolve as Washington rewrites the tax code and adjusts long-standing rules. Retirement Planners Clint Huntrods and Loren Merkle explain how recent legislation affects tax brackets, Required Minimum Distributions, inherited IRAs,…

The Retirement Readiness Checklist: Where to Start and What to Tackle Next

Retirement Planner Loren Merkle, and Director of Medicare & Long-Term Care AnnaMarie Morrow walk through the Retirement Readiness Checklist, breaking retirement planning into nine practical areas to help you discover where to…

Will $1 Million Last? Stress Testing Retirement Spending

This blog explores how long $1 million might last in retirement under different spending scenarios, and why assumptions around lifestyle, inflation, taxes, and market volatility matter more than the headline number. A Question Nearly Everyone Asks One of the most common retirement questions sounds simple: If I have $1 million, how long will it last? But as Retirement…

Launching Our First Magazine: Meet Adventurous Angie

A brand-new Merkle Retirement Planning magazine is here, and its first issue puts a spotlight on Adventurous Angie—an energetic retiree proving that retirement isn’t the end of the story; it’s the start of an exciting new chapter. Meet Angie and discover how she followed a customized retirement plan that helped her retire before Medicare eligibility—and…

Inside the Cave of Questions: Getting Started at 55+

This Indiana Jones–inspired episode of Retiring Today with Loren Merkle turns a common worry—how to start planning for retirement at 55—into a guided trek through six milestones: lifestyle, income, taxes, investments, health care, and legacy. We go on an adventure that blends adventure with practical guidance in search of the “compass of clarity.” Finding Your Way Out of the Cave Retirement planning can feel like stepping into a dim maze. As…

How to Know If You’re Retirement-Ready at Age 55

Our journey takes place inside the Cave of Questions because retirement often begins with more questions than answers and figuring out where to start can feel like navigating a dark cave. While inside, we discover that a map is a great place to begin—a guide to steer our travels. That map is the RetireSecure Roadmap, a visual representation of the personalized retirement plans we help families and individuals build. Each…

How Do I Stack Up? Understanding Where You Stand with Your Retirement Savings

That comparison—how you “measure up” to your peers, your neighbors, or even a number you once read in an article—is normal. But it’s not always helpful without context. Retirement Planners Loren Merkle and Chawn Honkomp discussed what those averages really mean and, more importantly, how to start focusing on what matters: your own retirement goals…

What is a Retirement Plan? Hint: It’s Not Your 401(k)

Many people assume their retirement savings tell them everything they need to know about the future. This article explores why a 401(k) is only one piece of the puzzle and what a true written retirement plan includes, from income and taxes to health care and legacy planning. The 401(k) Balance For many people approaching retirement,…

Retirement Road Test: $1 Million Portfolio

A common saying is you need a million dollars for retirement, but what does that actually mean for you? In this blog, you’ll meet Tom and Sandi. They have $1 million saved for retirement at age 65, and in the first iteration of their retirement road test, that money was projected to run out by age 79. Rather than…

Will $1 Million Last? Stress Testing Retirement Spending

This blog explores how long $1 million might last in retirement under different spending scenarios, and why assumptions around lifestyle, inflation, taxes, and market volatility matter more than the headline number. A Question Nearly Everyone Asks One of the most common retirement questions sounds simple: If I have $1 million, how long will it last? But as Retirement…

What Washington Changes Could Mean for Your Retirement

Retirement laws continue to evolve as Washington rewrites the tax code and adjusts long-standing rules. Retirement Planners Clint Huntrods and Loren Merkle explain how recent legislation affects tax brackets, Required Minimum Distributions, inherited IRAs, and long-term planning — and why flexibility matters more than ever. Taxes: The Quiet Threat to Retirement Wealth For many retirees, taxes quietly take a…

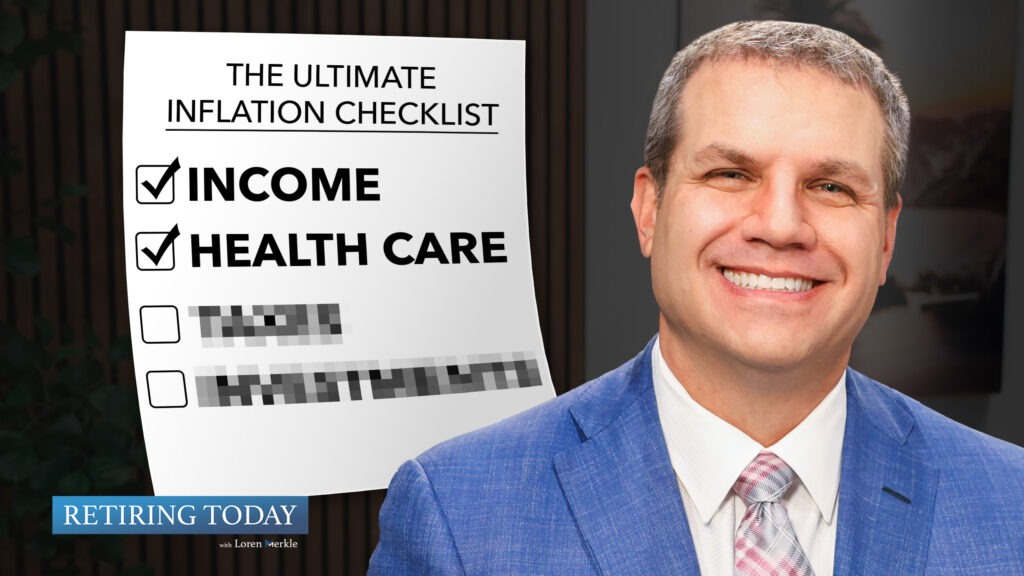

The Retirement Readiness Checklist: Where to Start and What to Tackle Next

Retirement Planner Loren Merkle, and Director of Medicare & Long-Term Care AnnaMarie Morrow walk through the Retirement Readiness Checklist, breaking retirement planning into nine practical areas to help you discover where to start and what to tackle next. Get Clear on Your Retirement Vision For many households, Social Security isn’t a side dish—it’s the main course. Chawn explains that for…

What is a Retirement Plan? Hint: It’s Not Your 401(k)

Many people assume their retirement savings tell them everything they need to know about the future. This article explores why a 401(k) is only one piece of the puzzle and what a true written retirement plan includes, from income and taxes to health care and legacy planning. The 401(k) Balance For many people approaching retirement,…

Retirement Road Test: $1 Million Portfolio

A common saying is you need a million dollars for retirement, but what does that actually mean for you? In this blog, you’ll meet Tom and Sandi. They have $1 million saved for retirement at age 65, and in the first iteration of their retirement road test, that money was projected to run out by age 79. Rather than…

Will $1 Million Last? Stress Testing Retirement Spending

This blog explores how long $1 million might last in retirement under different spending scenarios, and why assumptions around lifestyle, inflation, taxes, and market volatility matter more than the headline number. A Question Nearly Everyone Asks One of the most common retirement questions sounds simple: If I have $1 million, how long will it last? But as Retirement…

What Washington Changes Could Mean for Your Retirement

Retirement laws continue to evolve as Washington rewrites the tax code and adjusts long-standing rules. Retirement Planners Clint Huntrods and Loren Merkle explain how recent legislation affects tax brackets, Required Minimum Distributions, inherited IRAs, and long-term planning — and why flexibility matters more than ever. Taxes: The Quiet Threat to Retirement Wealth For many retirees, taxes quietly take a…

We’re Off to Plan Retirement | The Yellow Brick Road to Retirement

Planning for retirement is often seen as a daunting task, filled with more questions than answers. In a special edition of “Retiring Today with Loren Merkle” we take a whimsical yet informative journey along our own yellow brick road to plan for retirement with Dorothy (host Molly Nelson), the Lion (Retirement Planner Loren Merkle), and…

Retirement Planning at Age 59: Taking Action Steps for a Secure Future

Planning for retirement is a journey filled with anticipation, excitement, and certainly a fair share of apprehension. At age 59, the runway to retirement becomes increasingly clearer, yet the path may be strewn with uncertainties. Experienced retirement planners Loren Merkle and Clint Huntrods, explored actionable strategies for those on the brink of this exciting transition….

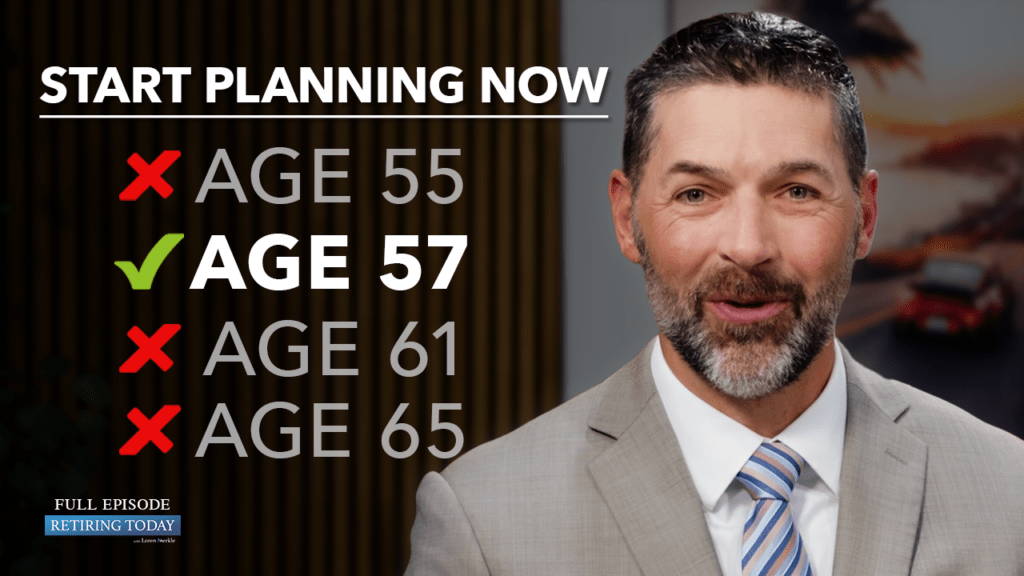

Navigating Your Path to Early Retirement at Age 57

Are you 57 and dreaming of retirement? You’re not alone. Many individuals in their late 50s begin to seriously envision their retirement. Yet, transitioning from dreaming to doing can feel overwhelming. With numerous moving pieces and uncertainties, it’s crucial to start your journey with a plan. Experienced retirement planners Loren Merkle and Chawn Honkomp dive…

Retirement investment strategies | Exploring the Role of Annuities and CDs

In this episode of “Retiring Today,” experienced retirement planners Loren Merkle and Chawn Honkomp dive deep into making sense of annuities. With the backdrop of a volatile stock market and record-high interest rates, annuities have become a hot topic for those nearing retirement. This blog post will unravel the intricate details, benefits, and considerations surrounding…

Elections and Your Retirement | Managing Market Uncertainty

In this episode of Retiring Today, Elections and Your Retirement, we dive into how market volatility is influenced by election cycles and effective strategies you can employ to safeguard your investments. Whether you’re apprehensive about the upcoming election’s impact on the stock market or curious about the potential changes to Social Security and how they…

The Retirement Readiness Checklist: Where to Start and What to Tackle Next

Retirement Planner Loren Merkle, and Director of Medicare & Long-Term Care AnnaMarie Morrow walk through the Retirement Readiness Checklist, breaking retirement planning into nine practical areas to help you discover where to start and what to tackle next. Get Clear on Your Retirement Vision For many households, Social Security isn’t a side dish—it’s the main course. Chawn explains that for…

Launching Our First Magazine: Meet Adventurous Angie

A brand-new Merkle Retirement Planning magazine is here, and its first issue puts a spotlight on Adventurous Angie—an energetic retiree proving that retirement isn’t the end of the story; it’s the start of an exciting new chapter. Meet Angie and discover how she followed a customized retirement plan that helped her retire before Medicare eligibility—and…

Fact or Fiction: Medicare, Costs, and Choices — What Really Matters Before 65 (and After)

When it comes to Medicare, misinformation travels fast. Maybe a friend insists it’s free. A coworker swears long-term care is covered. Someone else warns you about penalties for signing up too late. The truth? Some of what you hear is right—but a lot of it isn’t. You’ll learn what Medicare actually covers, what it costs,…

Can You Retire Earlier Than Expected?

In this episode of Retiring Today with Loren Merkle we cover important strategies to help you plan for the possibility of an extended retirement, emphasizing the need to anticipate a longer lifespan than previous generations. ––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––– Recent data from the Social Security Administration highlights that men and women reaching the age of 65 today can…

The Complete Guide to Medicare in 2025

In this episode of Retiring Today, Loren Merkle and AnnaMarie Morrow discuss the most critical Medicare updates that will help you make the best decisions for your retirement plan. – Complete explanation of the $2000 out-of-pocket maximums for Medicare Part D Key topics: – A comprehensive breakdown of Medicare Parts A, B, C, and D…

Launching Our First Magazine: Meet Adventurous Angie

A brand-new Merkle Retirement Planning magazine is here, and its first issue puts a spotlight on Adventurous Angie—an energetic retiree proving that retirement isn’t the end of the story; it’s the start of an exciting new chapter. Meet Angie and discover how she followed a customized retirement plan that helped her retire before Medicare eligibility—and…

Inside the Cave of Questions: Getting Started at 55+

This Indiana Jones–inspired episode of Retiring Today with Loren Merkle turns a common worry—how to start planning for retirement at 55—into a guided trek through six milestones: lifestyle, income, taxes, investments, health care, and legacy. We go on an adventure that blends adventure with practical guidance in search of the “compass of clarity.” Finding Your Way Out of the Cave Retirement planning can feel like stepping into a dim maze. As…

How to Know If You’re Retirement-Ready at Age 55

Our journey takes place inside the Cave of Questions because retirement often begins with more questions than answers and figuring out where to start can feel like navigating a dark cave. While inside, we discover that a map is a great place to begin—a guide to steer our travels. That map is the RetireSecure Roadmap, a visual representation of the personalized retirement plans we help families and individuals build. Each…

Top Legacy Planning Traps That Could Derail Your Retirement

Legacy planning isn’t always top of mind when preparing for retirement, but overlooking it can have costly and stressful consequences. You’ve worked hard to build your wealth—now it’s time to make sure it’s protected and passed on according to your wishes. In this blog, Retirement Planners Loren Merkle and Chawn Honkomp share five common legacy…

Legacy Planning with Attorney Charlie Bottenberg

This blog post explores the often-overlooked essentials of estate planning, dispelling the myth that it’s only for the wealthy. With insights from retirement planner Loren Merkle and estate planning attorney Charlie Bottenberg, it covers the importance of updating wills, the role of trusts, powers of attorney, and strategies to protect your legacy and loved ones—especially…

3 Costly Health Care Traps to Avoid in Retirement

One area that can catch even the most diligent savers off guard is health care. We explore three of the biggest health care traps in retirement—and how you can avoid them. ––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––– Trap 1: Failing to Plan for Extra Health Care Costs Many people see Medicare as their golden ticket to affordable health care in…